Silver bulls are lining up as the US Dollar hits a 61.8% Fibo area

- Silver is holding up in support but within a firmer US Dollar environment.

- Bulls are lurking in support as US Dollar takes on a 61.8% Fibo.

Spot silver XAG/USD fell to $24.8090 per ounce on Monday but has since recovered some ground to $24.9816 currently but remains well below the highs of the day of $25.6080. The drop comes amid a revival of the US Dollar bulls and hawkish sentiment surrounding the Federal Reserve again.

While investors looked for cues on whether the market will see a 'one and done' rate hike by the U.S. Federal Reserve in May, on Friday, to the contrary, Federal Reserve´s Governor Christopher Waller said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. With a combination of firm consumer spending for the past quarter, and the April survey of business activity in New York state rising for the first time in five months, the US Dollar gained 0.6%. This is making greenback-priced precious metals less attractive for overseas buyers, while benchmark Treasury yields climbed to a more than two-week high.

Moreover, Fed funds futures are showing that the expectations that the Fed will start cutting rates later this year have been pushed back to November from September, with a smaller cut now anticipated also.

With a relatively light calendar for the rest of the week, investors will focus on US flash PMIs for April and any further comments from Fed officials before they enter into a blackout period from April 22 ahead of the Fed's May 2-3 meeting. In this regard, analysts at TD Securities said the S&P PMIs for early April will offer a first comprehensive look at the state of the US economy post-banking turmoil. ´´Note that the March data was not clearly impacted by banking jitters, but perhaps it was too soon to be reflected: both the mfg and services PMIs registered their third consecutive increase then, with the latter advancing further into expansion territory.´´

As for Fed speakers, we have heard from President and CEO of the Federal Reserve Bank of Richmond Thomas Barkin so far who has stated that he wants to see more evidence of inflation settling back to target. Barkin also said he feels reassured by what he is seeing in the banking sector.

Silver technical analysis

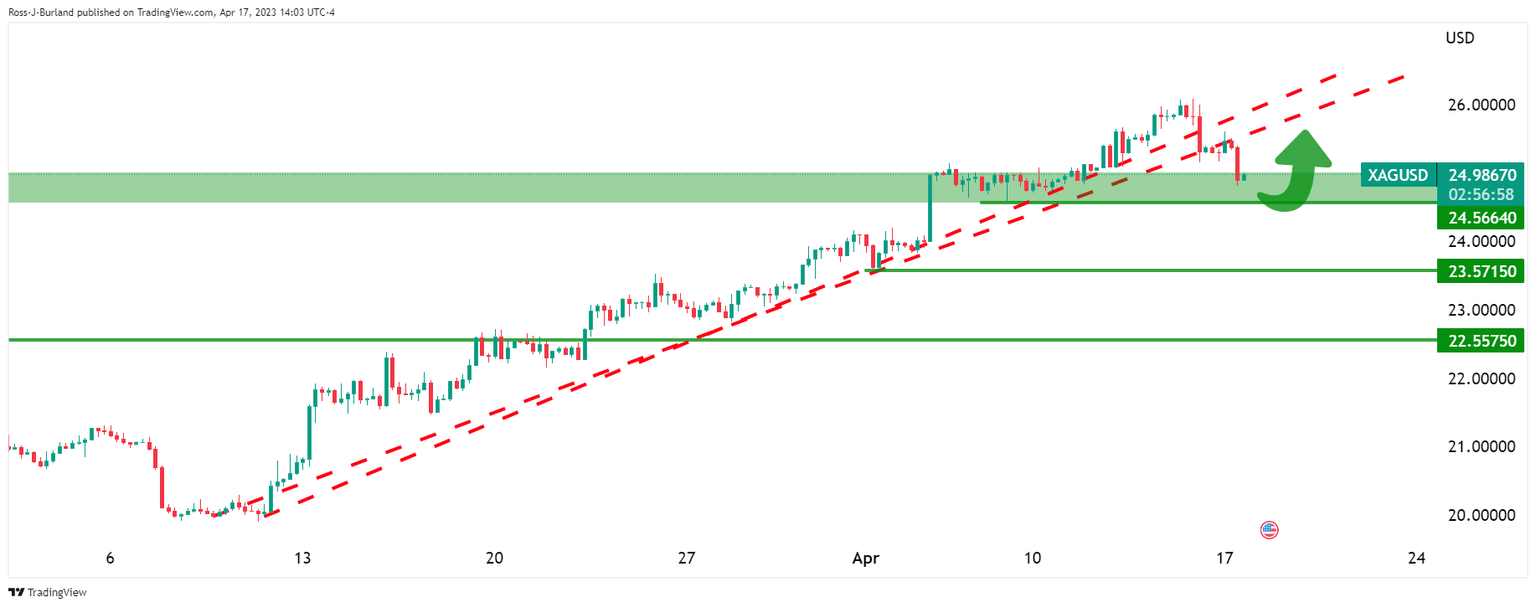

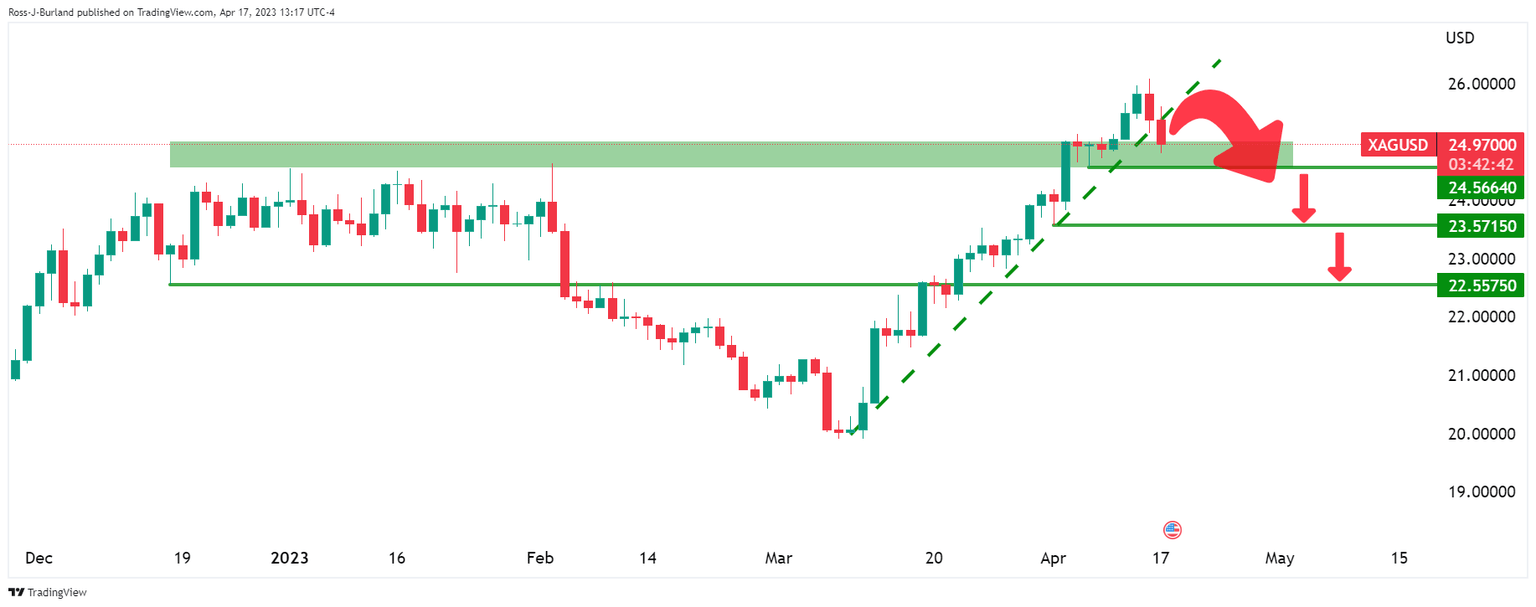

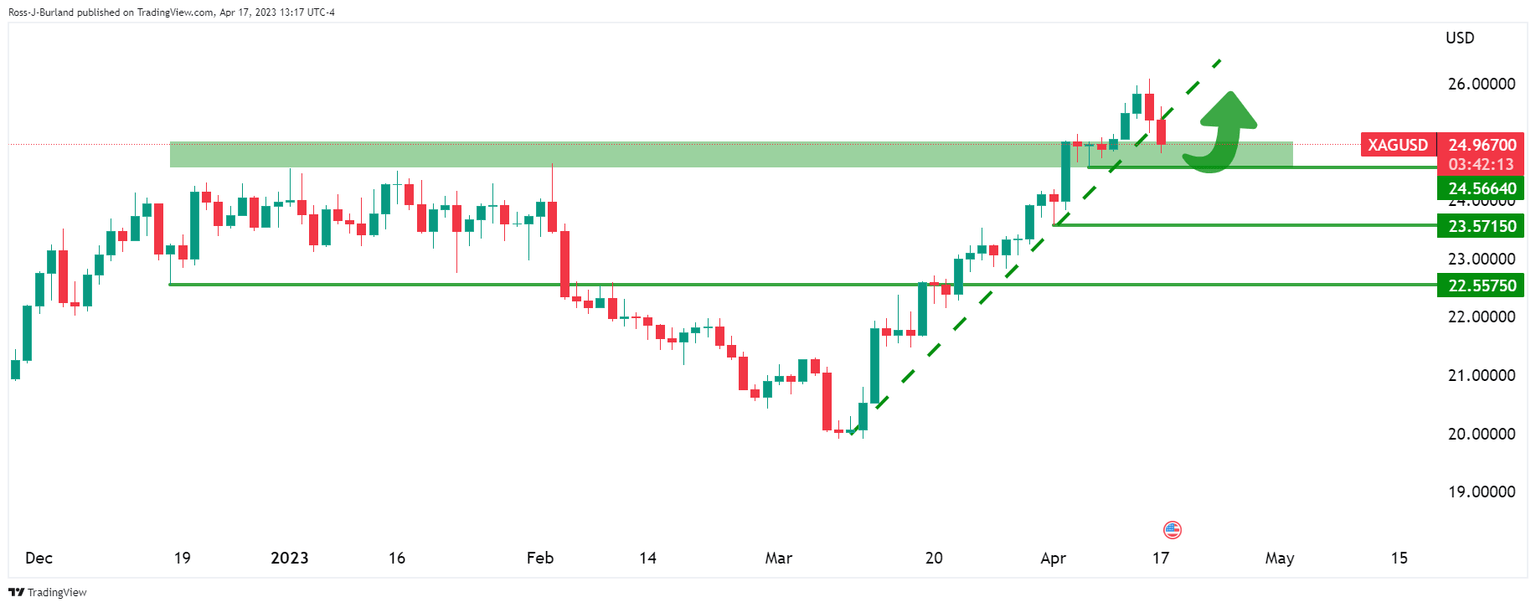

Silver has broken below the trendline support and could close on a daily candle in the support area. $24.5664 is the first import structure level that may otherwise give way to sell-off as illustrated below. However, there could be some consolidation and price discovery to follow over the coming days in and around the recent highs and lows.

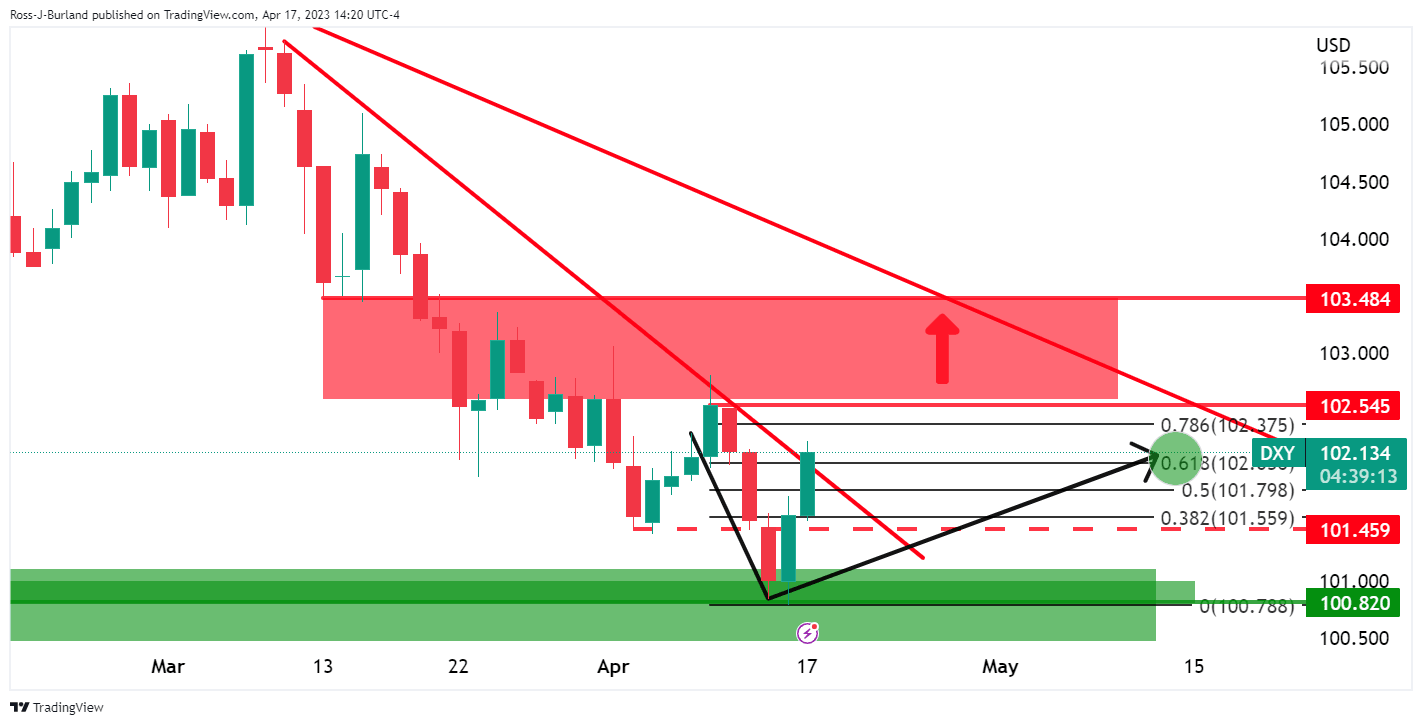

US Dollar takes on a 61.8% Fibo:

If the DXY stalls, Silver bulls will be in play.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.