Silver Price Analysis: US Dollar´s bearish correction could still support, but bears are moving in

- Silver has corrected into a 61.8% Fibonacci area and bears are moving in.

- However, the confirming break-of-structure-point is not until $24.9332 to confirm a downside bias.

- US Dollar could continue to correct lower, bullish for Silver.

As per the prior session´s analysis, ´´Silver bulls are lining up as the US Dollar hits a 61.8% Fibo area,´´ the US Dollar did indeed come under pressure and Silver has corrected bullishly as the following will illustrate:

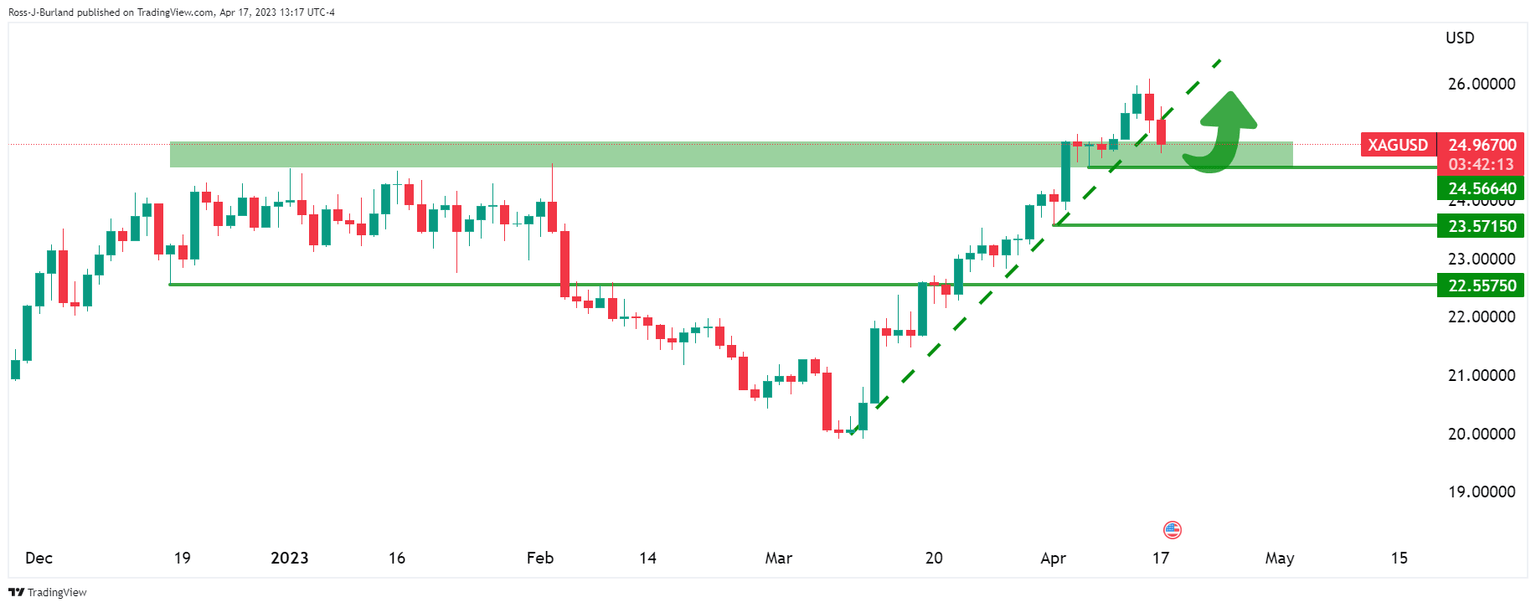

Silver prior analysis

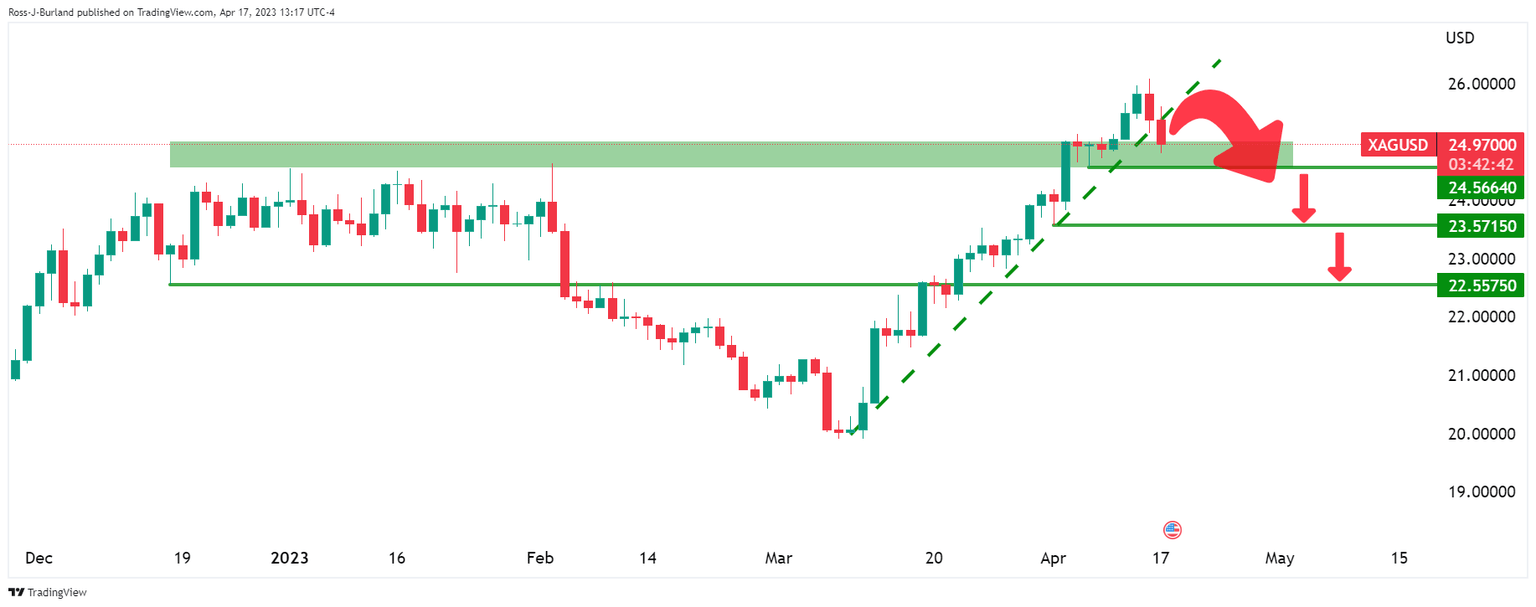

It was stated that Silver had broken below the trendline support and that the Silver price could close on a daily candle in the support area.

$24.5664 was the first import structure level that may otherwise have given way to sell-off as illustrated below. However, it was explained that there could be some consolidation and price discovery to follow over the coming days in and around the recent highs and lows.

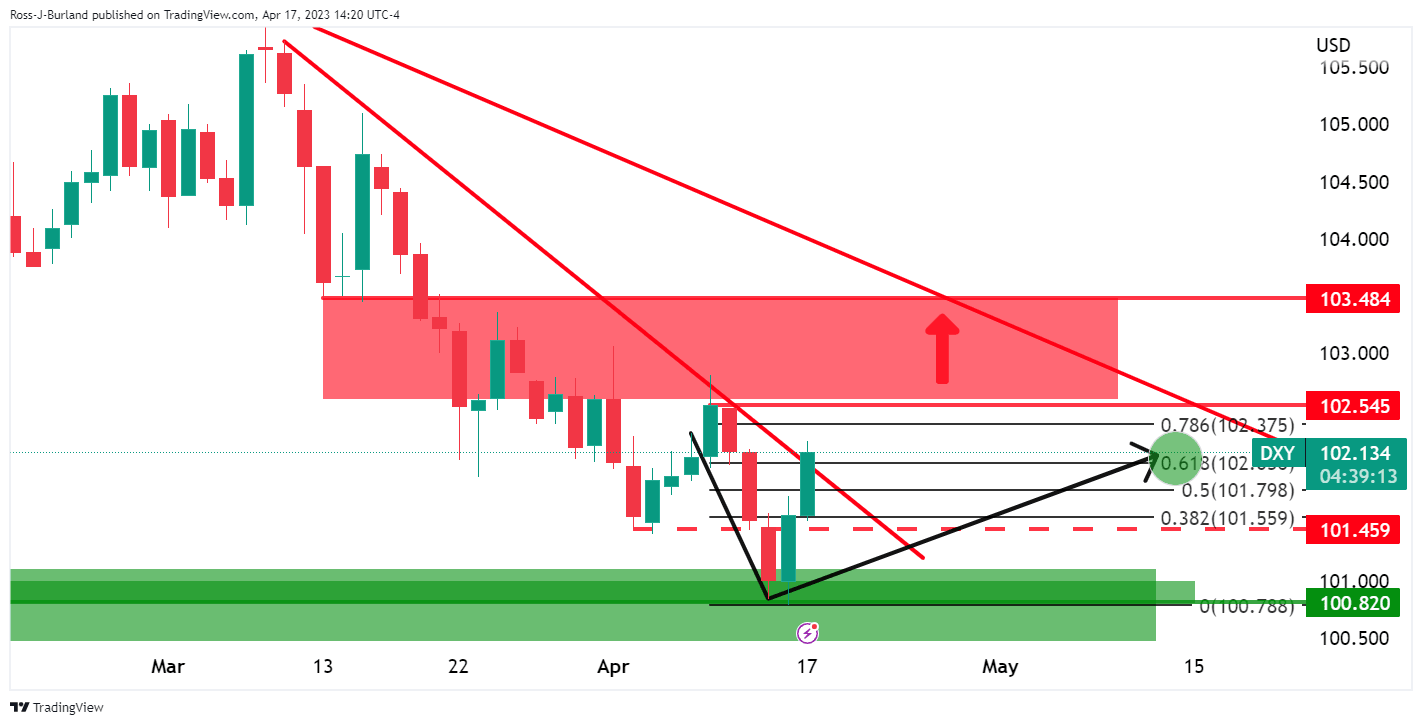

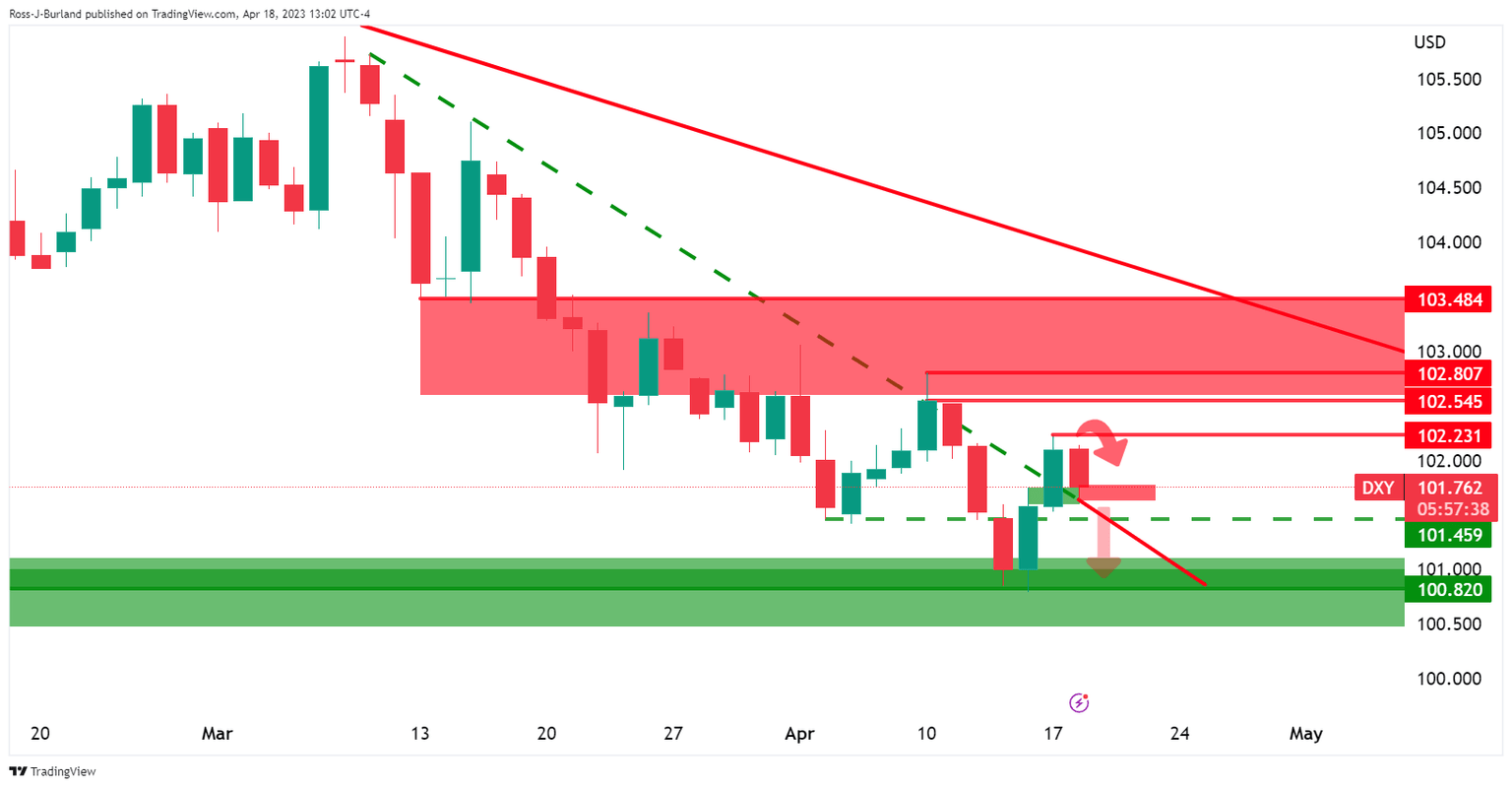

US Dollar took on a 61.8% Fibo:

It was acknowledged that f the DXY stalled, then Silver bulls would be in play:

Silver & DXY updates

We are seeing the correction in the US Dollar on Tuesday. However, so long as 101.50 holds on a closing basis, then the bulls will likely be encouraged within a bullish schematic that is in development.

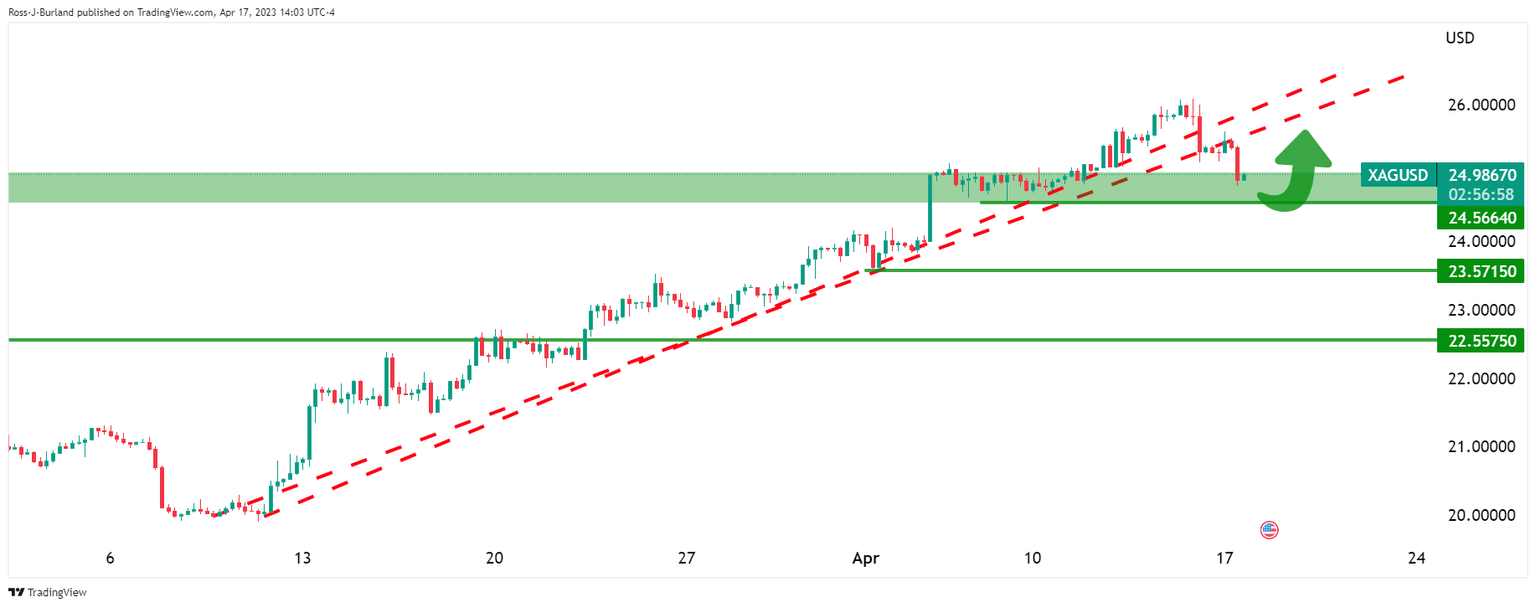

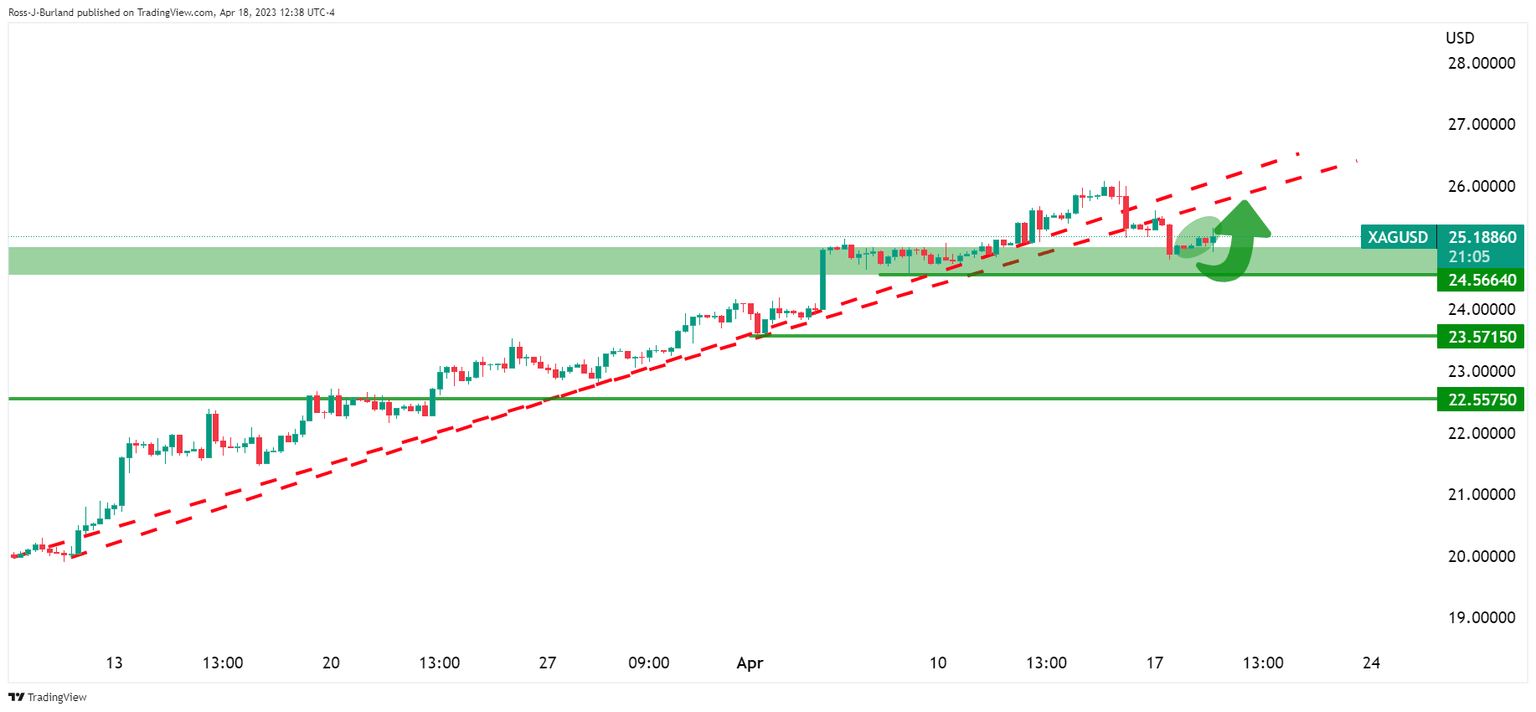

This is giving rise to a bullish correction in the white metal:

However, while being on the backside of the bearish trend, the $24.5664 structure remains vulnerable:

Zooming in:

Silver has corrected into a 61.8% Fibonacci area and is being rejected toward trendline support. However, the confirming break-of-structure-point is not until $24.9332 to confirm the downside bias.

Silver H1 chart

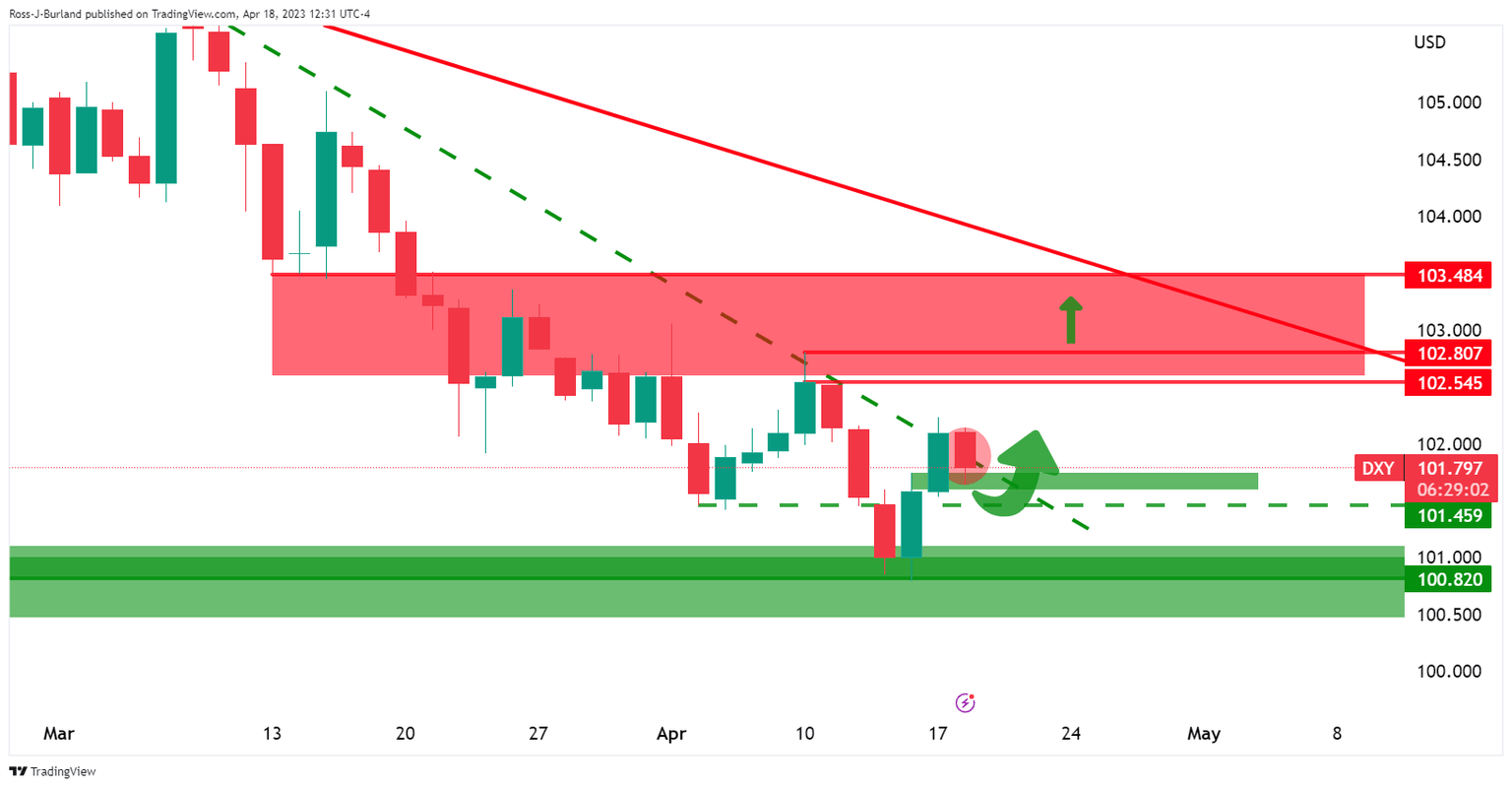

US Dollar bearish scenario

All in all, this could be too premature and the US Dollar could remain under pressure for some time to come, leading to a firmer correction in Silver for the sessions and days ahead:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.