GBP/USD outlook: Falls on softer than expected UK inflation data

GBP/USD

Cable fell to new multi-month low (the lowest since May 26) early Tuesday, hit by softer than expected UK inflation readings in August.

Annualized CPI dropped to 6.7% (the lowest since Feb 2022) from 6.8% in July and beating forecast for 7.0% increase, while core inflation (excluding volatile components) was down to 6.2% y/y in August, compared to 6.8% forecast and 6.9% previous month.

Although inflation remains high (over three times above 2% target) August data bring some optimism and provides relief to the Bank of England which was widely expected to raise interest rates for the 15th consecutive time in a policy meeting on Thursday, as bets now stand at 50-50 chance for staying on hold this time.

However, there is a risk of fresh increase in inflationary pressure, as oil and food prices continue to rise, maintaining inflationary pressure and keeping in play risk of further policy tightening.

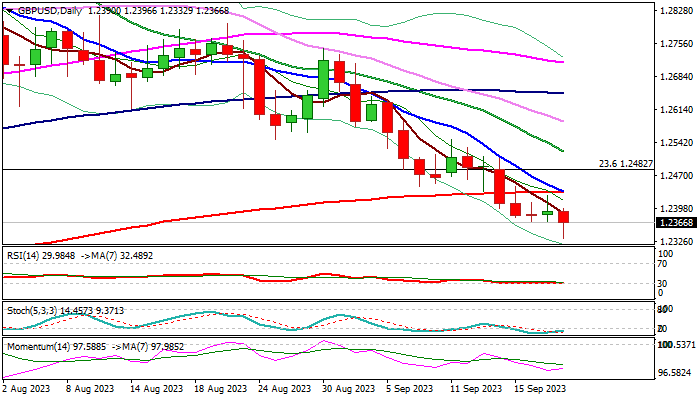

Technical picture on daily chart is bearish (bear-cross 5/200DMA’s / strong negative momentum) but oversold conditions produce headwinds as the price is approaching key short-term support at 1.2307 (May 25 trough).

Upticks should be capped by broken 200DMA (1.2432) to keep larger bears intact for attack at 1.2307 pivot, break of which would open way for deeper correction of a larger 1.0348/1.3141 uptrend and expose targets at 1.2074 (Fibo 38.2% of 1.0348/1.3141) and 1.2000 (psychological).

Conversely, sustained break above 200DMA would signal stronger correction, with lift above pivotal 1.2500 zone to generate initial signal of reversal.

Market await Fed’s verdict (due later today and expected to stay on hold) and more significant decision of the Bank of England on Thursday.

Sterling is likely to come under fresh pressure if BoE pauses this time, while bulls may gain traction if the central bank opts for another rate hike and keeps hawkish stance.

Res: 1.2432; 1.2482; 1.2504; 1.2522.

Sup: 1.2332; 1.2307; 1.2274; 1.2190.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.