Might we see a minimal job loss recession? Why not?

Job openings are the key reason many people believe a recession is not in the cards. OK, what if?

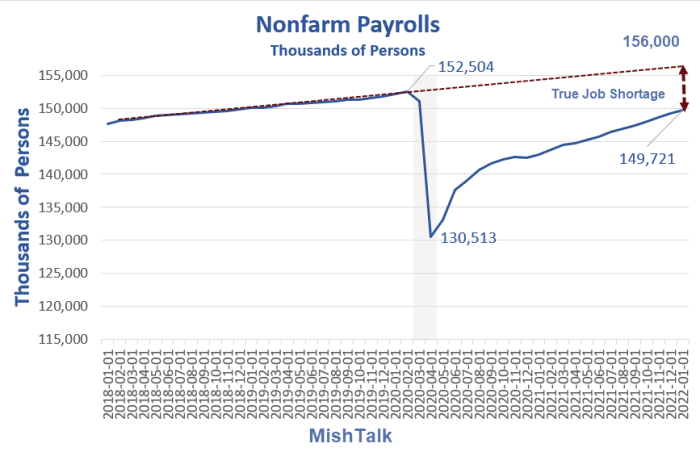

Nonfarm Payrolls data from BLS, chart by Mish

To recover jobs to the level they were at pre-Covid, the economy needs 152,504,000 minus 149,721,000 jobs (2,783,000).

But to recover to the trend the economy needs 6,279,000 jobs.

Job Openings

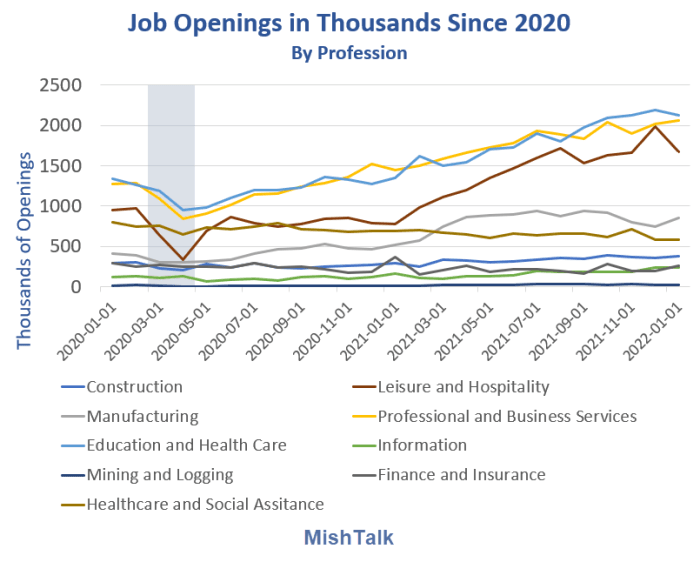

Job openings data from BLS, chart by Mish

What if instead of firing millions of leisure and hospitality workers, the openings vanish?

Will we need construction workers if housing slows?

What about manufacturing jobs if the automotive sector takes a dive?

Comparison to Double Dip Recession

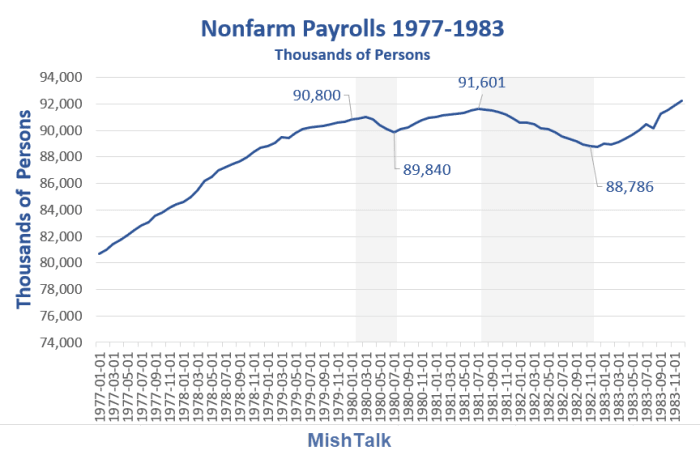

Nonfarm Payrolls data from BLS, chart by Mish

If we look back at the 1980-1981 double dip recession, the number of jobs lost was minimal.

The 1980 recession gained jobs for the first two months of the recession then compared to pre-recession lost less than a million jobs.

The larger 81 recession lost less than 2 million jobs.

In both cases, the number of jobs rose before the recession ended in stark contrast to the housing bubble bust.

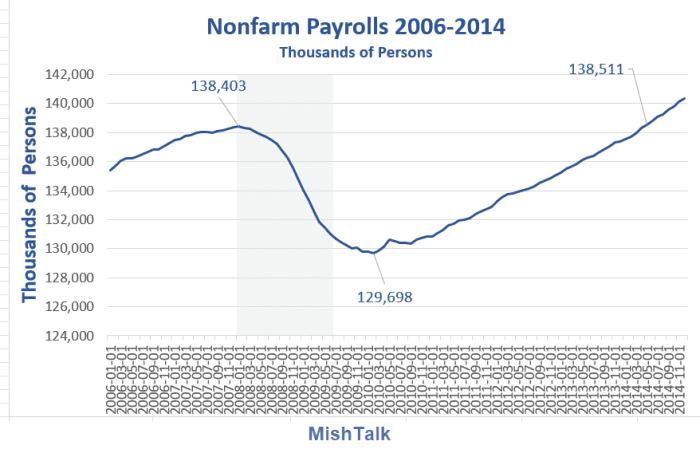

Nonfarm Payrolls 2006-2014

Nonfarm Payrolls data from BLS, chart by Mish

Comparison

- The housing bubble "Great Recession" suffered immense job josses with a very slow job recovery.

- The double dip recessions in the 1980s had small job losses and speedy recoveries.

I expect the next recession to look much more like the 1980s inflationary recessions than the housing bubble "Great Recession".

I also envision very steep stock market declines. As a result of the stock market wealth impact, people start looking for work even some of those who retired early.

So while the employment loss may be relatively small, the change in unemployment rate is likely to be more significant.

What Can the Fed Do About the Price of Food, Medicine, Gasoline, or Rent?

The answer is nothing or next to nothing. Rates hikes will not impact inelastic items.

For discussion, please see What Can the Fed Do About the Price of Food, Medicine, Gasoline, or Rent?

Bubbles Will Pop

If you think the Fed can fix decades of easy money and reckless Congressional spending while not remotely understanding inflation, you are only nuts.

Please note Most People Have No Idea How Much Stocks are Likely to Crash

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc