Pound Sterling tumbles as dovish BoE bets swell after soft UK Inflation

- The Pound Sterling falls vertically after the UK inflation data for September came in slower than expected.

- UK annual headline CPI decelerated below the bank’s target of 2%.

- Traders expect the Fed to cut interest rates moderately in the remainder of the year.

The Pound Sterling (GBP) faces an intense sell-off as the United Kingdom (UK) Office for National Statistics (ONS) has published a soft Consumer Price Index (CPI) report for September. The CPI report showed that the annual headline inflation softened to 1.7%. Price pressures were expected to decelerate but at a slower pace to 1.9% from 2.2% in August. Month-on-month headline inflation remained flat.

The core CPI inflation – which excludes volatile items such as food, energy, oil, and tobacco – decelerated at a faster-than-expected pace to 3.2%, from the estimates of 3.4% and the former reading of 3.6%. Services inflation, a closely watched indicator by Bank of England (BoE) officials, grew at a slower pace of 4.9% from 5.6% in August. A sharp deceleration in price pressures is expected to force traders to raise bets supporting interest rate cuts in each of the two policy meetings remaining this year.

Currently, financial market participants expect the BoE to cut interest rates by 25 basis points (bps) in one of the policy meetings scheduled in November and December.

Market experts were anticipating a slowdown in the service inflation as growth in the UK’s Average Earnings Excluding Bonuses, a wage growth measure that drives consumer spending, in the three months ending August was the slowest in two years. The wage growth measure rose expectedly by 4.9%, slower than the prior release of 5.1%.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | -0.33% | -0.52% | -0.19% | -0.46% | 0.07% | -0.12% | -0.19% | |

| EUR | 0.33% | -0.15% | 0.20% | -0.11% | 0.43% | 0.24% | 0.11% | |

| USD | 0.52% | 0.15% | 0.34% | 0.04% | 0.58% | 0.39% | 0.32% | |

| JPY | 0.19% | -0.20% | -0.34% | -0.30% | 0.23% | 0.02% | -0.01% | |

| CAD | 0.46% | 0.11% | -0.04% | 0.30% | 0.52% | 0.33% | 0.28% | |

| AUD | -0.07% | -0.43% | -0.58% | -0.23% | -0.52% | -0.19% | -0.23% | |

| NZD | 0.12% | -0.24% | -0.39% | -0.02% | -0.33% | 0.19% | -0.07% | |

| CHF | 0.19% | -0.11% | -0.32% | 0.01% | -0.28% | 0.23% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling underperforms US Dollar

- The Pound Sterling tests territory below the psychological support of 1.3000 against the US Dollar (USD) on Wednesday. The US Dollar stays afloat near a more than two-month high as traders have priced in moderate interest rate cuts from the Federal Reserve (Fed) in the remaining policy meetings this year, with the US Dollar Index (DXY) holding onto gains near 103.30. The Fed started the policy-easing cycle with a larger-than-usual size of 50 basis points (bps) in September.

- According to the CME FedWatch tool, 30-day Federal Funds futures pricing data suggests that there will be interest rate cuts by 25 bps in the November and December meetings.

- Traders have priced out expectations of another 50 bps rate cut in November after a string of better-than-expected United States (US) data for September, which showed signs of economic resilience. US data such as Nonfarm Payrolls (NFP) and the ISM Services PMI grew at a robust pace, diminishing fears of an economic slowdown.

- Apart from the upbeat US data, price pressures grew at a faster-than-expected pace in September, signaling that the battle against inflation is far from over.

- Going forward, investors will pay close attention to the monthly US Retail Sales data for September, which will be published on Thursday. The Retail Sales data, a key measure of consumer spending, is estimated to have grown by 0.3%.

Technical Analysis: Pound Sterling slips below 1.3000

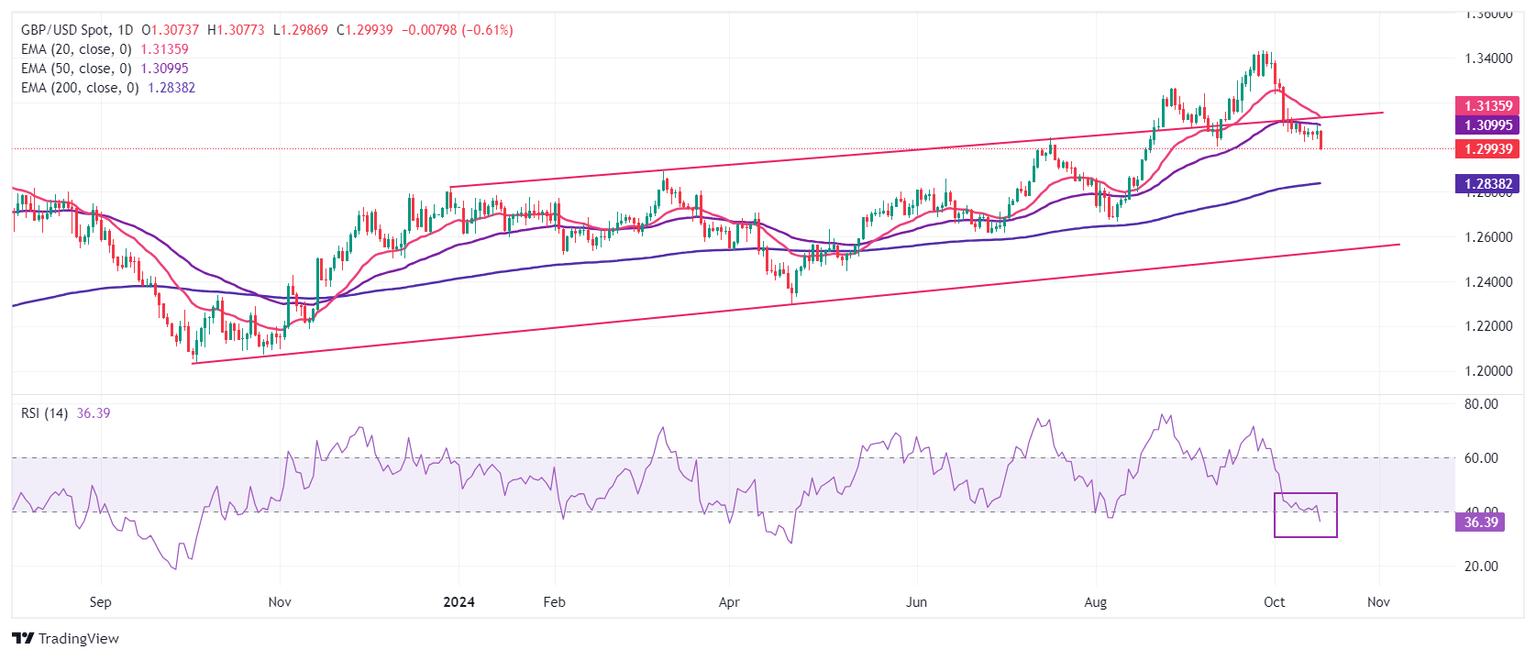

The Pound Sterling slides below 1.3000 against the US Dollar in New York trading hours. The GBP/USD pair weakens after breaking below the four-day trading range of 1.3020-1.3100. The Cable was already under pressure after slipping below the upward-sloping trendline plotted from the 28 December 2023 high of 1.2827 earlier in October.

The near-term trend of the major appears to be vulnerable as the 20- and 50-day Exponential Moving Averages (EMAs) near 1.3135 and 1.3100, respectively, are sloping downwards.

A downside move in the Relative Strength Index (RSI) below 40.00 suggests a bearish momentum.

Looking down, the 200-day EMA near 1.2840 will be a major support zone for Pound Sterling bulls. On the upside, the Cable will face resistance near the round-level figure of 1.3100.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.