US Dollar rallies after geopolitical tensions spark concerns in global markets

- The US Dollar sees overnight comments from Fed Chairman Powell trigger a change in US Dollar sentiment.

- In the Middle East, rumours on Iran set to launch ballistic missiles into Israel triggers risk off.

- The US Dollar Index prints a seven-day high ahead of ISM Manufacturing PMI data.

The US Dollar (USD) sees traders ignoring rather soft Purchase Managers INdex numbers from the Institute for Supply Management (ISM) this Tuesday. Overshadowing those numbers are the geopolitical tensions that are building up in Iran. After the incursion from Israel into the Iranian border region, a headline on possibly retaliation by Iran towards Israel via balistic missiles is triggering a broad flight to safe havens.

Looking at the economic calendar, the JOLTS Jobs Openings number was the outlier on the day. Expectations were for a steady number, while actually an uptick was printed for the August number. This means the Job market is still quite healty in demand and could be a sign on the wall for the upcoming Nonfarm Payrolls number on Friday.

Daily digest market movers: Risk Off will do

- Fed Chairman Powell left some remarkable comments overnight. One was that the Fed is even taking data into consideration for its upcoming policy meeting during its blackout period. This will make markets even more data dependent in the runup to the event.

- Israel is carrying out a “targeted” ground offensive in Lebanon, while Hezbollah is firing back with artillery and rockets targeting Israeli soldiers near the town of Metula. The United Arab Emirates, meanwhile, has issued a statement expressing deep concerns over Israel’s ground operation, warning of repercussions of this dangerous situation for the region, Bloomberg reports.

- The final reading of the S&P Global Manufacturing Purchasing Managers Index (PMI) for September was a steady 47.3 against 47 in the first reading.

- At 14:00 GMT, the ISM Manufacturing numbers for September was released:

- The headline PMI remained unchanged at 47.2 from a month earlier.

- Among the main subindexes, the Prices Paid component fell into contraction to 48.3, from 54, while the Employment Index fell as well to 43.9, from 46.

- In the slipstream of ISM, the JOLTS Job Openings for August saw an uptick over 8 million to 8.04 million job openings against the 7.711 million previously.

- Several Fed speakers will take the stage this Tuesday:

- At 15:00 GMT, Federal Reserve Bank of Atlanta Raphael Bostic delivers welcoming remarks and moderates a conversation with Federal Reserve Board Governor Lisa Cook at the Technology-Enabled Disruption conference in Atlanta.

- Near 22:15 GMT, Federal Reserve Bank of Richmond Thomas Barkin participates in a panel discussion with Atlanta Fed President Raphael Bostic and Boston Fed President Susan Collins at the Technology-Enabled Disruption conference in Atlanta.

- Equities are nosediving with all US major indices down over 1%. European equities are set to close off in the red as well for this Tuesday.

- The CME Fedwatch Tool shows a 63.0% chance of a 25 basis-point rate cut at the next Fed meeting on November 7, while 37.0% is pricing in another 50-basis-point rate cut.

- The US 10-year benchmark rate trades at 3.71%, softer on the day with inflow triggering lower yields as prices surge.

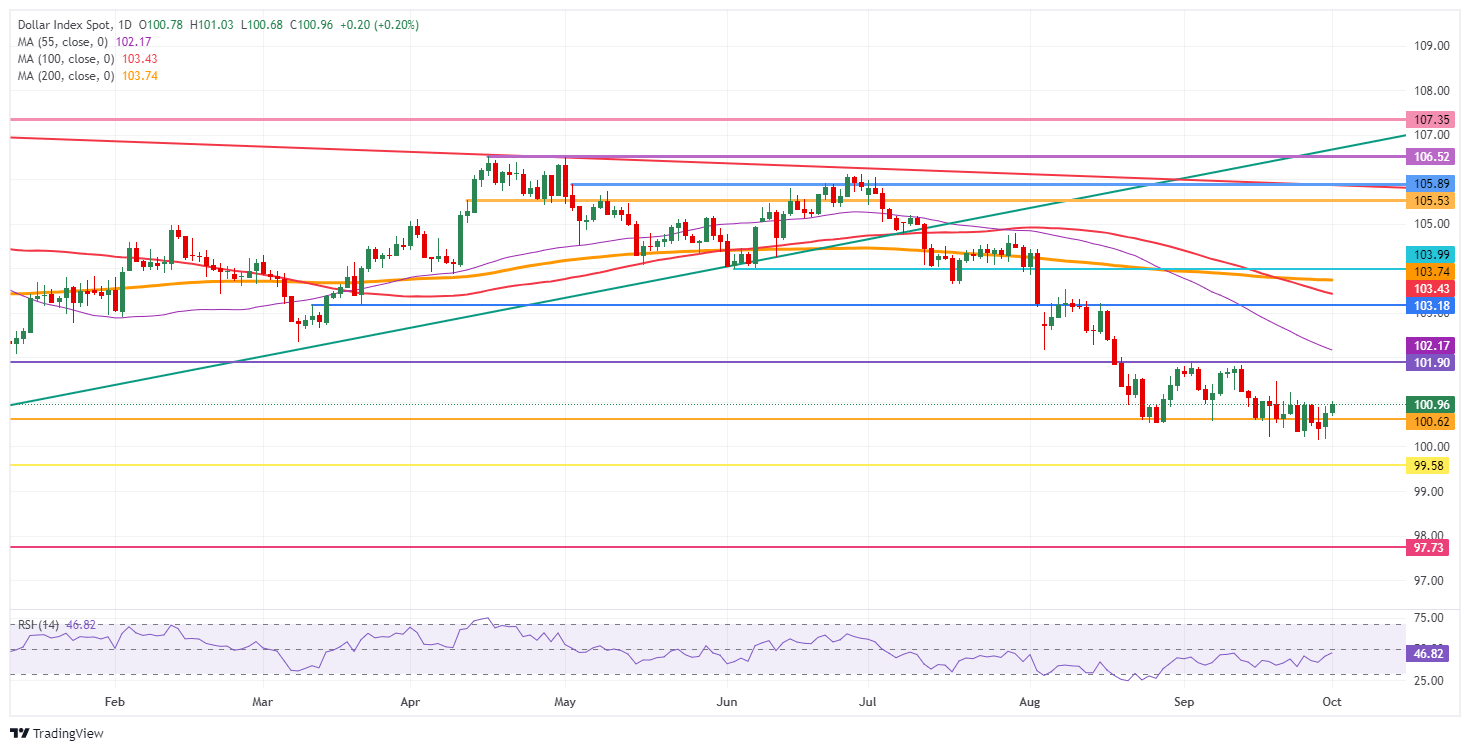

US Dollar Index Technical Analysis: Pushing through

The US Dollar Index (DXY) gets help from Fed Chairman Jerome Powell, whose comments have eased market expectations of another big rate cut for the upcoming rate decision in November. Fewer odds for a bigger cut support the US Dollar, as it subdues performance from other currencies in the DXY basket such as the Euro (EUR). Markets are increasingly pricing in that the European Central Bank (ECB) might be set to deliver a surprise rate cut in October, which widens the rate differential in favour of a stronger US Dollar.

The recovery looks to be a fierce one with the DXY already taking out four previous daily highs during Tuesday’s Asian trading. In case Dollar bulls can turn things further around, look at 101.90 for the next resistance level on the upside. Just above there, the 55-day Simple Moving Average (SMA) at 102.22 will come in.

On the downside, 100.62 is flipping back from resistance into support, in case the DXY closes above it this Tuesday. The fresh low of 2024 is at 100.16, so a test will take place before more downside takes place. Further down, and that means giving up the big 100.00 level, the July 14, 2023, low at 99.58 comes into play.

US Dollar Index: Daily Chart

Employment FAQs

Labor market conditions are a key element in assessing the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels because low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given their significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.