Gold Price Forecast: Can XAUUSD change its course?

- Gold Price gave up Monday's gains as the market's sentiment improved.

- US 10-year Treasury yields renew three-year high amid aggressive US Fed officials.

- Might we see a minimal job loss recession? Why not?

Gold Price trades near a daily low of $1,910.64, pressured by the upbeat tone of Wall Street, regardless of a solid reason for such optimism. Inflation-related concerns retook centre stage following comments from US Federal Reserve chief Jerome Powell, who said that “inflation is much too high,” and that he is ready to hike rates by 50 bps if needed to curb inflation. As a result, government bond yields soared to fresh multi-year highs.

But the US is not the only one suffering from prices pressure. Heating inflation is also a concern in Europe, exacerbated by the Ukraine-Russia crisis leading to soaring energy prices. Last but not least, a new wave of coronavirus is hitting Europe, with cases sharply up from a week ago. The current Wall Street momentum is keeping XAUUSD buyers sidelined, but that could quickly change at the sightless sign. The war and inflation are poised to be the main market drivers for some time now.

On the war front, Moscow said that talks with Ukraine are ongoing but claimed they should be more active and substantive. Kyiv, on the other hand, said it would discuss the Crimea and Donbass situation after a ceasefire.

Also read: Gold Price Forecast: XAUUSD bulls to face an uphill battle amid hawkish Fed, Ukraine saga

US 10-year Treasury yields have risen to a fresh high since May 2019 of 2.375% as the market’s fears of inflation magnified, pushing the Fed policymakers towards more aggressive monetary policies going forward.

On Monday, Atlanta Fed President Bostic and Richmond Fed’s Barkin promoted the US central bank’s ability to restrain inflation by indirectly signaling a faster pace of the rate hike. However, the comments from Fed Chair Jerome Powell who said, “The Fed will raise rates by more than 25bps at a meeting or meetings if necessary,” offered a major upside momentum to the T-bond coupons.

“Sharp moves in the US Treasury market are increasingly pointing to the risk of an approaching recession, with "bond vigilantes coming out of the woodwork" and markets doubting the U.S. Federal Reserve's plan to engineer a "soft landing" for the economy as it hikes interest rates to fight inflation, market experts said,” mentioned Reuters. On the same line were comments from International Monetary Fund’s (IMF) Asia-Pacific Director Changyong Rhee, who said, “The US has the room to raise interest rates.” IMF’s Rhee also mentioned that Asia’s inflation would peak in Q2 of this year.

Firmer yields help the US dollar Index (DXY) print a three-day uptrend around 98.70 while disappointing the riskier assets like commodities and Antipodeans, including Gold.

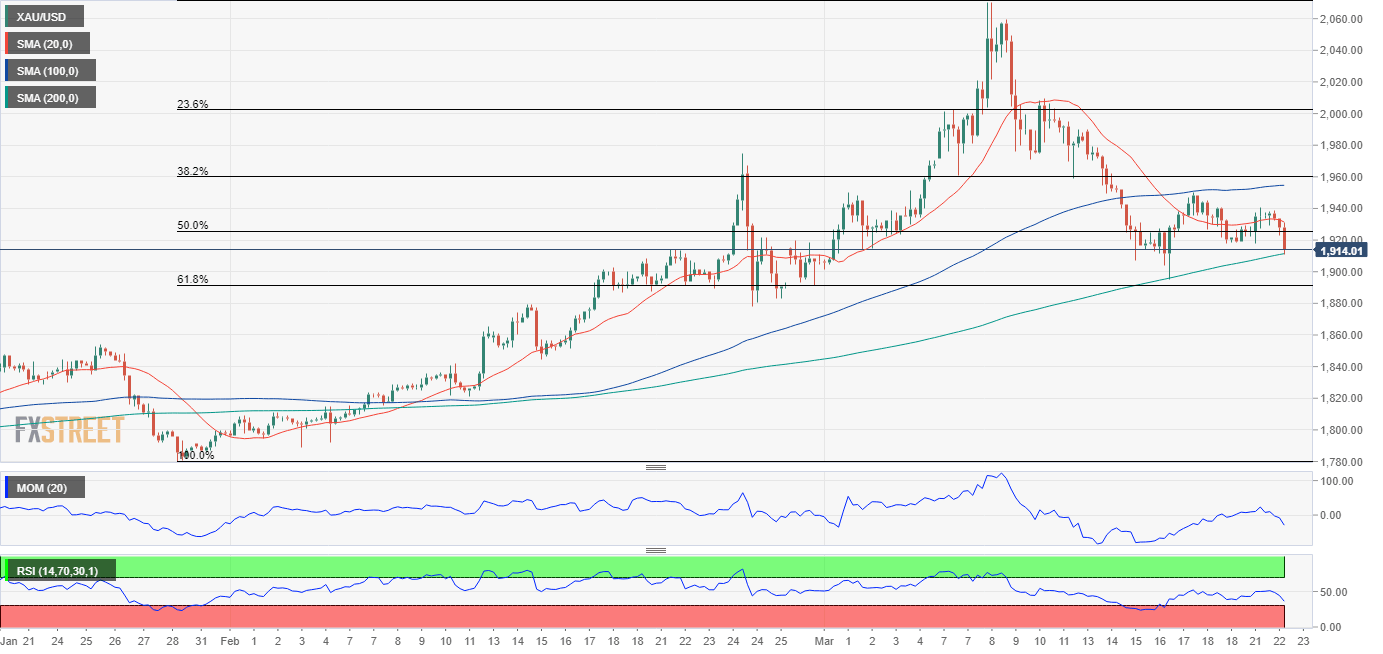

Gold Price technical analysis

XAUUSD has broken below the Fibonacci retracement of its 2022 rally at $1,925.20, now an immediate resistance level. The daily 20 SMA keeps providing dynamic resistance, now at $1,946, while technical indicators in the daily chart are stuck around their midlines, lacking clear directional strength. Gold Price is quickly approaching the $1,900 threshold, and a break below the latter exposes the weekly low at $1,985. The 61.8% retracement of the aforementioned rally comes at $1,890 a critical support level, as a break below it could mean a steeper sell-off.

Still, and given persistent tensions in Eastern Europe, the bearish potential remains limited. The ongoing optimism does not have enough support to be more than temporal and will likely fade unless the crisis suddenly ends. Gold buyers will be looking to renew their longs at lower levels, close to the next Fibonacci support.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.