Pound Sterling slumps after MPC hearings, fresh escalation in Russia-Ukraine war

- The Pound Sterling weakens after the Monetary Policy Hearing and renewed geopolitical tensions.

- The BoE reduced interest rates on November 7 as disinflation was faster than projected.

- Nomura expects the Fed to leave interest rates unchanged in December.

The Pound Sterling (GBP) fails to hold onto Monday’s recovery against the US Dollar (USD) and falls back in North American trading hours on Tuesday. The GBP/USD pair retreats as the US Dollar bounces back after fresh escalation in geopolitical tensions, which improved demand for safe-haven assets. The US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, rebounds from 106.10 and aimd to recapture the annual high of 107.00.

The near-term outlook of the US Dollar remains firm as market participants expect the economic agenda of President-elected Donald Trump to boost inflationary pressures and prompt economic growth, a scenario that will lead the Federal Reserve (Fed) to deliver fewer interest rate cuts.

Trump’s victory in both US houses (the Senate and the House and Representatives) and better-than-expected monthly Retail Sales data for October have led traders to pare back bets of an interest rate cut in the December meeting. The probability for the Fed to reduce interest rates by 25 bps to 4.25%-4.50% has diminished to 58.4% from 77% a month ago.

Global brokerage firm Nomura expects the Fed to pause the policy-easing cycle in December. "We currently expect tariffs will drive realized inflation higher by the summer, and risks are skewed towards an earlier and more prolonged pause,” analysts at Nomura said. Nomura expects the Fed to cut interest rates by 25 bps in March and June meetings next year.

Daily digest market movers: Pound Sterling weakens as market sentiment turns risk-averse

- The Pound Sterling declines against its major peers on Tuesday after Monetary Policy Hearings in which several Bank of England (BoE) policymakers – including Governor Andrew Bailey – responded to questions before the Treasury Select Committee regarding the latest decisions on interest rates.

- The British currency weakens across the board as Andrew Bailey commented that the pace of disinflation was faster than expected, which allowed them to cut interest rates by 25 basis points (bps) to 4.75% in the policy meeting on November 7. However, Bailey and other policymakers showed concerns over upside risks to inflation remaining persistent. "Services inflation is still above a level that's compatible with on-target inflation," Andrew Bailey said. BoE external member Catherine Mann, an outspoken hawk, said, "Financial markets' inflation expectations suggest the BoE will not get to sustainable 2% inflation in the forecast horizon."

- Selling pressure in the Pound Sterling has also been prompted by a fresh escalation in the Russia-Ukraine war after Kyiv launched United States (US)-supplied missiles in the Russian region. Before that, Russia updated its nuclear doctrine, a move that gives them the right to use nuclear weapons against a critical threat to their sovereignty, as a retaliation to the supply of ATACMS missiles by Washington to Ukraine, which renewed fears of a fresh escalation in geopolitical tensions and forced investors to flee towards safe-haven assets.

- For more cues on interest rate outlook, investors will pay close attention to the Consumer Price Index (CPI) data for October, which will be published on Wednesday. The inflation data will significantly influence market expectations for the BoE interest rate decision in the December meeting.

- Traders see a roughly 80% that the BoE will cut interest rates again by 25 basis points (bps) to 4.50%, according to Reuters. This would be the second interest rate cut by the BoE in a row and the third in this year.

- The headline CPI is expected to rise by 0.5% after remaining flat in September on month. Annual headline inflation is estimated to have accelerated to 2.2% from the prior release of 1.7%. Economists expect the core CPI – which excludes volatile food and energy prices – to grow steadily by 3.2%. Investors will also pay close attention to the service inflation data, a measure closely tracked by BoE officials when deciding on interest rates.

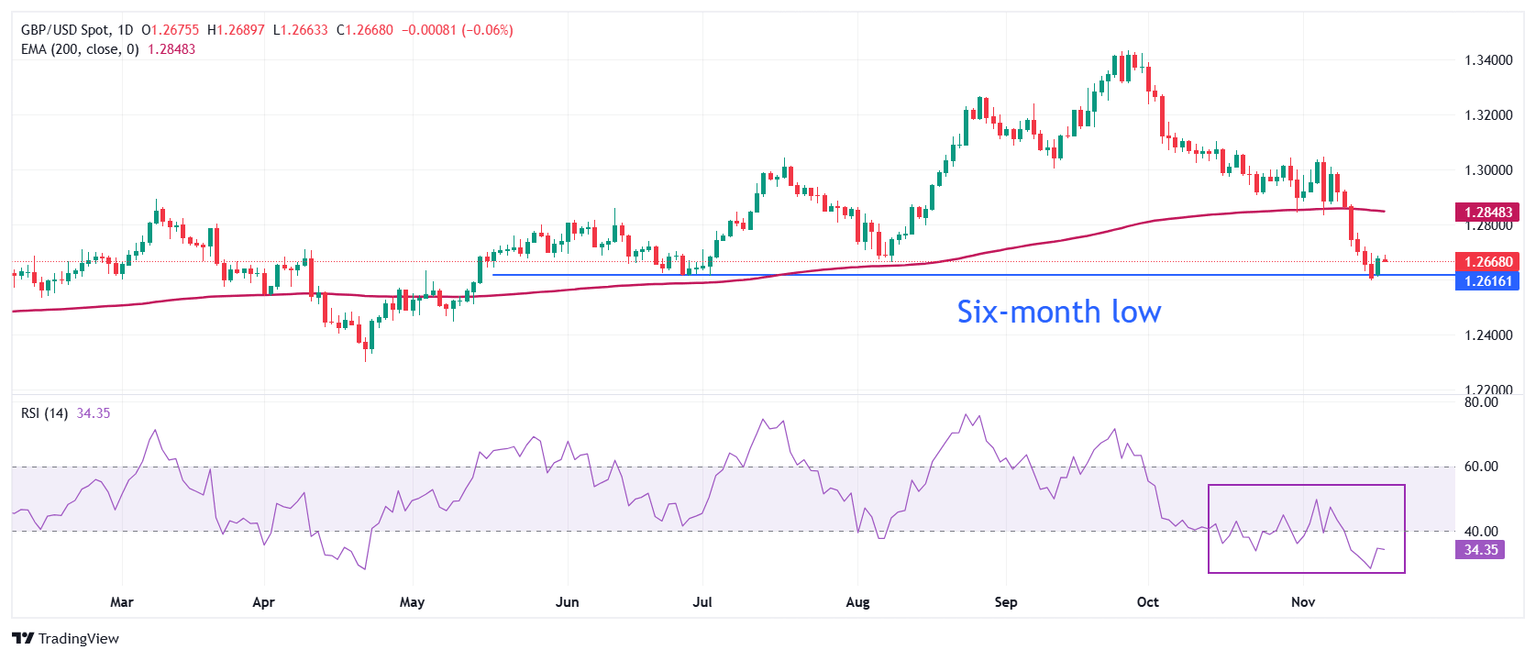

Technical Analysis: Pound Sterling seems vulnerable above 1.2600

The Pound Sterling struggles to hold ground near 1.2600 against the US Dollar after discovering some buying interest. More broadly, the GBP/USD pair remains under pressure as it trades well below the 200-day Exponential Moving Average (EMA) at around 1.2850.

The 14-day Relative Strength Index (RSI) stays near 30.00, suggesting a strong bearish momentum.

Looking down, the psychological support of 1.2500 will be a major cushion for Pound Sterling bulls. On the upside, the Cable will face resistance near the 200-day EMA.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.