Dow Jones Industrial Average adds 450 points on Wednesday

- The Dow Jones added a full percent on Wednesday, climbing over 450 points.

- Equities are staging a rebound after the week’s early declines.

- FOMC Meeting Minutes reiterate need to be 'data dependent' moving forward.

The Dow Jones Industrial Average (DJIA) rallied another 450 points on Wednesday, extending a bullish turnaround after an early-week decline that briefly dragged the major equity index back below 42,000. The midweek market session sees investors hitting the bids despite a low-weighted print August Wholesale Inventories, and a lukewarm appearance from Federal Reserve (Fed) Bank of Dallas President Lorie Logan.

US Wholesale Inventories grew by less than expected, rising a scant 0.1% versus the expected hold at July’s figure of 0.2%. However, there was a mixed print between the numbers: while non-durable goods inventories decreased, falling 0.1% versus the anticipated 0.5% uptick. Meanwhile, durable goods inventories rose much faster than expected, climbing 0.3% versus the previous month’s 0.1% as US consumers dedicate more of their consumption to non-durable goods and eschew investment in long-life purchases.

Dallas Fed President Lorie Logan hit newswires early Wednesday, trying to draw investor focus back to ongoing inflation risks that still loom in the darkness. Despite rate-cut-hungry markets clamoring for more rate cuts to follow up September’s jumbo 50 bps rate trim, Dallas Fed President Logan noted that economic growth that continues to clock in above forecasts poses a very real risk to inflation. While US inflation has made significant progress toward the Fed’s 2% annual target, price growth in key core categories continues to run hotter than expected.

The Federal Open Market Committee’s (FOMC) Meeting Minutes from the September rate call revealed little new, as many market participants expected. The Fed minutes noted that "most" of the policymakers agreed with the call for a 50 bps cut, giving a nod to "some" participants favoring a quarter-point rate cut instead. This is likely a reference to Fed Governor Michelle Bowman, who stood as the lone dissenter to the official decision to cut rates by an outsized half-percent, the first Fed official to object to an otherwise unanimous policy decision in decades. The FOMC's Meeting Minutes essentially doubled down on the Fed's "data dependent" stance, reiterating that further policy changes will be based on any shifts in economic data heading into November.

Rate markets are currently pricing in a perfectly pedestrian 25 bps rate cut in November. However, according to the CME’s FedWatch Tool, rate traders still see a 15% chance that the Fed may not move rates at all on November 7.

Dow Jones news

Equity markets rolled over into full bull mode on Wednesday, with all but four of the Dow Jones’ constituent equities finding room in the green during the US market session. IBM (IBM) rallied over 2% to climb into $238 per share, with Nike (NKE) hot on its heels, rising a comparable 2% and clipping above $82.50 per share.

On the low side, Boeing (BA) continues to struggle with an ongoing worker strike. Things became more complicated for the battered aerospace company after the Boeing workers’ union rejected a recent proposal.

Dow Jones price forecast

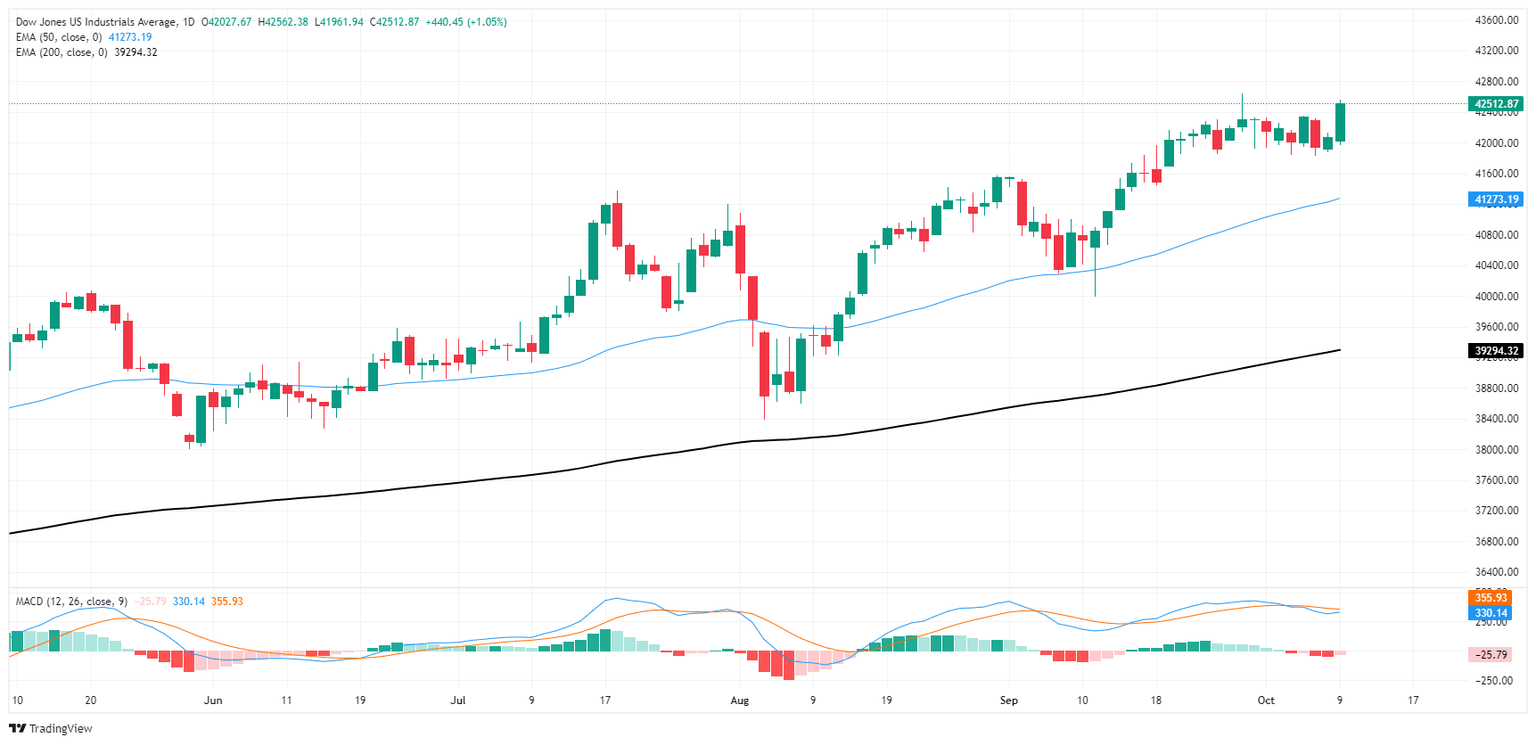

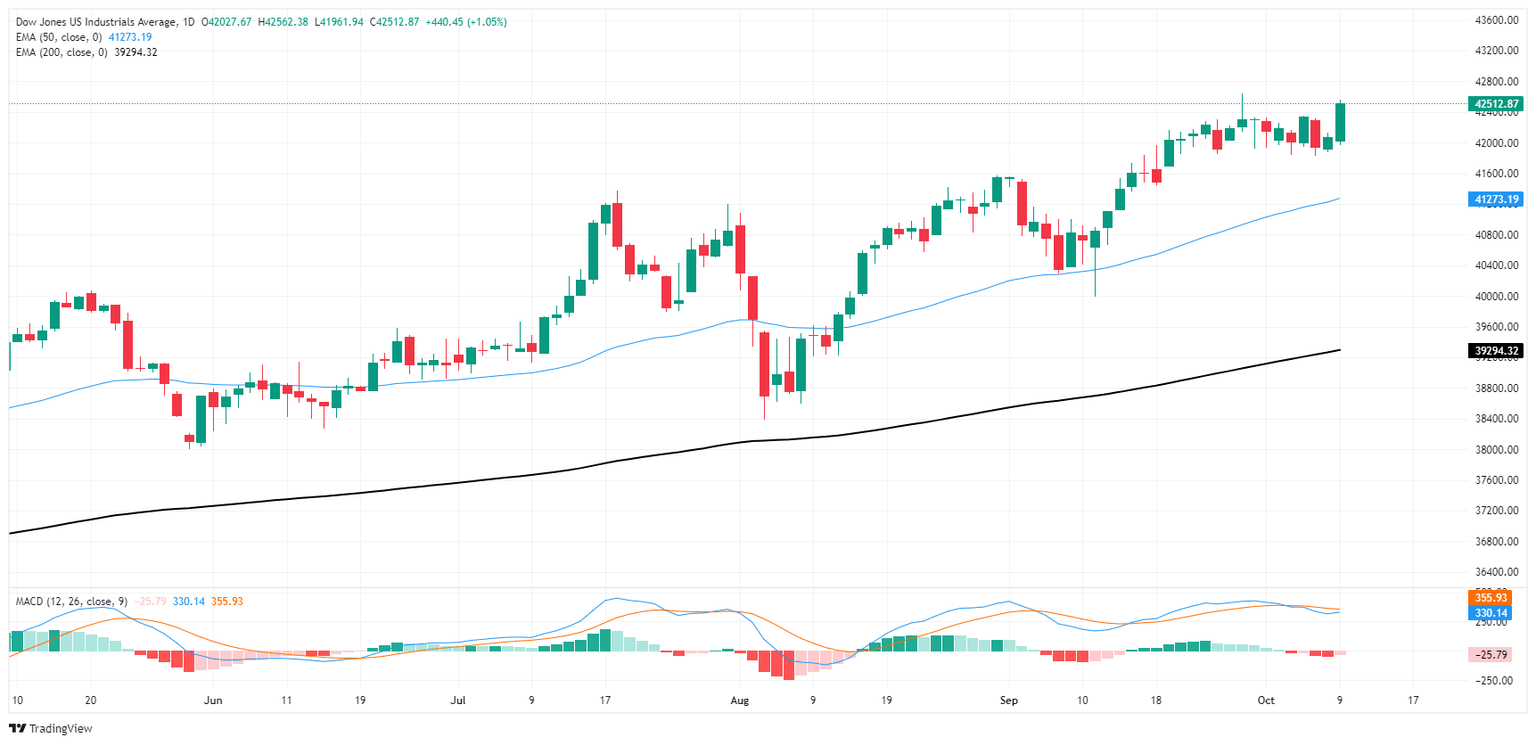

The Dow Jones continues to outpace its own averages, grinding out chart paper north of the 50-day Exponential Moving Average (EMA) and sticking close to record highs. Price action stuck close to late September’s peak bids, and a bearish pullback that essentially went nowhere has momentum indicators poised for another flip into buy signals.

The Dow Jones remains up roughly 6.25% from September’s swing low into the 40,000 major handle, with intraday action churning just above 42,000. The major equity index has returned 12.75% YTD, with half of those gains from September alone.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.