Pound Sterling falls back as weak UK labor data stokes BoE dovish bets

- The Pound Sterling gives up gains against its major peers on Tuesday after the UK labor market data showed weak labor demand.

- UK labor demand remained weak as employers dissented from the government’s decision to direct them to higher NI contributions.

- Traders see the Fed keeping interest rates steady in the next two policy meetings.

The Pound Sterling (GBP) surrenders its marginal gains against its major peers on Tuesday in the aftermath of the United Kingdom (UK) labor market data for three months ending November. The initial reaction from the British currency was positive after the Office for National Statistics (ONS) showed that the wage growth accelerated, with Average Earnings Excluding Bonus rising at a robust pace of 5.6%, faster than estimates of 5.5% and the former 5.2%.

Average Earnings Including Bonus also rose by 5.6%, as expected, faster than the 5.2% growth in three months ending October. However, the labor growth remained significantly weak, with a fresh addition of 35K workers against the former reading of 173K, which limited the Pound Sterling's upside.

Also, the ILO Unemployment Rate rose to 4.4%, higher than estimates and the prior release of 4.3%. Weak labor growth clearly shows employers’ discontent with the government’s decision to increase their contribution to National Insurance (NI).

Bank of England (BoE) officials closely track wage growth data when deciding on interest rates, as wage growth is a major contributor to inflationary pressures in the UK service sector. Technically, stronger-than-expected UK wage growth should have jeopardized recently grown expectations that the BoE will reduce interest rates by 25 basis points (bps) to 4.5% in the policy meeting on February 6. However, soft labor demand would offset this. After the labor market report, analysts at Nomura commented that this data will give the BoE a "green light to cut in February".

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. The British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.62% | 0.69% | 0.14% | 0.95% | 0.83% | 0.89% | 0.46% | |

| EUR | -0.62% | 0.08% | -0.44% | 0.32% | 0.21% | 0.27% | -0.16% | |

| GBP | -0.69% | -0.08% | -0.55% | 0.25% | 0.13% | 0.19% | -0.23% | |

| JPY | -0.14% | 0.44% | 0.55% | 0.80% | 0.68% | 0.73% | 0.31% | |

| CAD | -0.95% | -0.32% | -0.25% | -0.80% | -0.11% | -0.05% | -0.48% | |

| AUD | -0.83% | -0.21% | -0.13% | -0.68% | 0.11% | 0.06% | -0.36% | |

| NZD | -0.89% | -0.27% | -0.19% | -0.73% | 0.05% | -0.06% | -0.43% | |

| CHF | -0.46% | 0.16% | 0.23% | -0.31% | 0.48% | 0.36% | 0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling weakens against US Dollar despite vauge Trump tariff plan

- The Pound Sterling corrects against the US Dollar (USD) on Tuesday after failing to sustain the recovery move to near a 10-day high of 1.2344. The GBP/USD pair declines as the US Dollar (USD) bounces back after President Donald Trump confirms that the universal tariff hikes proposal remains afloat, but “We are not ready for that yet”.

- A delay in the tariff hike plan has jeopardized the US Dollar’s outlook as market participants anticipated that the imposition of hefty tariffs would be one of the initial decisions by Trump soon after returning to the White House. The assumption of higher tariffs also forced traders to raise bets supporting the Federal Reserve (Fed) to keep interest rates at their current levels for longer.

- Meanwhile, market speculation that the Fed will not announce an interest rate cut decision in the next two monetary policy meetings remains intact. Still, traders are divided over the May policy meeting decision. According to the CME FedWatch tool, traders see an almost 50% chance that the Fed will keep interest rates in the current range of 4.25%-4.50% in May.

- On the economic front, investors will pay close attention to the preliminary US S&P Global Purchasing Managers Index (PMI) data for January, which will be published on Friday.

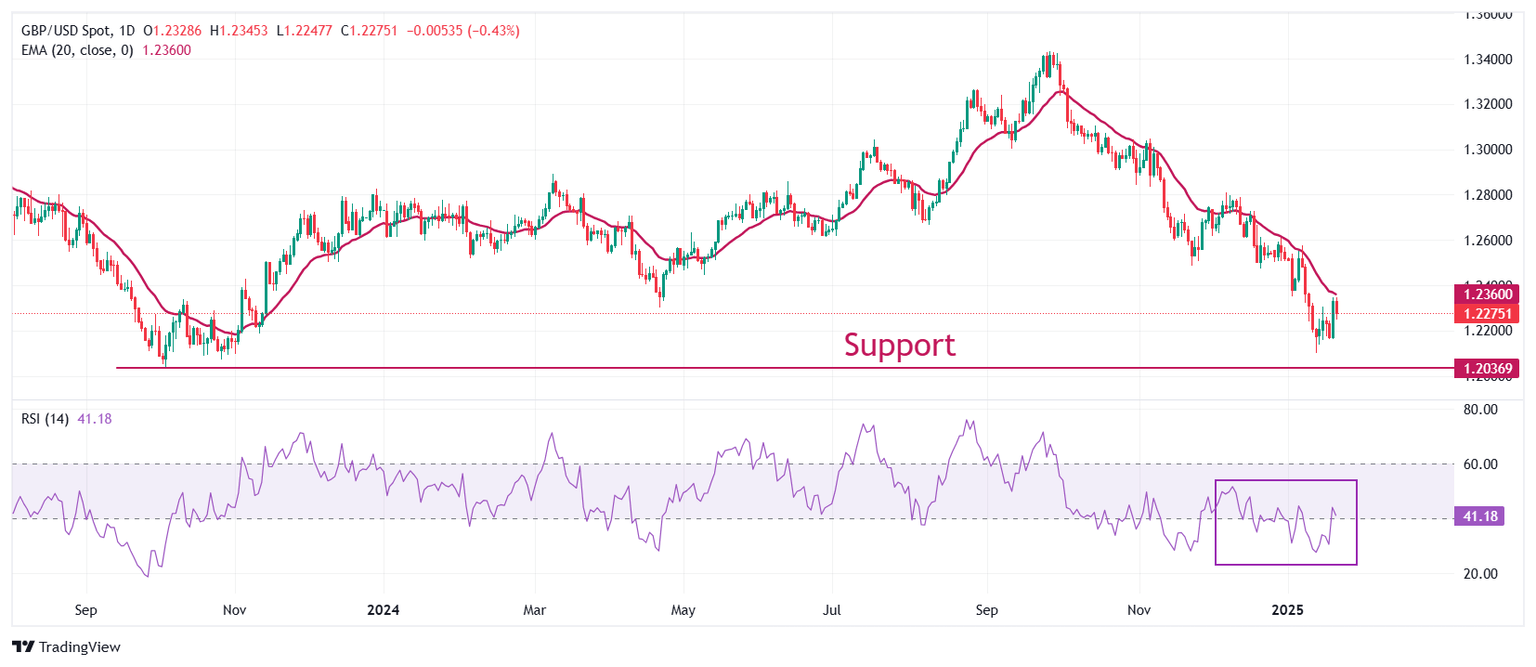

Technical Analysis: Pound Sterling dips below 1.2300

The Pound Sterling declines to near 1.2275 against the US Dollar on Tuesday after posting a fresh 10-day high near 1.2345 earlier in the day. The GBP/USD pair rebounded but failed to reclaim the 20-day Exponential Moving Average (EMA), which trades around 1.2360.

The 14-day Relative Strength Index (RSI) rebounds above 40.00. The bearish momentum would end if the RSI manages to sustain above that level.

Looking down, the pair is expected to find support near the October 2023 low of 1.2050. On the upside, the round-level resistance of 1.2400 will act as key resistance.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.