Mexican Peso slumps as second half of 2024 kicks off

Most recent article: Mexican Peso slides on increased risk of Trump victory

- Mexican Peso dips, starting 2024’s second half on a weak note.

- Political uncertainty in Mexico and US election speculation fuel risk-aversion, overshadowing strong economic fundamentals.

- Banxico Governor Rodriguez Ceja maintains a dovish stance, noting economic resilience and openness to rate adjustments.

The Mexican Peso begins the second half of the year on the back foot against the US Dollar, tumbling more than 0.40% after posting its worst first semester since the COVID-19 pandemic. Investors' uncertainty hurts the Peso after the ruling political party, Morena, might control the Mexican Congress and push bills that threaten the status quo. The USD/MXN trades at 18.39 after hitting a daily low of 18.25.

Mexico’s currency would likely continue to be driven by domestic politics and threats that former US President Donald Trump could win November’s elections. Therefore, the Mexican Peso would be hurt by risk-aversion even though the economy remains solid. According to Goldman Sachs analyst Teresa Alves, “Mexico’s macroeconomic and FX fundamentals are in a healthier position now.”

Bank of Mexico (Banxico) Governor Victoria Rodriguez Ceja gave dovish responses to an interview by El Financiero. She emphasized, “The Mexican economy is in a solid position to face any external or internal challenges that may arise,” adding that volatility in Mexico’s financial markets had subsided, which caused a sharp depreciation of the Mexican currency in early June.

She mentioned that the Peso’s depreciation influenced the Governing Board from easing policy and said the progress in disinflation “allows us to continue discussing downward adjustments in our rate, and I consider that this is what we will be doing in our next monetary policy meetings.”

Consequently, the Peso extended its losses on Monday despite US economic data being softer.

Daily digest market movers: Mexican Peso edges lower on strong US Dollar

- Citibanamex survey reveals that economists are now expecting fewer rate cuts by the central bank. They have also revised the Gross Domestic Product (GDP) growth for 2024 downward from 2.2% to 2.1% YoY and anticipate the USD/MXN exchange rate will end the year at 18.70, up from the previously reported 18.00.

- Mexico’s Business Confidence deteriorated from 53.7 to 53 in June, according to the National Statistics Agency (INEGI).

- S&P Global Manufacturing PMI for June was 51.1, a tenth lower from May’s 51.2.

- June’s US S&P Global Manufacturing PMI was 51.6, higher than the previous month yet missing forecasts of 51.7.

- ISM Manufacturing PMI for June was 48.5, lower than estimates of 49.1 and May’s 48.7.

- Greenback’s recovery, as measured by the US Dollar Index (DXY), gains from 105.42 to 105.87, underpinning the USD/MXN pair.

- CME FedWatch Tool shows odds for a 25-basis-point Fed rate cut at 58.2%, down from 59.5% last Friday.

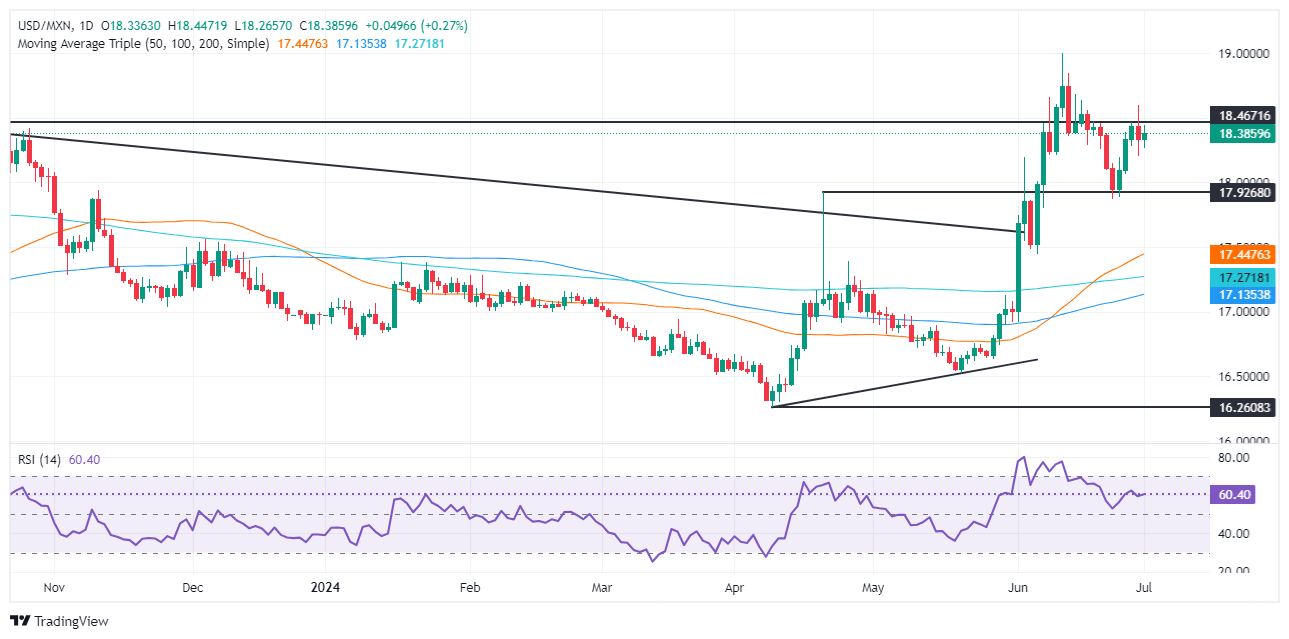

Technical analysis: Mexican Peso falls as USD/MXN rallies past 18.30

The USD/MXN is consolidating in the 18.00-18.40 range after hitting a daily low of 18.25. Momentum favors buyers, as shown by the Relative Strength Index (RSI) being bullish. Despite that, buyers must reclaim the June 28 high of 18.59 if they would like to extend their gains and challenge the year-to-date (YTD) high of 18.99.

In that event, further gains are seen, including the March 20, 2023, high of 19.23. Once cleared, it will expose 19.50.

For a bearish continuation, sellers must reclaim the April 19 high turned support at 18.15, which would pave the way toward 18.00. The next support would be the 50-day Simple Moving Average (SMA) at 17.37 before testing the 200-day SMA at 17.23.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.