EUR/USD bounces back even though Russia-Ukraine war escalates

- EUR/USD rebounds from1.0600 on Tuesday as the US Dollar retreats despite geopolitical tensions escalate.

- The focus of ECB officials turns toward preserving growth rather than taming price pressures.

- Trump’s policies are expected to boost US inflation and economic growth.

EUR/USD recovers its intraday losses and rebounds to near 1.0600 in Tuesday’s North American session. It appears that the recovery from the yearly low around 1.0500 last week in the major currency pair strives hard to stay afloat, with the US Dollar (USD) giving up its intraday gains despite dismal market sentiment due to fresh escalation in the Russia-Ukraine war. Moscow warned of a potential third world war after US President Joe Biden provided long-range ballistic missiles to Ukraine and allowed them to launch deep inside the Russian region.

However, the outlook of the the Greenback remains firm on expectations that Trump’s policies will prompt inflation and economic growth. According to analysts at Capital Economics, "While a period of consolidation looks likely in the near term, we have revised up our forecasts for the US Dollar and now project a further 5% appreciation by the end of 2025." Economists added, "That is based primarily on a view that President-elected Donald Trump will push ahead with the core tariff policies he proposed on the campaign trail and that the US economy will continue to outperform its major peers."

The scenario of high inflation and strong growth will result in fewer interest rate cuts by the Federal Reserve (Fed), which will result in a sharp policy divergence with the ECB. Meanwhile, traders have also pared some bets supporting interest rate cuts by the Fed in December. According to the CME FedWatch tool, there is a 62% chance that the central bank will cut its key borrowing rates by 25 bps to the 4.25%-4.50% range, down from 77% noted a month ago.

This week, investors will pay close attention to the preliminary S&P Global Purchasing Managers Index (PMI) data for November, which will be released on Friday. The PMI report is expected to show that the overall private sector activity improved in the US while steadying in the Eurozone. Business sentiment is also expected to have improved as Trump is confirmed to return to administration.

Daily digest market movers: EURUSD recovers despite uncertainty over Eurozone economic outlook

- EUR/USD bounces back even though European Central Bank (ECB) policymakers have become more worried about the Eurozone economic growth due to firm expectations of a likely trade war with the United States (US) than getting inflation under control.

- Market participants are worried that protectionist policies by President-elected Donald Trump could disrupt the Eurozone’s growth potential. Though the blanket of higher import tariffs by the US will have a negative impact on all economies, the effect will be worse on the European Union (EU) as Trump mentioned, in his election campaign, that the euro bloc will "pay a big price" for not buying enough American exports.

- "Protectionist tendencies could disrupt the global supply chains that are essential to European industries, with a negative impact on firms’ growth potential, competitiveness, and financial resilience," Claudia Buch, head of ECB’s supervisory arm, told the European Parliament on Monday.

- Fears of Trump’s external policies have deepened the debate over whether the European Central Bank will cut interest rates by 25 or 50 basis points (bps) in the December meeting. On Monday, ECB policymaker and Governor of the Central Bank of Ireland Gabriel Makhlouf said that it is a bit far to say that an interest rate cut in December is “in the bag” and the bank needs “pretty overwhelming” evidence for an interest rate reduction by 50 bps.

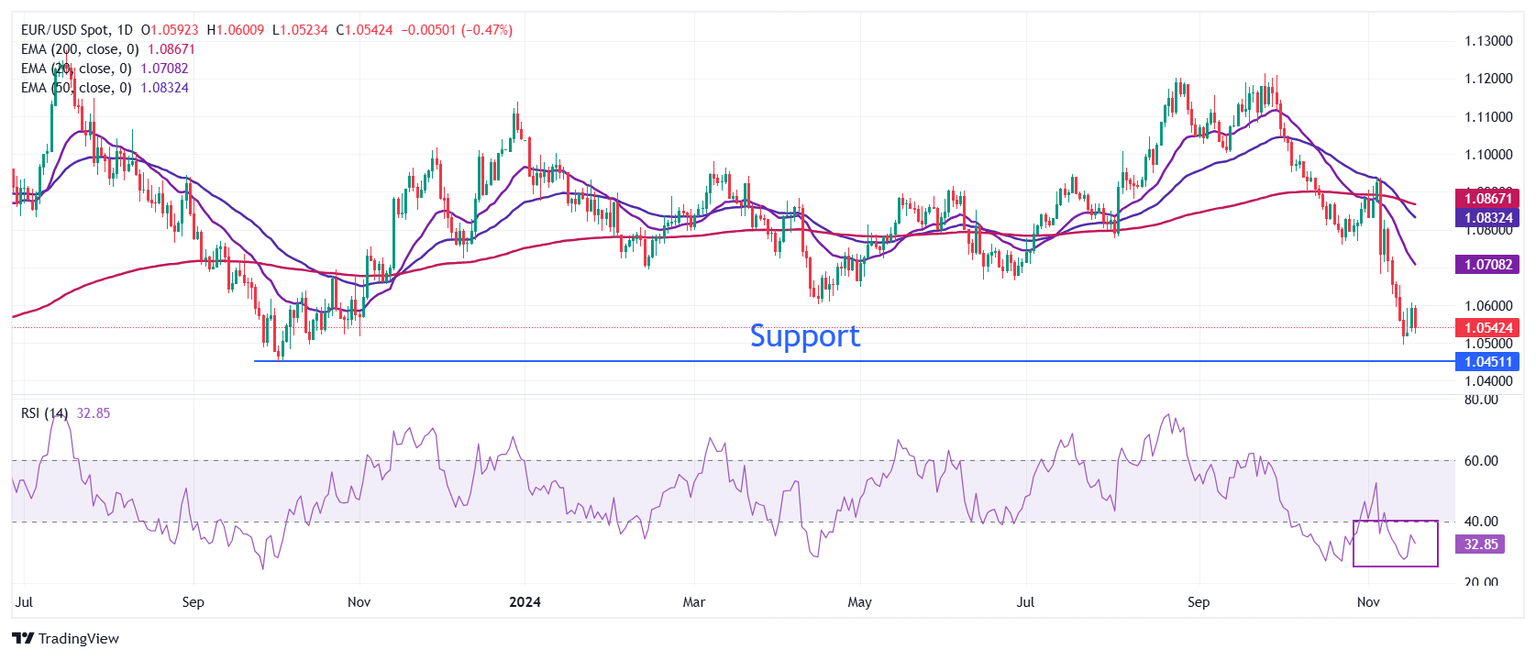

Technical Analysis: EUR/USD strives to extend recovery above 1.0600

EUR/USD bounced back from the key support of 1.0500 and aims to extend recovery above 1.0600 on Tuesday. The outlook of the major currency pair remains bearish as all short- to long-term Exponential Moving Averages (EMAs) are declining.

The 14-day Relative Strength Index (RSI) oscillates in the bearish range of 20.00-40.00, adding to evidence of more weakness in the near term.

Looking down, below the year-to-date low at around 1.0500, the pair is expected to find a cushion near the October 2023 low at around 1.0450. On the flip side, the round-level resistance of 1.0600 will be the key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.