Pound Sterling moves higher as US core PCE Inflation cools down expectedly

- The Pound Sterling moves higher against the US Dollar ahead of the US core PCE Inflation for May.

- Revised UK Q1 GDP estimates show that the economy grew at a higher pace of 0.7%.

- Fed policymakers expect rate cuts at this time are inappropriate.

The Pound Sterling (GBP) gains against the US Dollar (USD) in Friday’s New York session. The GBP/USD pair rises slightly as the United States (US) core Personal Consumption Expenditures (PCE) Price Index declined expectedly in May.

The core PCE inflation data, the Federal Reserve’s (Fed) preferred inflation measure, decelerated to 2.6% year-over-year (YoY), as expected, from April’s reading of 2.8%. On a monthly basis, the underlying inflation grew modestly by 0.1% against the prior increase of 0.2%.

Soft inflation figures have weighed on the US Dollar (USD) and would boost expectations of early rate cuts by the Fed. At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls to 105.80.

According to the CME FedWatch tool, 30-day fed funds futures pricing data suggest that traders have priced in two rate cuts this year, and the policy-easing cycle will begin at the September meeting. On the contrary, Fed officials advocate for keeping interest rates at their current levels until they are convinced that inflation will decline to the desired rate of 2%.

On Thursday, Fed Governor Michelle Bowman reiterated that the central bank is not yet at a point where it is appropriate to reduce interest rates. She warned of more rate hikes if progress in disinflation appears to stall or reverse.

Daily digest market movers: Pound Sterling performs strongly as UK Q1 GDP expanded at a higher rate than previously thought

- The Pound Sterling strengthens against its entire peers after the United Kingdom (UK) Office for National Statistics (ONS) reported in its revised Q1 Gross Domestic Product (GDP) report that the economy expanded at a higher rate of 0.7% quarter on quarter (QoQ) than estimates and the preliminary release of 0.6%. On an annualized basis, the economy grew by 0.3%, upwardly revised from 0.2%.

- Meanwhile, uncertainty ahead of UK elections and the timing of the Bank of England (BoE) rate cut will keep the Pound Sterling on its toes. According to the latest exit polls, the Opposition Labor Party is expected to win from the UK Prime Minister Rishi Sunak-led Conservative Party.

- For the BoE rate-cut timeframe, investors expect that the majority of officials will vote for reducing interest rates in the next monetary policy meeting, which will be held on August 1. Policymaker Swati Dhingra and Deputy Governor Dave Ramsden have been supporting rate cuts, and it will be crucial to see which members join them.

- The reason for the high probability of the BoE lowering borrowing rates in August is the return of annual headline inflation to the bank’s target of 2%. However, price pressures in the service sector are still higher than what is required to make rate cuts appropriate.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | -0.11% | -0.18% | -0.02% | -0.33% | -0.17% | 0.09% | |

| EUR | 0.04% | -0.07% | -0.12% | 0.02% | -0.30% | -0.14% | 0.12% | |

| GBP | 0.11% | 0.07% | -0.06% | 0.07% | -0.24% | -0.08% | 0.16% | |

| JPY | 0.18% | 0.12% | 0.06% | 0.12% | -0.17% | -0.02% | 0.25% | |

| CAD | 0.02% | -0.02% | -0.07% | -0.12% | -0.31% | -0.15% | 0.08% | |

| AUD | 0.33% | 0.30% | 0.24% | 0.17% | 0.31% | 0.16% | 0.40% | |

| NZD | 0.17% | 0.14% | 0.08% | 0.02% | 0.15% | -0.16% | 0.24% | |

| CHF | -0.09% | -0.12% | -0.16% | -0.25% | -0.08% | -0.40% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

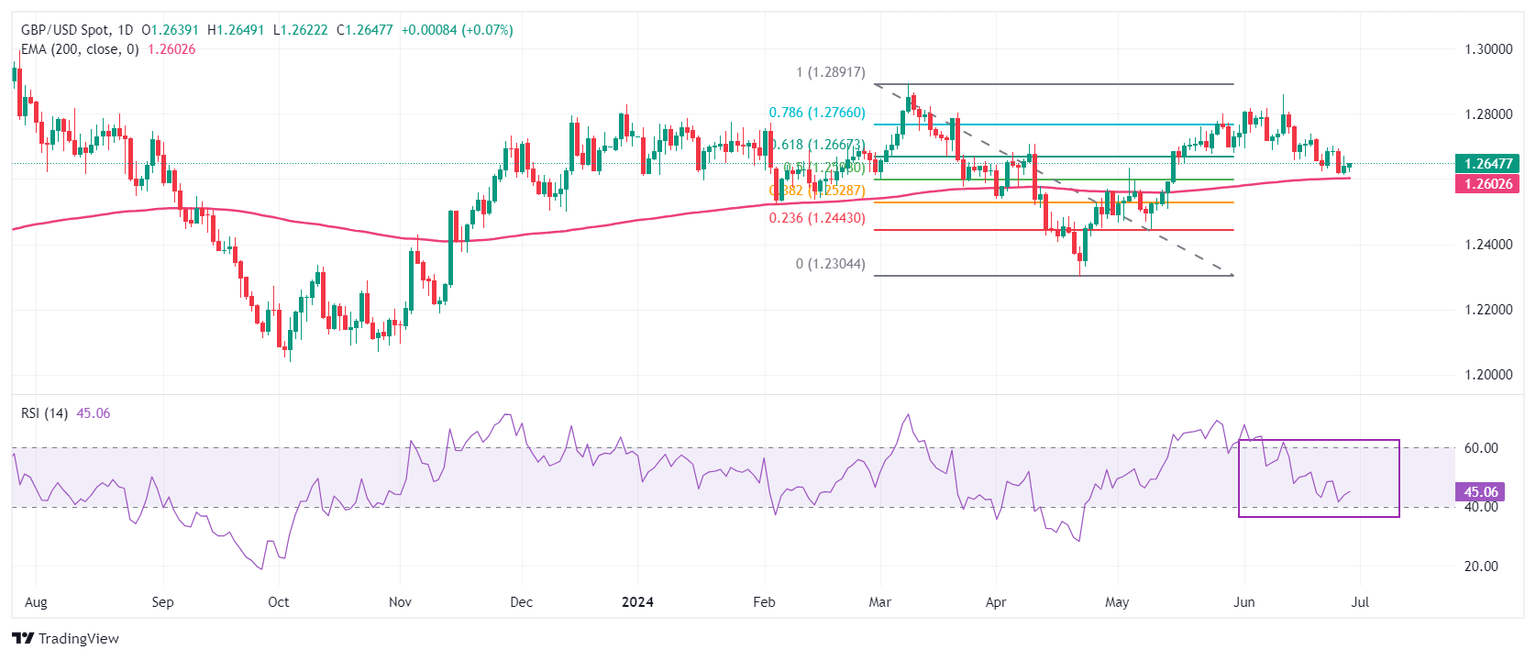

Technical Analysis: Pound Sterling remains aims to recapture 61.8% Fibo retracement support

The Pound Sterling holds key support near 1.2600 against the US Dollar. The GBP/USD pair trades inside Thursday’s trading range as investors prefer to remain sideways ahead of the release of the US inflation data. The Cable declines toward the 200-day Exponential Moving Average (EMA), which trades around 1.2590.

The pair has dropped below the 61.8% Fibonacci retracement support at 1.2667, plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating a consolidation ahead.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Jun 28, 2024 12:30

Frequency: Monthly

Actual: 2.6%

Consensus: 2.6%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.