Zilliqa Price Prediction: ZIL prepares to skyrocket by more than 70% towards $0.12

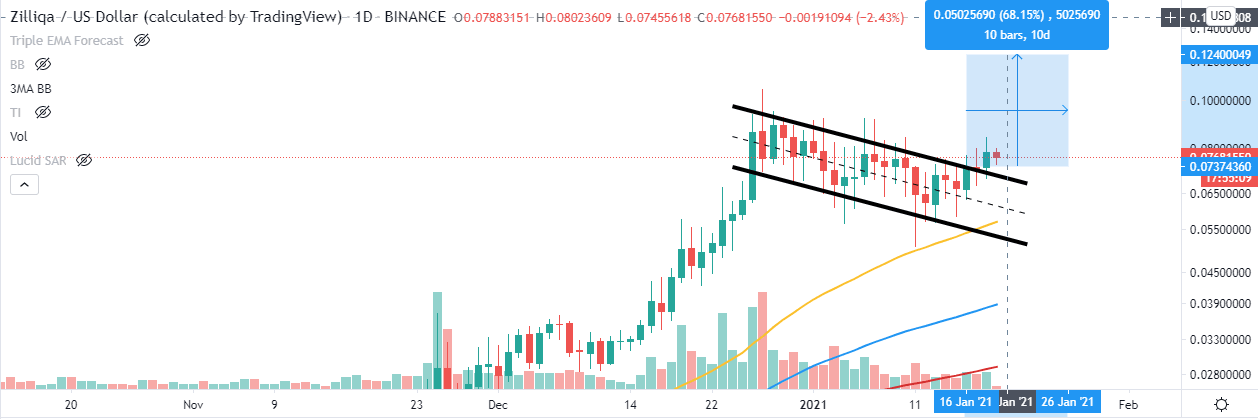

- Zilliqa breaks out of a bull flag pattern, pointing toward a rise to $0.12.

- ZIL/USD might revisit the 50 SMA support on the 4-hour chart before breakout comes into the picture.

Zilliqa seems to be getting ready for a massive elevation to highs around $0.12. The expected breakout follows a breakdown from the recent December peak at $0.106. For now, the least resistance path is upwards especially with the critical hurdle in the rearview.

Zilliqa nurtures the breakout to $0.12

ZIL has already stepped out of a bull flag pattern that appeared on the daily chart. The pattern forms after an asset price action extend considerably upwards followed a period of consolidation. The breakout from the bull flag often results in a powerful move higher, equaling the length of the flag pole. Therefore, if buying volume continues to rise behind the Zilliqa, the price will resume the uptrend targeting $0.12.

ZIL/USD daily chart

On the other hand, it is worth mentioning that the 4-hour chart shows that ZIL/USD is likely to retrace before embarking on the discussed upswing. Initial support will be provided by the 50 Simple Moving Average. If push comes to shove, the 100 SMA will come in handy, preventing losses under $0.07.

ZIL/USD 4-hour chart

At the moment, breaking above $0.08 is key to the expected uptrend. Therefore, a daily close at this level, may call for more buy orders, thereby increasing the volume behind Zilliqa and setting it up for the anticipated rally.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637466341767765672.png&w=1536&q=95)