US Dollar ticks up with Powell issuing warnings

- The US Dollar ticks up on the back of Powell's testimony.

- Powell warns for easing too soon.

- The US Dollar index hovers around 105.00 with a small bounce-off support.

The US Dollar (USD) trades in the green, though by just a few decimals of a percentage on the back of US Federal Reserve (Fed) Chairman Jerome Powell's comments on Capitol Hill. In his semi-annual testimony, Powell confirms that disinflation is on track, though delivers warnings that easing too quick could harm the process. No hints thus towards September, which triggers a bit of US Dollar strenght on the back of the comments.

On the economic front, some relatively soft and third-party data come out from the National Federation of Independent Business (NFIB) and the TechnoMetrica Institute of Policy and Politics (TIPP). On the central banking front, as already mentioned, all eyes will be on Fed Chairman Powell. Though Federal Reserve Vice Chair for Supervision Michael Barr and Federal Reserve Governor Michelle Bowman should not be disregarded for possibly delivering some good remarks during the day.

Daily digest market movers: Powell sticks to the script

- The dust is settling quickly over the French election news. Expect this topic to fade into the background completely, as it will take a long time before any coalition will get formed in France.

- The National Federation of Independent Business (NFIB) already has released its numbers: the monthly Business Optimism Index for June jumped from 90.5 to 91.5, beating the 89.5 estimate.

- At 12:55 GMT, the weekly Redbook Index for the week ending July 5 came out. The previous week, the number came in at 5.8% with now 6.3% for this week.

- At 14:00 GMT, the TechnoMetrica Institute of Policy and Politics (TIPP) will release the Economic Optimism Index for July. The previous reading was at 40.5, with no forecast available.

- The US Treasury will allocate a 52-week bill at 15:30 GMT and a 3-year note at 17:00 GMT.

- Three US Federal Reserve speakers are making their way to the stage on Tuesday:

- At 13:15 GMT, Federal Reserve Vice Chair for Supervision Michael Barr gives a speech titled "Financial Inclusion: Past, Present, and Hopes for the Future" at the Financial Inclusion Practices and Innovation Conference, in Washington, United States.

- Fed Chairman Jerome Powell delivers “The Semiannual Monetary Policy Report" to the US Congress in Washington. His speech will be published in full just minutes before his verbal delivery at Congress begins near 14:00 GMT.

- At 17:30 GMT, Federal Reserve Governor Michelle Bowman delivers a speech titled "Promoting an Inclusive Financial System" at the Financial Inclusion Practices and Innovation Conference, in Washington.

- This morning, equity markets painted a remarkable picture: both Asian and US indices are up, while Europe is lagging, with all major European indices down.

- The CME Fedwatch Tool is broadly backing a rate cut in September despite recent comments from Fed officials. The odds now stand at 73.6% for a 25-basis-point cut. A rate pause stands at a 22.9% chance, while a 50-basis-point rate cut has a slim 3.5% possibility.

- The US 10-year benchmark rate trades at 4.30%, near its weekly low.

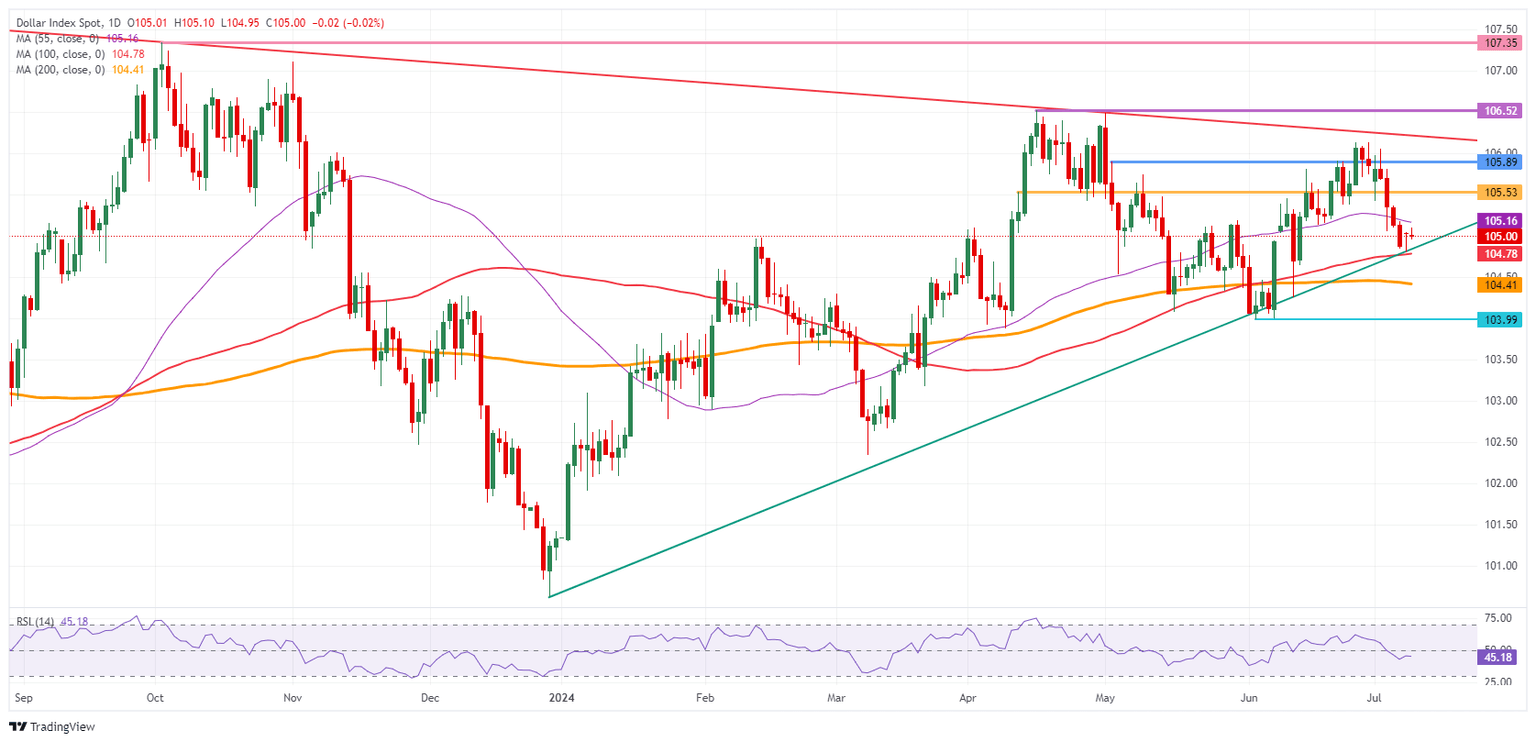

US Dollar Index Technical Analysis: Play and repeat

The US Dollar Index (DXY) is back to square one this week after the small losses registered on Monday that occurred on the back of the French election outcome in Europe. With a government formation now in total gridlock, markets can write off France for the coming months as no risk anymore and quickly dial in on the speech from US Federal Reserve Chairman Jerome Powell. Expectations are that Powell will repeat that the Fed remains data-dependent, more needs to be done, though that disinflation is on the right trajectory with rates remaining stable, pushing forward any change in monetary stance to the Jackson Hole Symposium by late August.

On the upside, the 55-day Simple Moving Average (SMA) at 105.16 remains the first resistance. Should that level be reclaimed again, 105.53 and 105.89 are the next nearby pivotal levels. In case Fed Chairman Powell delivers some hawkish comments before Congress, the red descending trend line in the chart around 106.23 and April’s peak at 106.52 could come into play.

On the downside, the risk of a nosedive move is increasing, with only the double support at 104.78, which is the confluence of the 100-day SMA and the green ascending trend line from December 2023, still in place. Should that double layer give way, the 200-day SMA at 104.43 is the gatekeeper that should catch the DXY and avoid further declines. Further down, the correction could head to 104.00 as an initial stage.

US Dollar Index: Daily Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.