NZD/USD Price Analysis: Aims to extend upside above 0.6100 at US Dollar’s cost

- NZD/USD rises to 0.6100 as US Dollar weakens due to strong speculation for Fed rate cuts in September.

- The New Zealand Dollar strengthens despite cooling inflationary pressures.

- NZD/USD rebounds from 50% Fibo retracement at 0.6035.

The NZD/USD pair rallies to near the round-level resistance of 0.6100 in Wednesday’s American session. The Kiwi asset strengthens as the US Dollar (USD) faces an intense sell-off due to firm speculation that the Federal Reserve (Fed) will pivot to policy normalization from the September meeting.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slides further and posts a fresh four-month low near 103.60.

Meanwhile, the New Zealand Dollar (NZD) strengthens even though the Q2 Consumer Price Index (CPI) softened at a faster-than-expected pace. This has boosted expectations of early rate cuts by the Reserve Bank of New Zealand (RBNZ).

The data showed that quarterly inflation grew by 0.4%, slower than expectations and Q1 reading of 0.6%. The annual CPI data decelerated at a robust pace to 3.3% from the consensus of 3.5% and the former release of 4.0%.

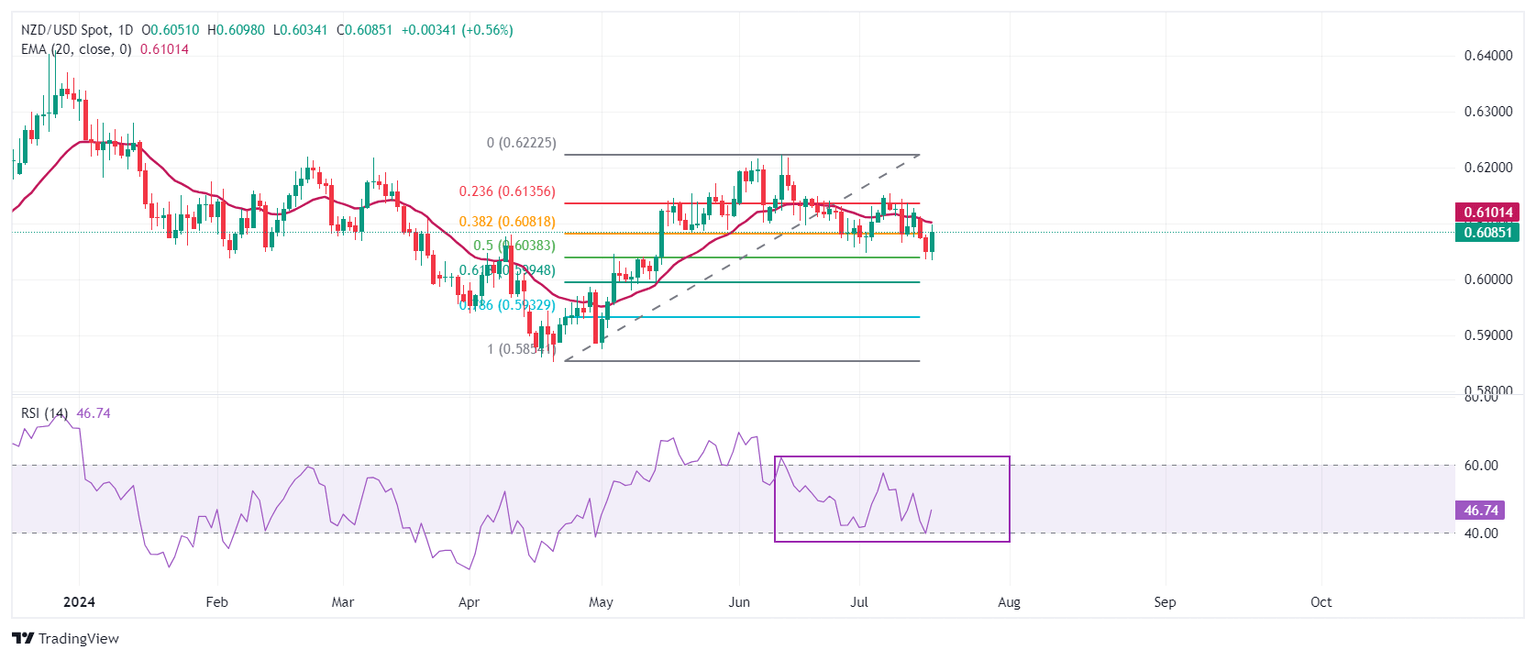

NZD/USD finds a temporary support near 50% Fibonacci retracement (plotted from April 19 low near 0.5850 to June 12 high at 0.6222) at 0.6035 on a daily timeframe. The near-term outlook remains bearish as the 20-day Exponential Moving Average (EMA) near 0.6100 acts as major barricade to NZD bulls.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among market participants.

Fresh upside would appear if the asset breaks above July 3 high at 0.6130 for targets near May 28 high around 0.6170 and June 12 high of 0.6222.

However, a breakdown below April 4 high around 0.6050 would expose the asset to the psychological support of 0.6000.

NZD/USD daily chart

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.