Pound Sterling slides as UK GDP misses estimates, factory activity contracts

- The Pound Sterling drops as the UK GDP rose at a slower-than-expected pace, and factory activity contracted in November.

- Traders have raised BoE dovish bets for February’s policy meeting.

- Investors await the US weekly jobless claims and Retail Sales data for December on Thursday.

The Pound Sterling faces selling pressure in Thursday’s North American session after the release of the United Kingdom's (UK) monthly Gross Domestic Product (GDP) and factory data for November. The Office for National Statistics (ONS) reported that the economy returned to growth after contracting in October. However, the growth rate was slower than projected. The economy rose by 0.1% after declining at a similar pace in October. Economists expected the economy to have expanded by 0.2%.

Both Manufacturing and Industrial Production data contracted in November on a monthly as well as annual basis. Month-on-month, Industrial and Manufacturing Production contracted by 0.4% and 0.3%, respectively. The pace of decline was slower than that seen in October. Economists expected Industrial Production to have grown by 0.1%, while Manufacturing Production was estimated to have remained flat.

Signs of continuous weakness in the UK factory activity suggest that producers are not fully utilizing their operating capacity on the assumption that the already weak demand environment will worsen further after United States (US) President-elect Donald Trump slaps hefty import tariffs globally once he takes office.

However, growing expectations that the Bank of England’s (BoE) monetary policy easing will be less gradual this year would offer some relief for factory owners. Traders have raised BoE dovish bets after the release of the UK Consumer Price Index (CPI) data for December on Wednesday, which showed signs of cooling price pressures.

Traders see a roughly 84% chance that the BoE will reduce interest rates by 25 basis points (bps) to 4.5% at its policy meeting in February. For the entire year, economists expect four interest rate cuts, according to a Reuters poll.

Cooling price pressures have offered some relief to Chancellor of the Exchequer Rachel Reeves as they led to a pause in the rally in yields on UK gilts. 30-year UK gilt yields have corrected to 5.28% from their more-than-26-year high of 5.47%. The British currency has faced a significant decline in the last few trading days as soaring UK gilt yields due to uncertainty over the economic outlook.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. The British Pound was the strongest against the Canadian Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | -0.28% | -0.29% | -0.68% | 0.00% | -0.10% | -0.07% | -0.48% | |

| EUR | 0.28% | -0.01% | -0.40% | 0.30% | 0.19% | 0.22% | -0.20% | |

| USD | 0.29% | 0.00% | -0.41% | 0.30% | 0.19% | 0.22% | -0.20% | |

| JPY | 0.68% | 0.40% | 0.41% | 0.71% | 0.58% | 0.57% | 0.20% | |

| CAD | -0.01% | -0.30% | -0.30% | -0.71% | -0.10% | -0.08% | -0.49% | |

| AUD | 0.10% | -0.19% | -0.19% | -0.58% | 0.10% | 0.03% | -0.39% | |

| NZD | 0.07% | -0.22% | -0.22% | -0.57% | 0.08% | -0.03% | -0.41% | |

| CHF | 0.48% | 0.20% | 0.20% | -0.20% | 0.49% | 0.39% | 0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling weakens against USD

- The Pound Sterling remains under pressure slightly below 1.2200 against the US Dollar (USD) in North American trading hours. The GBP/USD pair falls due to weak UK data. While, the US Dollar trades higher, with the US Dollar Index (DXY) wobbling around 109.30, but is likely to face selling pressure as the US Initial Jobless Claims data for the week ending January 10 remains higher-than-expected and the Retail Sales data rose moderately in December.

- The US Department of Labor reported individuals claiming jobless benefits for the first time were 217K, higher than estimates of 210K and the prior release of 203K. Month-on-month Retail Sales data, a key measure of consumer spending, rose by 0.4%, slower than estimates of 0.6% and the former release of 0.8%. However, the Retail Sales rose at a faster pace of 3.9% than the prior reading of 3.8%.

- Going forward, the US Dollar will be influenced by market expectations for the Federal Reserve’s (Fed) likely interest rate action for the entire year.

- Market participants expect the Fed’s policy-easing path to be less gradual than anticipated earlier. Expectations for the Fed policy outlook were impacted after the release of the United States (US) inflation data for December on Wednesday, which showed that the progress in the disinflation trend has not stalled yet.

- According to the CME FedWatch tool, traders expect the Fed to deliver more than one interest rate cut this year and anticipate the first reduction in June. Before December’s inflation data, traders were anticipating only one interest rate reduction in September.

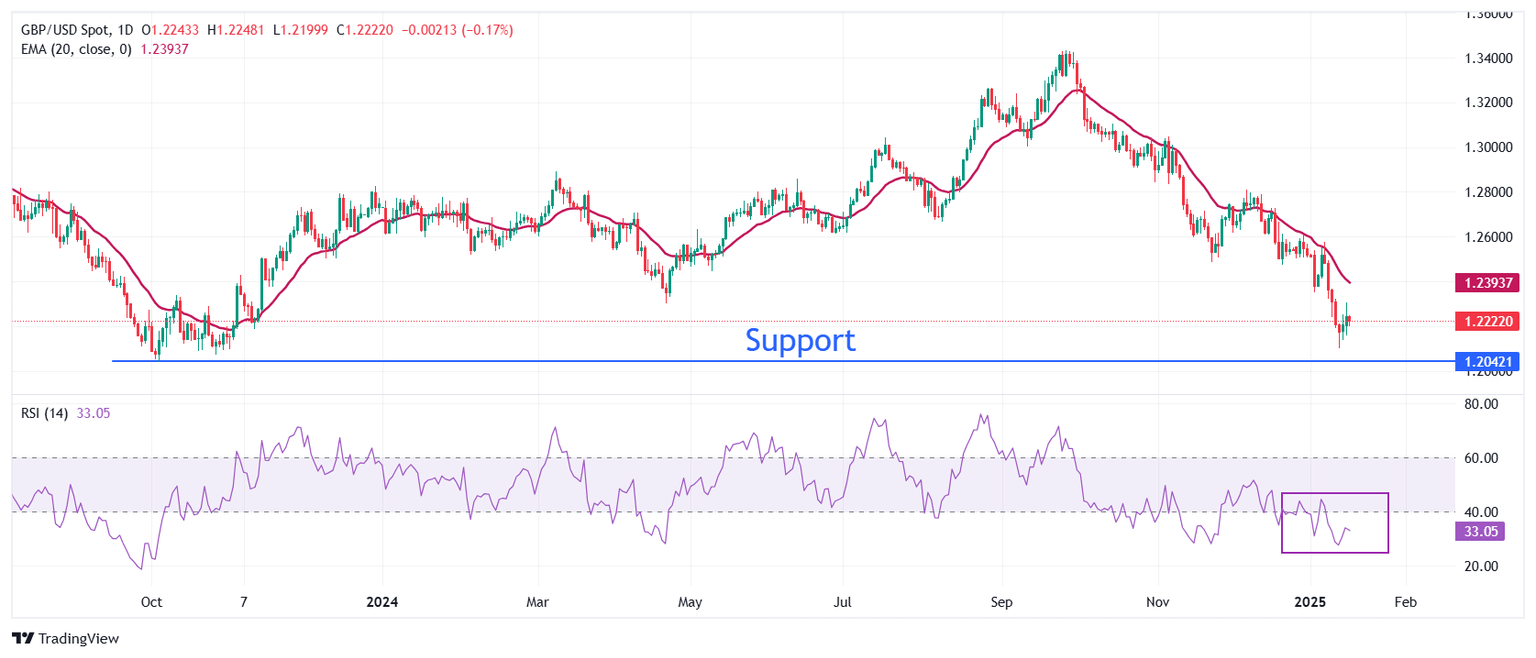

Technical Analysis: Pound Sterling stays below 1.2200

The Pound Sterling trades near the key level of 1.2200 against the US Dollar on Thursday. The outlook for the Cable remains weak as the vertically declining 20-day Exponential Moving Average (EMA) near 1.2394 suggests that the near-term trend is extremely bearish.

The 14-day Relative Strength Index (RSI) rebounds slightly after diving below 30.00 as the momentum oscillator turned oversold. However, the broader scenario remains bearish until it recovers inside the 20.00-40.00 range.

Looking down, the pair is expected to find support near the October 2023 low of 1.2050. On the upside, the 20-day EMA will act as key resistance.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jan 15, 2025 13:30

Frequency: Monthly

Actual: 3.2%

Consensus: 3.3%

Previous: 3.3%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.