Gold Price Forecast: XAU/USD loses momentum above $1,915 as Fed Minutes loom – Confluence Detector

- Gold Price stays defensive after four-day winning streak.

- XAU/USD bears seek entry as US-China trade war appears imminent, recession bell rings.

- FOMC Minutes will be crucial for Gold Price downside as $1,915 provides headwind to bears.

Gold Price (XAU/USD) struggles to extend recovery from a multi-month low marked the last week as traders await the Federal Open Market Committee (FOMC) Minutes for the June meeting. Apart from the pre-event anxiety, the fears of a full-fledged trade war between the US and China join the concerns about the global economic slowdown to prod the XAU/USD price.

Alternatively, softer US data and expectations that the Gold demand from India and China will increase over time put a floor under the Gold Price. However, the metal sellers need to confirm Fed Chairman Jerome Powell’s hawkish statements like, “two more rate hikes in 2023”, to retake control. In doing so, they also need to smash the $1,915 key support.

It should be observed that the US markets were closed the previous day and hence a lack of major catalysts, as well as waiting for the full markets, also restrict the XAU/USD moves.

Also read: Gold Price Forecast: Will Fed Minutes help validate bullish wedge for XAU/USD?

Gold Price: Key levels to watch

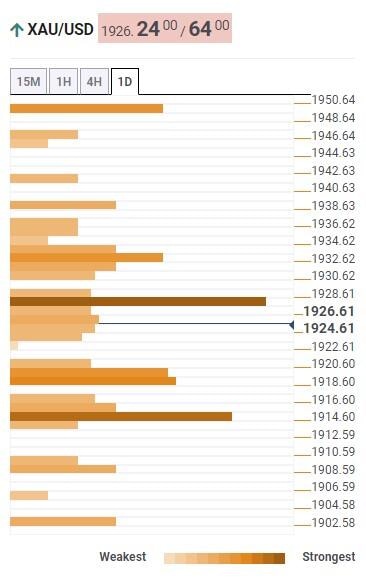

Our Technical Confluence Indicator signals that the Gold Price jostles with a short-term key resistance surrounding $1,930, including Fibonacci 23.6% on one-day and 38.2% on one-month, as well as the previous high on four-hour.

Following that, the previous weekly high of around $1,934 may prod the XAU/USD bulls before directing them to the Fibonacci 61.8% on one-month, also known as the golden Fibonacci ratio, surrounding $1,950.

It’s worth noting that the Gold Price upside past $1,950 appears too lucrative for the bulls and can easily prod the previous monthly high of $1,983.

On the contrary, the 10-DMA joins the Pivot Point one-day S1 to restrict immediate downside of the Gold Price near $1,918.

A break of $1,918, however, will need validation from the $1,915 support confluence comprising the Pivot Point one-day S2 and Fibonacci 23.6% on one-month.

If at all the Gold Price remains weak past $1,915 key support, the odds of witnessing the XAU/USD slump toward $1,900 threshold can’t be ruled out.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.