Pound Sterling drops as US Dollar recovers, BoE rate-cut bets swell

- The Pound Sterling fails to hold ground against the US Dollar ahead of a US data-packed week.

- Growing speculation for Trump’s victory has improved the US Dollar’s appeal.

- A sharp decline in UK Retail Sales has boosted BoE rate-cut hopes.

The Pound Sterling (GBP) falls to near the round-level support of 1.2900 against the US Dollar (USD) in Monday’s American session. The near-term outlook of the GBP/USD pair has become uncertain after a corrective move from an annual high of 1.3044 recorded last Wednesday. The Cable faced selling pressure as improved speculation for Donald Trump winning United States (US) presidential elections this year prompted the US Dollar’s appeal.

The expectations for Donald Trump increased as US President Joe Biden decided to endorse Vice President Kamala Harris to nominate herself as a contender for elections.

Investors expect Donald Trump's election victory to lead to a rise in trade restrictions that will increase inflation. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, recovers its intraday losses to near 104.40.

Meanwhile, firm speculation that the Federal Reserve (Fed) will start reducing interest rates from the September meeting will limit the upside in the US Dollar.

This week, investors will keenly focus on a string of US economic data such as the preliminary S&P Global Purchasing Managers Index (PMI) for July, Q2 Gross Domestic Product (GDP), June’s Durable Goods Orders, and the Personal Consumption Expenditures (PCE) Price Index, the Fed's favorite inflation gauge, for June.

Daily digest market movers: Pound Sterling outperforms its peers, except US Dollar and Japanese Yen

- The Pound Sterling performs strongly against its major peers, except the Japanese Yen (JPY) and the US Dollar. The British currency exhibits strength due to political stability in the United Kingdom (UK) economy and minimal exposure to the Chinese economy. Asia-Pacific currencies have weakened due to uncertainty over China's economic outlook. The Euro and the US Dollar remain on their toes due to political uncertainty in their respective economies.

- The Pound Sterling remains firm despite a sharp decline in the UK Retail Sales data for June, which has raised doubts over whether the Bank of England (BoE) will leave interest rates unchanged in its August policy meeting.

- Data released on Friday showed that UK monthly Retail Sales contracted at a faster-than-expected pace of 1.2% in June. Economists expected a decline of 0.4% against 2.9% growth in May. The decline in Retail Sales was noted across all areas except for automotive fuel. Retail Sales data is a key measure of consumer spending, which drives consumer inflation. Weak domestic demand weighs on price pressures.

- Apart from a sharp contraction in Retail Sales, Average Earnings declined expectedly in three months ending in May. However, the pace at which wages are growing is still higher than what is needed for BoE officials to gain confidence in reducing interest rates.

- Meanwhile, expectations of persistent consumer inflation have slightly increased as UK new Finance Minister Rachel Reeves has promised to consider a wage increase for public sector employees later this month.

- Going forward, the next trigger for the Pound Sterling will be the preliminary S&P Global/CIPS PMI data for July, which will be published on Wednesday. The report is expected to show that the Manufacturing PMI expanded at a faster pace to 51.1 from the former release of 50.9. The Composite PMI is estimated to have increased to 52.5 from 52.3 in May.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.00% | -0.03% | -0.41% | 0.32% | 0.81% | 0.62% | 0.09% | |

| EUR | -0.00% | -0.09% | -0.34% | 0.30% | 0.78% | 0.60% | 0.08% | |

| USD | 0.03% | 0.09% | -0.27% | 0.38% | 0.78% | 0.69% | 0.18% | |

| JPY | 0.41% | 0.34% | 0.27% | 0.70% | 1.14% | 0.94% | 0.40% | |

| CAD | -0.32% | -0.30% | -0.38% | -0.70% | 0.49% | 0.31% | -0.21% | |

| AUD | -0.81% | -0.78% | -0.78% | -1.14% | -0.49% | -0.18% | -0.72% | |

| NZD | -0.62% | -0.60% | -0.69% | -0.94% | -0.31% | 0.18% | -0.49% | |

| CHF | -0.09% | -0.08% | -0.18% | -0.40% | 0.21% | 0.72% | 0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

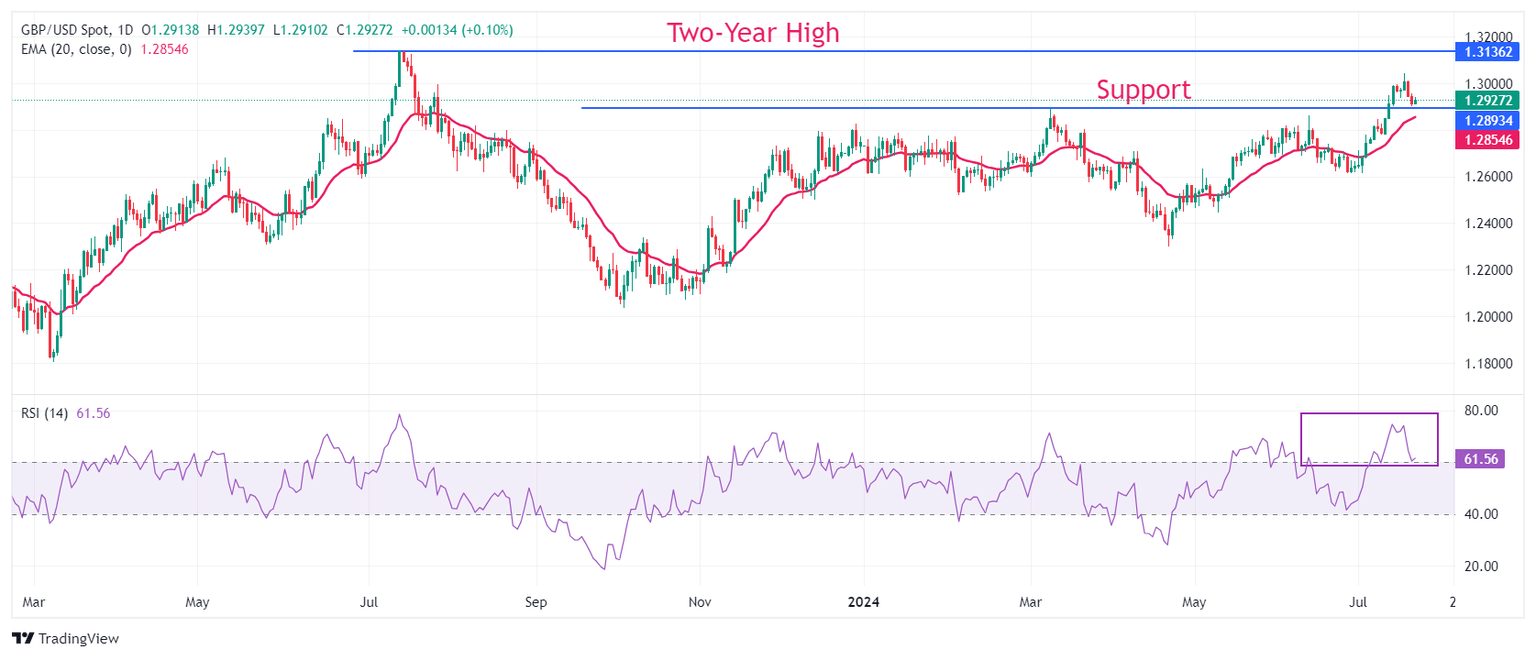

Technical Analysis: Pound Sterling struggles to hold 1.2900

The Pound Sterling appears as uncertain near 1.2900 against the US Dollar. The GBP/USD pair weakened after facing a sell-off from a fresh annual high of 1.3044 on Wednesday.

The upward-sloping 20-day Exponential Moving Average (EMA) near 1.2850 suggests that the uptrend is intact. After turning slightly overbought, the 14-day Relative Strength Index (RSI) declines and is expected to find a cushion near 60.00.

On the upside, a two-year high near 1.3140 will be a key resistance zone for the Cable. On the other hand, the March 8 high near 1.2900 will be a key support for the Pound Sterling bulls.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.