Mexican Peso uptrend extends bolstered by inflation data

Most recent article: Mexican Peso continues rising as carry flows support

- Mexican Peso extended its gains as USD/MXN drops deeper beneath 18.00.

- Mexico’s CPI surged close to 5% in June, driven by rising food prices and Peso depreciation.

- Banxico's Deputy Governor Jonathan Heath labels inflation data as “very worrying,” indicating hawkish stance.

The Mexican Peso surged during Tuesday’s North American session as June headline inflation exceeded consensus. This might prevent the Bank of Mexico (Banxico) from slashing interest rates amid a domestic economic slowdown. At the time of writing, the USD/MXN trades at 17.90, down 0.56%.

Mexico’s economic docket featured the Consumer Price Index (CPI), which jumped close to 5% in June due to the rise in food prices, revealed the National Statistics Agency (INEGI). This and the Peso’s more than 6% depreciation in June triggered a price rise. Other data showed that Consumer Confidence slightly improved, while Auto Exports decelerated sharply.

After the data, Banxico Deputy Governor Jonathan Heath wrote on X that June’s inflation data was “very worrying.” Traders should be aware that he leans on the hawkish front of the central bank alongside Deputy Governor Irene Espinosa.

La inflación general llegó a 4.98% en junio, la inflación más elevada de los últimos 12 meses. En el margen, la tasa anual de la segunda quincena de junio registró 5.17%. Muy preocupante.

— Jonathan Heath (@JonathanHeath54) July 9, 2024

Market participants are eyeing the release of Banxico’s latest monetary policy meetings on Thursday, which are expected to show that the Mexican institution will be patient before lowering borrowing costs.

Across the border, Federal Reserve (Fed) Chair Jerome Powell appeared at the US Senate Banking Committee and stated that the disinflation process is evolving and that the risks of achieving the dual mandate have become more balanced. He added that Fed officials needed more good inflation data to cut interest rates. Nevertheless, an unexpected weakening in the labor market could be another reason for the easing of policy.

Daily digest market movers: Mexican Peso climbs on hot CPI data

- Some analysts in Mexico estimate the economy might slow down but dodge a recession, according to the National Statistics Agency’s (INEGI) Coincident Indicator. Despite that, they said reforms pushed by President Andres Manuel Lopez Obrador (AMLO), particularly the judiciary reform, could affect the country’s creditworthiness.

- Mexico’s CPI rose from 4.69% YoY to 4.98% in June, while core CPI dipped from 4.21% to 4.13% annually, exceeding the estimated 4.15%.

- Auto Exports in June slowed from 13% in May to 3.3% YoY in June, while Auto Production decelerated from 4.9% to 3.8% in June.

- On Monday, the New York Federal Reserve revealed that consumer inflation expectations were lowered from 3.2% to 3% for one year.

- US CPI is foreseen dropping from 3.3% to 3.1% in the 12 months to June, while underlying inflation is projected to stay firm at 3.4% YoY.

- US Dollar Index (DXY), which tracks the value of a basket of six currencies against the US Dollar, advances some 0.16% and is up at 105.17.

- According to the CME FedWatch Tool data, the odds for a September cut are 70%, down from 73% on Monday.

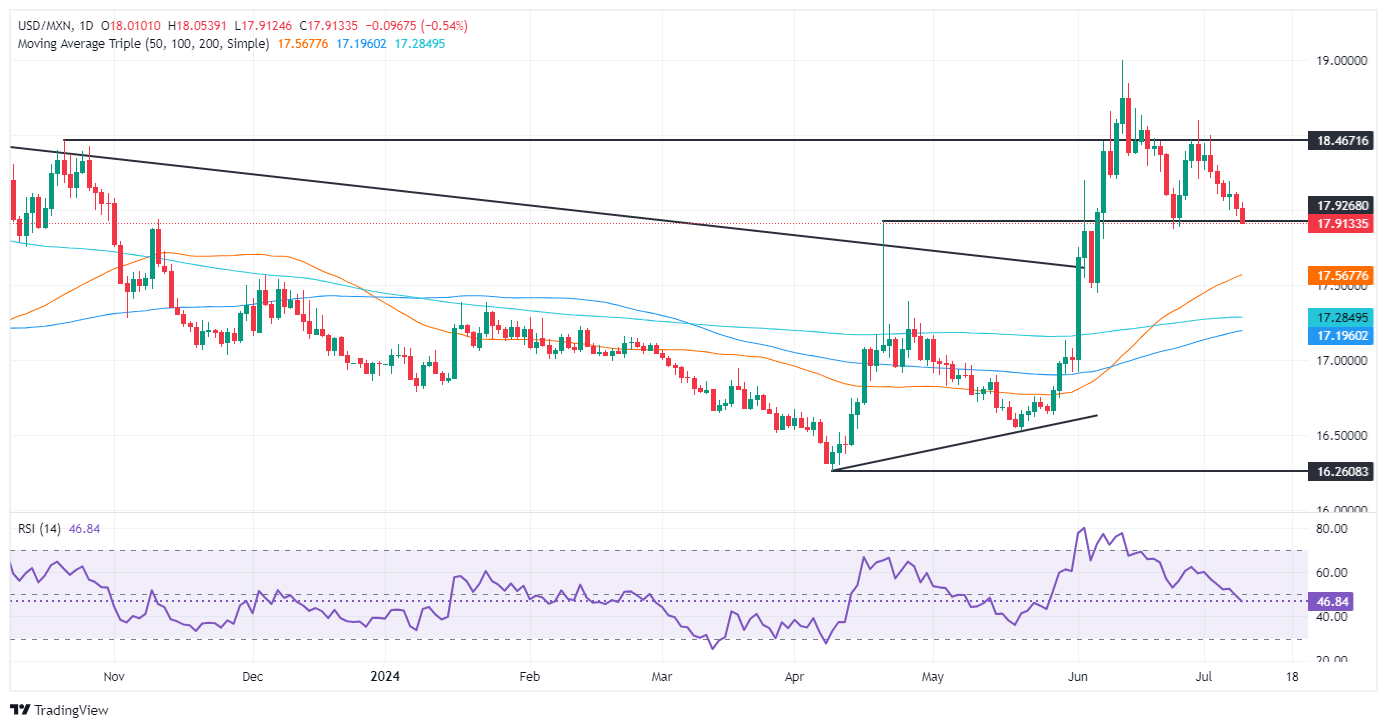

Technical analysis: Mexican Peso counterattacks as USD/MXN dives below 18.00

The USD/MXN has hit a ten-day low of 17.91, yet it remains slightly above the June 24 cycle low of 17.87, which if broken could extend the Greenback’s losses. Momentum favors shorts as the Relative Strength Index (RSI) dropped below the 50-neutral line.

That said, If USD/MXN achieves a daily close below 18.00, the next support would be the June 24 swing low of 17.87. Further losses are seen beneath the 50-day Simple Moving Average (SMA) at 17.56, followed by the 200-day SMA at 17.26. The next floor level would be the 100-day SMA at 17.17.

For a bullish resumption, USD/MXN needs to surpass 18.10, followed by a rally above the June 28 high of 18.59, allowing buyers to challenge the YTD high of 18.99. Conversely, sellers will need to push the pair below 18.00, which could extend the decline toward the December 5 high-turned-support at 17.56, followed by the 50-day SMA at 17.37.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.