Pound Sterling Price News and Forecast: GBP/USD holds positive ground around 1.2860

GBP/USD rebounds above 1.2850 ahead of US PCE data

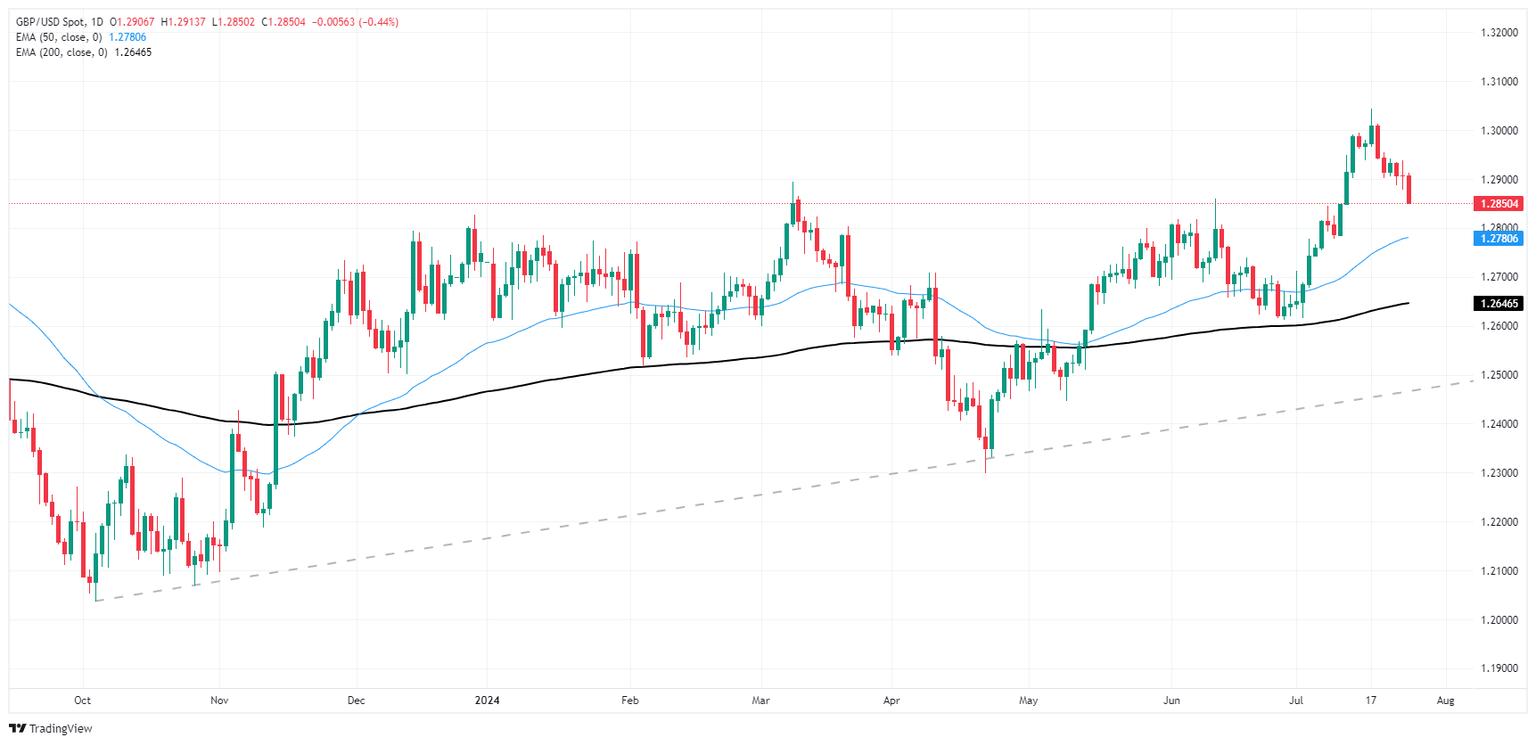

The GBP/USD pair gains traction near 1.2860 amid the weaker Greenback, snapping the three-day losing streak during the Asian trading hours on Friday. However, the potential upside of the major pair seems limited as market players expect the Bank of England (BoE) to cut interest rates in August.

The US economy grew faster than expected in the second quarter (Q2), according to the US Department of Commerce in an advance estimate released on Thursday. The US Gross Domestic Product (GDP) grows at an annual rate of 2.8% in Q2, marking an acceleration from 1.4% growth in Q1. This figure came in stronger than the estimation of 2%. Read more...

GBP/USD falls further as BoE looms ahead

GBP/USD floundered on Thursday, chalking in a third straight trading day in the red and declining below 1.2860 as market expectations of a Bank of England (BoE) rate cut next week weigh down the Pound Sterling.

US Gross Domestic Product (GDP) lurched higher in the second quarter, bringing annualized Q2 growth to 2.8%, well above the forecast 2.0% and piling onto the first quarter’s 1.4%. Markets initially recoiled from the firm upswing in growth figures, but a sharp contraction in US Durable Goods Orders helped keep hopes pinned for softening data to help push the Federal Reserve (Fed) toward a September rate cut. Read more...

GBP/USD Price Analysis: Drops below 1.2900 amid strong US data

The Pound Sterling dropped below 1.2900 for the third consecutive day, edged lower 0.17%, and traded at 1.2881 after hitting a daily high of 1.2913. Data from the UK wasn’t better than expected, while an outstanding growth report from the US bolstered the Greenback.

From a technical standpoint, the GBP/USD continues to edge lower, though sellers are encountering tough times clearing the June 12 peak at 1.2860, which turned support once cleared. Read more...

Author

FXStreet Team

FXStreet

-638575591414192963.png&w=1536&q=95)