Mexican Peso not favored by markets with Trump victory possibility increasing

Most recent article: Mexican Peso rises on dovish Powell comments

- The Mexican Peso depreciates on the back of risk of Donald Trump winning the US presidential elections in November.

- Such a victory would likely lead to higher tariffs on foreign imports, negatively impacting Mexico.

- Banxico Governor Victoria Rodríguez Ceja raises the possibility of interest-rate cuts coming down the track

The Mexican Peso (MXN) continues creeping lower in its most traded pairs on Tuesday as concerns mount that former US President Donald Trump could win the US presidential election in November and raise tariffs on Mexican imports. Meanwhile, commentary from Bank of Mexico (Banxico) Governor Victoria Rodríguez Ceja suggests the bank is moving closer to cutting interest rates, another negative factor for MXN.

One US Dollar (USD) buys 18.29 Mexican Pesos at the time of writing, whilst EUR/MXN trades at 19.65, and GBP/MXN at 23.19.

Mexican Peso in volatile ride

The Mexican Peso is sliding after the US Supreme Court judged Donald Trump has broad immunity from prosecution over his alleged attempts to undermine the 2020 election results that saw Democrat Joe Biden win by a narrow victory, as per Reuters.

The decision increases the chances Trump could go on and win the US presidential election in November. Such an outcome would probably have a negative impact on trade. Trump has said he will continue with an “America First” agenda, preferencing American-made goods and slapping tariffs on foreign imports. The move would be negative for the Peso given the close trade ties between the two nations.

Further, given the stark political differences between the two countries’ presidents, the likelihood of much goodwill generated between them is extremely low.

Banxico not helping out here

In an interview with El Financiero, Banxico Governor Victoria Rodríguez Ceja said, “The Mexican economy is in a solid position to face any external or internal challenges that may arise,” adding that volatility in Mexico’s financial markets after the June election had subsided.

Rodríguez Ceja added that the Peso’s depreciation following the election had influenced Banxico’s Governing Board not to cut interest rates (a weaker Peso drives up imported inflation) at their last meeting. But she added that progress was being made on disinflation and that “allows us to continue discussing downward adjustments in our rate, and I consider that this is what we will be doing in our next monetary policy meetings.”

If Banxico cuts interest rates at its next policy meeting it will probably have a negative impact on the Mexican Peso because lower interest rates attract less foreign capital inflows.

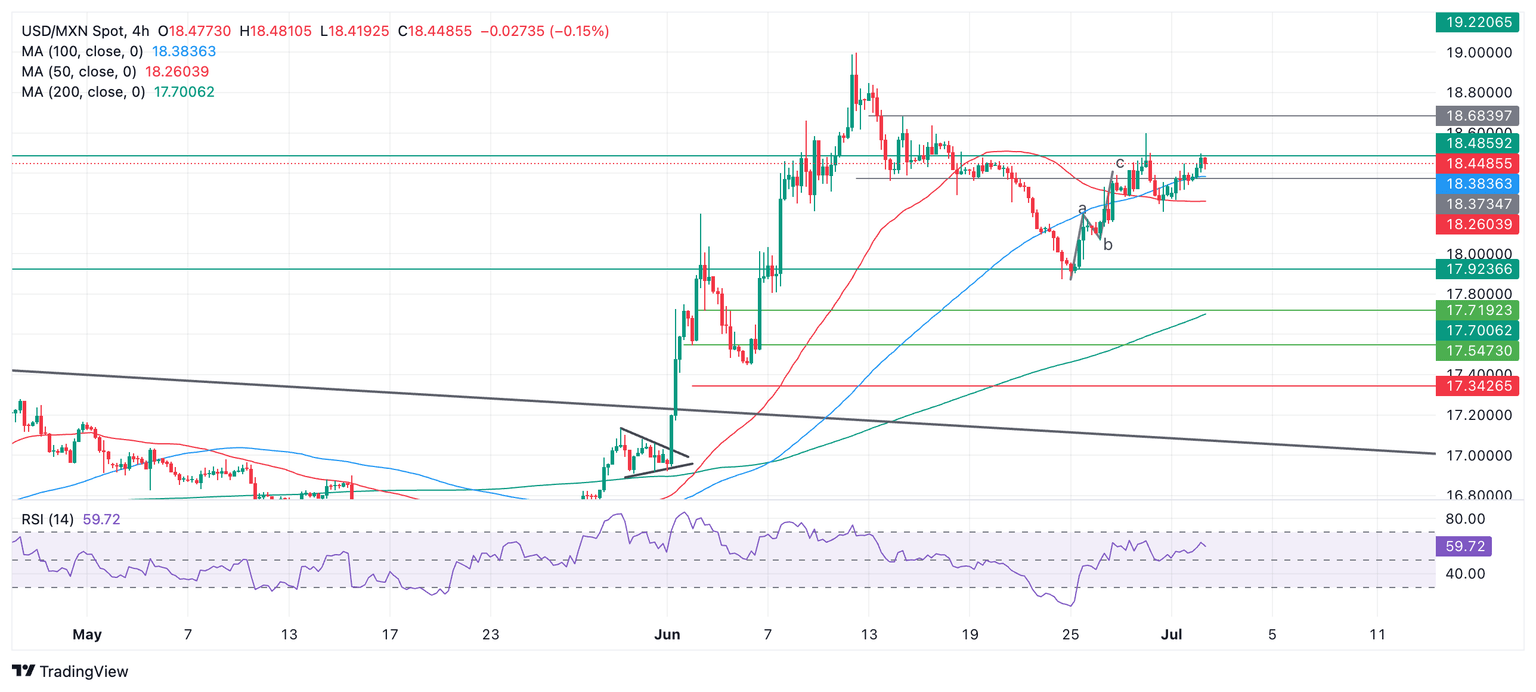

Technical Analysis: USD/MXN trending higher overall

USD/MXN manages to continue higher after pulling back from its June 28 swing high at 18.59 – it is now not so far away, trading in the 18.40s.

USD/MXN 4-hour Chart

If USD/MXN rallies and breaks above 18.59 it will make a higher high and is likely to continue up to 18.68 (June 14 high), followed by 19.00 (June 12 high). A break above 19.00 would provide strong confirmation of a resumption of the short-and-intermediate term uptrends.

A move below 18.06 (June 26 low), however, would suggest the short-term downtrend was resuming and probably see a continuation down to 17.87 (June 24 low).

The direction of the long-term trend remains in doubt.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.