Gold Price Forecast: XAU/USD bulls to face an uphill battle amid hawkish Fed, Ukraine saga

- Gold price eyes a sustained move up as Ukraine optimism could offset hawkish Fed.

- 50bps May Fed rate hike on the table while Ukraine is ready to discuss a deal.

- Gold price is teasing a symmetrical triangle breakout on the 4H chart.

Gold price rebounded firmly on Monday, marking a positive start to a new week, as investors paid more attention to the increased Russian attacks on the Ukrainian territories. Heightening Russian hostilities on Ukraine was seen after the latter rejected Moscow’s demand to surrender the embattled Southern port city of Mariupol. Markets also remained wary after US President Joe Biden warned that Russia is weighing a cyberattack against the US, as its military struggles in Ukraine. Adding to this, spiking oil prices reinforced stagflation concerns, which buoyed the sentiment around the traditional safe-haven gold. Meanwhile, the US dollar’s underperformance until Fed Chair Jerome Powell’s speech also helped gold price recover ground after tumbling last Friday.

Powell, in his in prepared remarks to the National Association for Business Economics (NABE), said, “If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.” The US dollar changed course to the upside, as the Treasury yields rocketed on Powell’s aggressive tightening outlook, with the 10-year benchmark yields hitting the highest level since 2019 at 2.32%. Although the dismal performance on Wall Street, helped the bright metal overcome the blow from Powell’s hawkish pivot.

Gold price is heading back towards $1,950, having reversed early decline on Tuesday, as the sentiment remains mixed amid Fed’s hawkishness and hopes for de-escalation in the Russia-Ukraine conflict. Ukrainian President Volodymyr Zelenskyy reportedly said late Monday that he “was prepared to discuss a commitment from Ukraine not to seek NATO membership in exchange for a cease-fire, the withdrawal of Russian troops and a guarantee of Ukraine security.” The renewed optimism on diplomacy limits the upside in the US dollar, reviving the demand for the USD-denominated gold price. The yellow metal also finds support from the continued surge in oil prices, in the face of stronger Western sanctions on Russia. The Treasury yields, however, flirt with fresh multi-month highs, keeping gold bulls cautious.

Looking forward, in absence of top-tier economic data from the US, the speeches from the Fed policymakers and developments surrounding the Ukraine crisis will continue to affect the market’s risk perception, eventually impacting gold price.

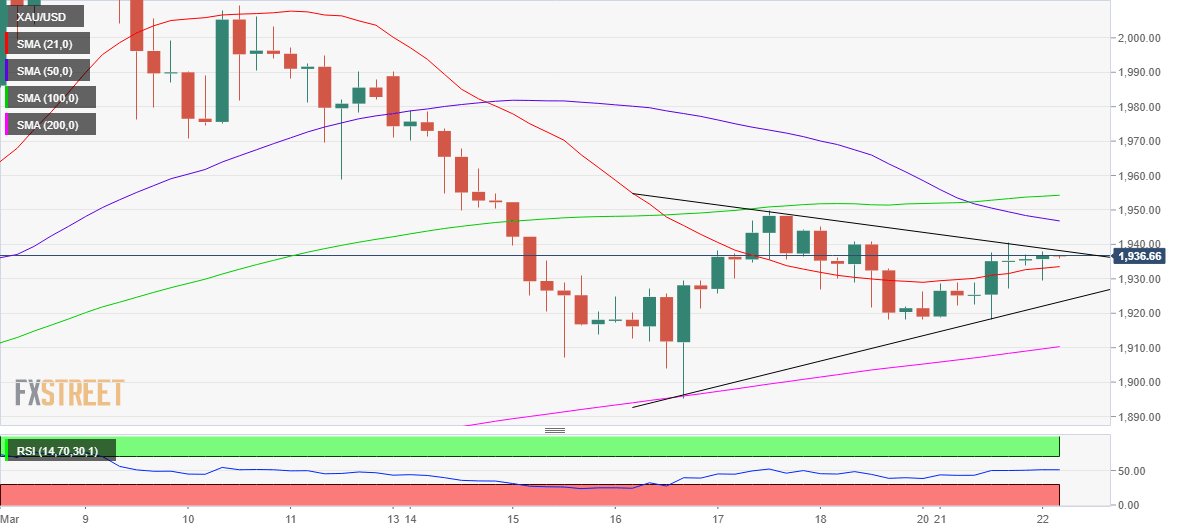

Gold Price Chart - Technical outlook

Gold: Four-hour chart

As well predicted here, gold price did recover to test the critical resistance at $1,943. In Tuesday’s trading so far, the metal remains exposed to upside risks, as it teases a symmetrical triangle breakout on the four-hour chart.

If gold bulls manage to settle above the falling trendline resistance at $1,938 on a four-hourly candlestick closing basis, then it would validate an upside breakout from the triangle.

The further advance will be initiated, thereafter, opening doors towards the mildly bearish 50-Simple Moving Average (SMA) at $1,945.

Up next, gold buyers will target $1,950, the March 17 highs en-route the ascending 100-SMA at $1,954.

The previous year’s high of $1,960 will be next in sight for gold optimists.

On the downside, if bulls failed to yield a triangle breakout, then the price of gold could pull back towards the 21-SMA at $1,933.

Deeper declines will then call for a test of the rising trendline (triangle) support at $1,923.

A sustained break below the latter will confirm a triangle breakdown, exposing the upward-sloping 200-SMA support at $1,910.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.