Crude Oil falls flat with US markets remaining closed for Thanksgiving this Thursday

- Headlines spark on Thursday with Israel possibly having breached the recent ceasefire deal already after one day.

- OPEC+ has moved the Output Policy Meeting to December 5, for an in-person meeting.

- The US Dollar Index bounces off support with US markets closed for Thanksgiving.

Crude Oil falling flat, and is returning less than 0.50% profit on this Thursday after headlines that Israel has already broken the ceasefire deal between in the Gaza region, Bloomberg reports. Meanwhile, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have confirmed they will postpone its upcoming Output Policy Meeting decision from Sunday to December 5. The conglomerate of Oil producers and exporters is again facing an existential crisis, with a slowdown in global demand with more non-OPEC supply to be released to markets taking place.

The US Dollar Index (DXY), which measures the performance of the US Dollar (USD) against a basket of currencies, is bouncing off a technical support level. With US markets closed on Thursday and Friday for Thanksgiving and Black Friday, the bounce of the DXY comes from Europe, where France is facing issues. The French Prime Minister Michel Barnier warned that France could become unstable if the French Parliament does not pass the much-needed budget plan, which could cause issues for France in financial markets, Bloomberg reported.

At the time of writing, Crude Oil (WTI) trades at $68.76 and Brent Crude at $72.54

Oil news and market movers: North Sea Loadings drop

- North Sea loadings are scheduled at around 587,000 barrels per day for January, the lowest leve since October, according to Bloomberg data.

- As Thursday evolves, headlines emerged that Israel has still executed some tactital moves in the Gaza and Lebanon region, potentially breaking the ceasefire deal, Bloomberg reports. Israel came out saying that is involved specific targets which were not part of the ceasefire negotiations.

- Delegates close to the matter confirmed in early Thursday trading that OPEC+ will delay its planned meeting for Sunday towards December 5, Reuters and Bloomberg reported. OPEC’s secretariat said that the delay was because several ministers will attend the meeting of the Gulf Cooperation Council in Kuwait on Sunday.

- China’s independent refiners have snapped up barrels from across the Middle East and Africa as offers of Iranian Oil remain scarce and are more expensive due to broadening US sanctions, Bloomberg reports.

- Israel has warned residents displaced by fighting and evacuation orders not to return to their homes in southern Lebanon, despite a ceasefire between Israeli forces and Hezbollah coming into effect Wednesday, CNN reports.

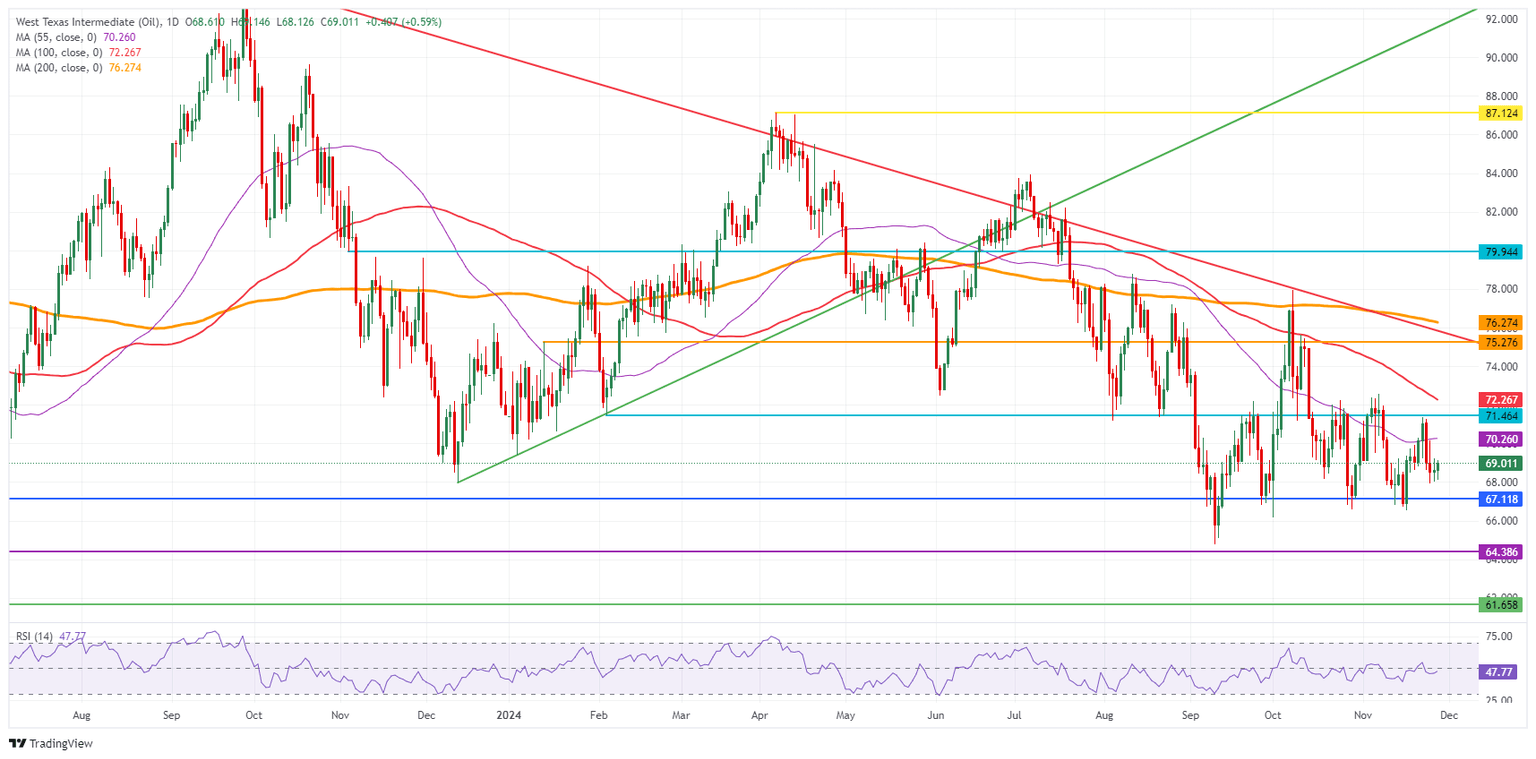

Oil Technical Analysis: Gridlock and oversupply main themes for Oil

Crude Oil price still faces selling pressure as traders become impatient about what OPEC+ will do to support Crude Oil prices. With the slowdown in the Chinese economy, a global slowdown in Oil demand, and the US set to pump and dump many more barrels under President-elect Donald Trump, the rabbit that OPEC+ will need to grab out of its magic hat must be an impressive one. Keep in mind that, with plenty of stop orders placed just below $67.00, a quick correction to $66.00 or even $64.00 could be a possible scenario.

On the upside, the pivotal level at $71.46 (February 5 low) and the 100-day Simple Moving Average (SMA) at $72.26 are the two main resistances. The 200-day SMA at $76.27 is still far off, although it could be tested if tensions intensify further. In its rally towards that 200-day SMA, the pivotal level at $75.27 (January 12 high) could still slow down any upticks.

On the other side, traders need to look towards $67.12 – a level that held the price in May and June 2023 – to find the first support. In case that breaks, the 2024 year-to-date low emerges at $64.75, followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

Brent Crude Oil FAQs

Brent Crude Oil is a type of Crude Oil found in the North Sea that is used as a benchmark for international Oil prices. It is considered ‘light’ and ‘sweet’ because of its high gravity and low sulfur content, making it easier to refine into gasoline and other high-value products. Brent Crude Oil serves as a reference price for approximately two-thirds of the world's internationally traded Oil supplies. Its popularity rests on its availability and stability: the North Sea region has well-established infrastructure for Oil production and transportation, ensuring a reliable and consistent supply.

Like all assets supply and demand are the key drivers of Brent Crude Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of Brent Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of Brent Crude Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact Brent Crude Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.