Pound Sterling rises as Trump's gradual tariff hikes prompt risk-on mood

- The Pound Sterling jumps to near 1.2375 against the US Dollar as Trump's tariffs on China are lower than feared.

- Trump threatens to impose 10% tariffs on China on February 1, lower than the 60% vowed in the election campaign.

- Investors expect the BoE to reduce interest rates by 25 bps in February.

The Pound Sterling (GBP) ticks higher to near 1.2375 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair gains as the US Dollar struggles to hold its two-week low, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trading cautiously around 107.90 as its safe-haven demand has moderated.

The USD’s safe-haven appeal has diminished as the tariff plans disclosed by the United States (US) administration under President Donald Trump are less fearful than what investors had anticipated in the election campaign. Trump said on Tuesday that he would impose 10% tariffs on China on February 1, the same day he vowed to slap 25% tariffs on other North American economies. In the election campaign, Trump threatened to impose 60% tariffs on China.

Market experts believe that tariffs would come in a more balanced way, due to which the risk premium of the US Dollar has diminished. A cautious tariff approach would also trim upside risks to inflation remaining persistent, weighing on firm expectations that the Federal Reserve (Fed) will keep interest rates at their current levels for longer.

According to the CME FedWatch tool, traders are confident that the Fed will keep its key borrowing rates in the range of 4.25%-4.50% in the upcoming three policy meetings.

Daily digest market movers: Pound Sterling gains against USD as investors start digesting Trump's tariff threats

- The Pound Sterling performs strongly against its major peers on Wednesday as market sentiment turns favorable for risk-perceived currencies amid ambiguity over Trump’s tariff plans. However, its outlook is still uncertain as the Bank of England (BoE) is almost certain to cut interest rates by 25 basis points (bps) to 4.5% in the policy meeting in February.

- Soft United Kingdom (UK) inflation and Retail Sales data for December, weak labor demand in three months ending November, and moderate Gross Domestic Product (GDP) growth have forced traders to price in a 25 bps interest rate reduction by the BoE next month.

- However, high wage growth is still a major concern for the BoE, given that wage pressures are the key driving force for inflation in the service sector. The Office for National Statistics (ONS) reported on Tuesday that Average Earnings Excluding Bonuses rose at a robust pace of 5.6%, faster than estimates of 5.5% and the former 5.2%.

- Going forward, investors will focus on the preliminary S&P Global/CIPS Purchasing Managers Index (PMI) data for January, which will be published on Friday.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.09% | 0.25% | 0.07% | -0.16% | -0.01% | -0.08% | |

| EUR | 0.14% | 0.05% | 0.41% | 0.20% | -0.03% | 0.12% | 0.05% | |

| GBP | 0.09% | -0.05% | 0.35% | 0.15% | -0.08% | 0.07% | 0.00% | |

| JPY | -0.25% | -0.41% | -0.35% | -0.18% | -0.42% | -0.29% | -0.34% | |

| CAD | -0.07% | -0.20% | -0.15% | 0.18% | -0.24% | -0.09% | -0.15% | |

| AUD | 0.16% | 0.03% | 0.08% | 0.42% | 0.24% | 0.15% | 0.09% | |

| NZD | 0.01% | -0.12% | -0.07% | 0.29% | 0.09% | -0.15% | -0.07% | |

| CHF | 0.08% | -0.05% | -0.00% | 0.34% | 0.15% | -0.09% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

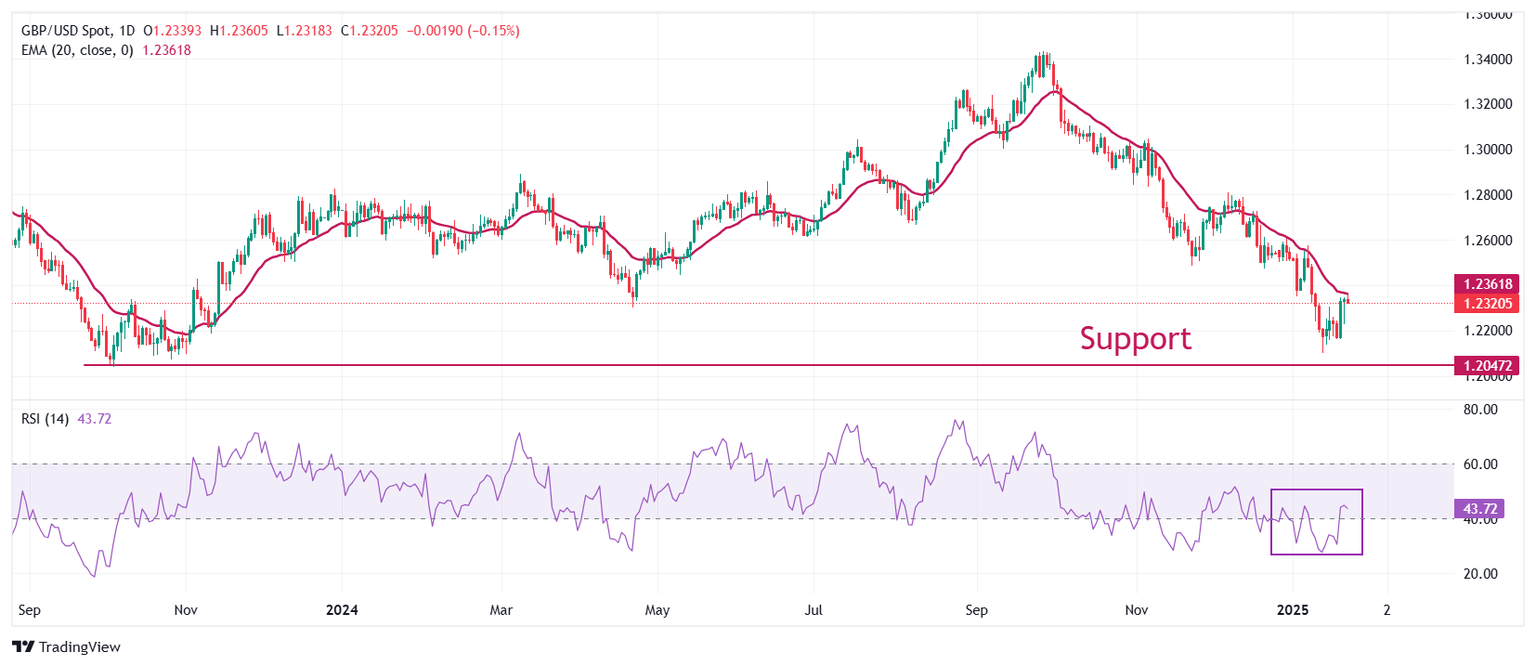

Technical Analysis: Pound Sterling rises close to 20-day EMA

The Pound Sterling strives to break above the 20-day Exponential Moving Average (EMA), which trades around 1.2360, against the US Dollar. The GBP/USD pair rebounded after posting a fresh over-one-year low of 1.2100 on January 13.

The 14-day Relative Strength Index (RSI) rebounds to near 43.50 from the 20.00-40.00 range, suggesting that the bearish momentum has ended, at least for now.

Looking down, the pair is expected to find support near the October 2023 low of 1.2050. On the upside, the round level of 1.2400 will act as key resistance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.