Pound Sterling Price News and Forecast: GBP/USD – Falls on softer than expected UK inflation data

GBP/USD Forecast: Pound Sterling eyes further losses after UK inflation data

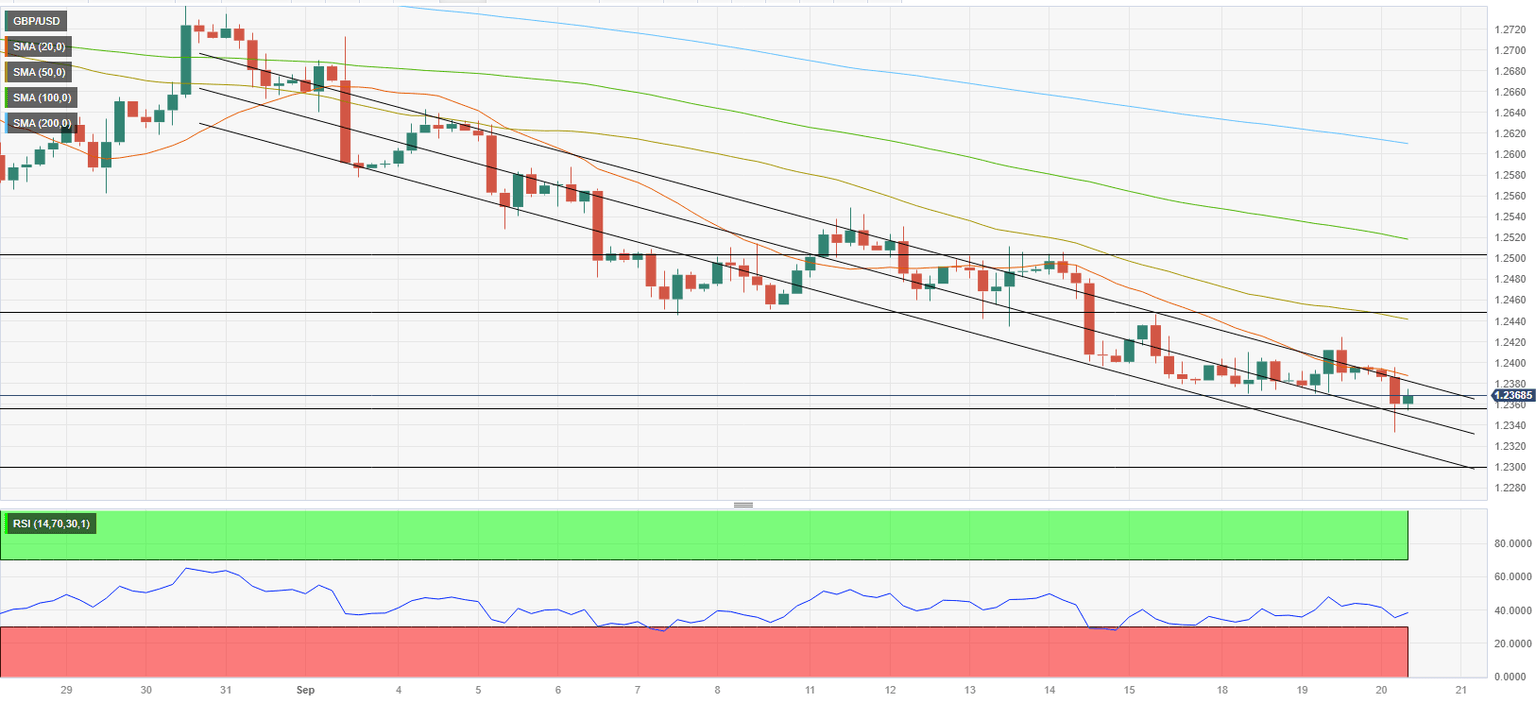

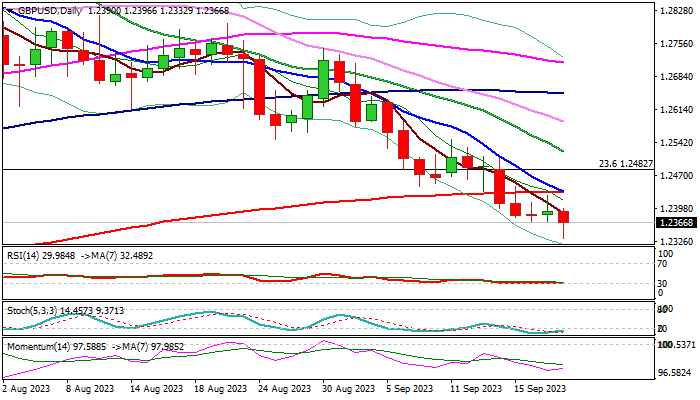

GBP/USD came under heavy bearish pressure and touched its lowest level in nearly four months at 1.2333 in the European morning before recovering back above 1.2350.

Inflation in the UK, as measured by the change in the Consumer Price Index (CPI), edged lower to 6.7% on a yearly basis in August from 6.8% in July, the UK's Office for National Statistics reported on Wednesday. More importantly, the Core CPI inflation, which excludes volatile food and energy prices, softened to 6.2% from 6.9% in the same period. Both of these readings came in below market expectations, forcing Pound Sterling to weaken against its major rivals. Read more...

GBP/USD outlook: Falls on softer than expected UK inflation data

Cable fell to new multi-month low (the lowest since May 26) early Tuesday, hit by softer than expected UK inflation readings in August. Annualized CPI dropped to 6.7% (the lowest since Feb 2022) from 6.8% in July and beating forecast for 7.0% increase, while core inflation (excluding volatile components) was down to 6.2% y/y in August, compared to 6.8% forecast and 6.9% previous month.

Although inflation remains high (over three times above 2% target) August data bring some optimism and provides relief to the Bank of England which was widely expected to raise interest rates for the 15th consecutive time in a policy meeting on Thursday, as bets now stand at 50-50 chance for staying on hold this time. Read more...

Pound Sterling recovers as uncertainty over BoE policy deepens after soft CPI report

The Pound Sterling (GBP) attracted significant offers after the UK’s Consumer Price Index (CPI) report for August turned out soft while investors projected a persistent one due to a recovery in energy prices. The GBP/USD pair weakened as core inflation decelerated significantly, portraying a slowdown in demand for non-durable goods. UK’s Producer Price Index (PPI) for core output contracted in August, which indicates that producers lost confidence in the demand outlook as high inflation bit households’ real income.

Ample volatility would remain in the Pound Sterling as the inflation data will be followed by the interest rate decision from the Bank of England (BoE). After a soft inflation report, BoE policymakers might announce the interest rate peak sooner but should remain on course to hike interest rates for the 15th straight time on Thursday. Read more...

Author

FXStreet Team

FXStreet