Equities report: Trump, the Fed and earnings to shake US equities markets

Major US stock markets indexes, over the past week have abandoned any bearish tendencies and moved decisively higher implying a wider degree of confidence on behalf of investors. We note that there were only few financial releases of interest in the past week and its expected to be a quiet week ahead from the US in that aspect. Hence we intend to focus primarily on the fundamentals leading the US equities markets as well as the earnings season. For a rounder view we provide a technical analysis of the S&P 500 daily chart.

Trump’s inauguration allowed US stock markets to rise further

Trump’s inauguration did not seem to have a major impact on the markets. The fact that in his inauguration speech, US President Trump did not proceed with any surprises. Overall given the intense style of US President Trump which the markets are used to, the inauguration speech seemed to be more or less moderated. We note Trump’s intentions to crack down on immigration, pardons for January 6th rioters, the reversal of initiatives for gender and race. Yet the highlight market wise may be Trump’s intentions to maximise oil and natural gas production as well as his intentions to apply tariffs on Mexico and Canada from February 1st onwards. Tariffs were also announced yesterday, for EU and Chinese products. Also we expect the Trump Government to further deregulate the markets which could provide support for the US stockmarkets. We also note that US President Trump on Tuesday announced a private sector investment of up to $500 billion to fund infrastructure for artificial intelligence, aiming to outpace rival nations in the business-critical technology, as per Reuters, a move that is also expected to be supportive for US stockmarkets and intensify the markets’ interest in AI.

The Fed’s interest rate decision may weigh on US stock markets

Trump’s intentions for cracking down on immigration and imposing tariffs of US imports from Mexico, Canada, the EU and China, may reignite inflationary pressures in the US economy which in turn may prompt the Fed to adopt a more hawkish stance. Hence, we highlight the release of the Fed’s interest decision next Wednesday. The market’s expectations as expressed by Fed Fund Futures are for the bank to remain on hold in the January meeting and its characteristic that the market has almost fully priced in such a scenario to materialise. The market also seems to expect the bank to proceed with a rate cut in the June meeting and that rate cut being possibly the only one for 2025. Hence should the bank remain on hold as expected, the market’s attention is to shift towards the bank’s accompanying statement and Fed Chairman Powell’s press conference about half an hour later. Should the accompanying statement and Powell’s press conference be characterised by a hawkish tone which would verify if not enhance the market’s expectations for the bank remaining on hold for a prolonged period, we may see the event weighing on US stockmarkets. On the flip side should the Fed’s decision be characterised by a less than expected hawkish tone, the release may support US stockmarkets as it would imply a faster easing of financial conditions in the US economy.

Past and upcoming earnings releases, focus on next Wednesday

In the past week, we note the release of the earnings reports of big banks, namely JPMorgan Chase & Co (JPM), Wells Fargo & Company (WFC), Goldman Sachs (GS), Black Rock (BLK), City Group ( C ), Bank of NY Mellon (BK), Bank of America (BAC) and Morgan Stanley (MS). All the named banks reported higher revenue than expected with most surpassing also the revenue figure of the past quarter. On a profitability level, all reported higher EPS figures than expected and most also higher EPS figures than the respective ones in the past quarter. The releases in an aggregated manner tended to highlight the health of the US banking sector which may have provided more confidence to the average investor. In the coming week amidst a slew of earnings releases, we note the release of the earnings reports of American Airlines (AAL) on Thursday, American Express (AXP) and Verizon (VZ) on Friday, AT&T (T) on Monday, Louis Vuitton ADR (LVMUY), Boeing (BA), Lockheed Martin (LMT), Starbucks (SBUX) and General Motors (GM) on Tuesday. Yet market interest is expected to heighten next Wednesday as we get the earnings reports of Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), IBM (IBM) and Alibaba ADR (BABA).

Technical analysis

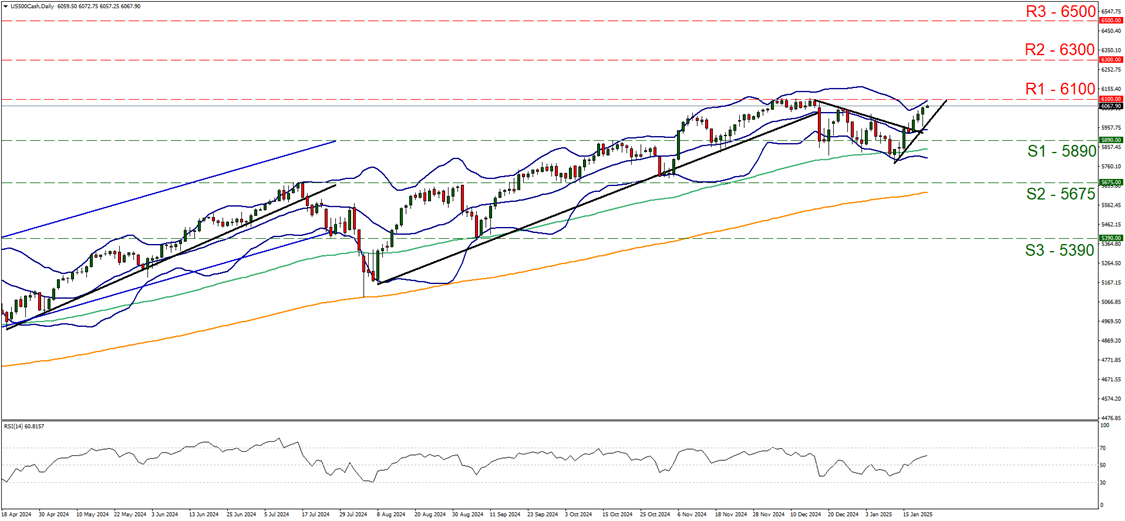

US500 cash daily chart

Support: 5890 (S1), 5675 (S2), 5390 (S3).

Resistance: 6100 (R1), 6300 (R2), 6500 (R3).

The S&P500 appears to have interrupted its downward motion and over the past week has been moving upwards aiming for the record high level marked by the 6100 (R1) resistance line. We recognise the ceiling set by the R1 yet at the same time tend to maintain a bullish outlook for the index given the upward trendline that has started to form by the index’s price action over the past week. Please note that the RSI indicator has risen above the reading of 50, aiming for the reading of 70 and implying an intensifying bullish sentiment among market participants for the index. For our bullish outlook to be maintained, the index would have to continue rising breaking the 6100 (R1) resistance line with the next possible target for the bulls being set at the 6300 (R2) resistance level. A bearish outlook seems currently remote and for its adoption we would require the price action of S&P 500 to reverse direction, break the prementioned upward trendline in a first signal that the upward motion has been interrupted and continue lower to break the 5890 (S1) support line clearly thus paving the way for the 5675 (S2) support level.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.