Zilliqa Price Forecast: ZIL must hold above critical support to avoid 25% drop

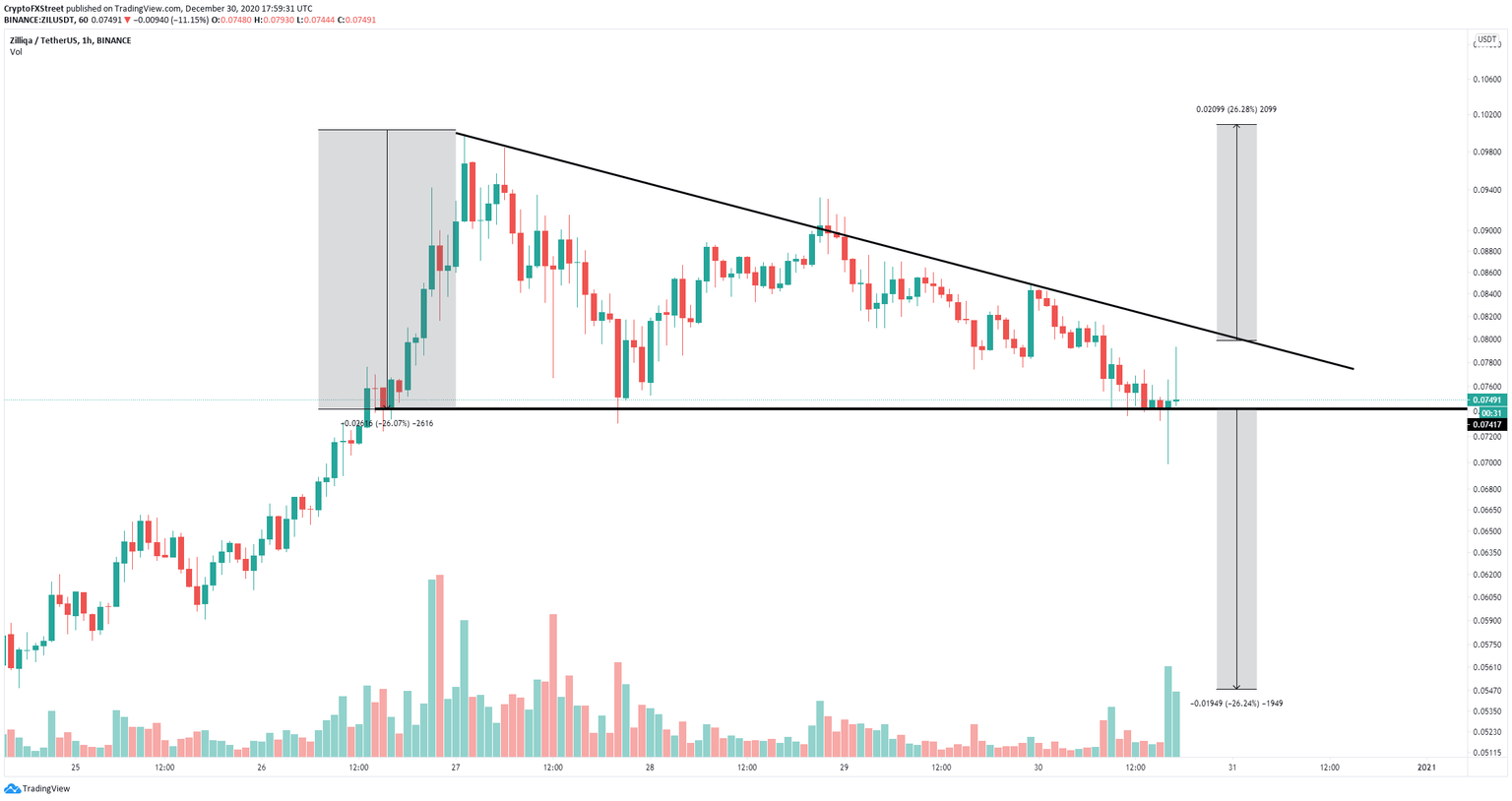

- Zilliqa price is bounded inside a descending triangle pattern on the hourly chart.

- The digital asset experienced a fakeout and managed to recover but remains highly indecisive.

Zilliqa had a violent 6% drop below a critical support level at $0.074 from which it recovered within the next 30 minutes. Despite the recovery, the direction of the trend is still not clear.

Zilliqa price shows bearish and bullish signs at the same time

The breakdown below the critical support level at $0.074 seemed like a clear bearish sign. However, bulls managed to buy the dip and pushed Zilliqa up to $0.079 before plummeting again down to $0.074.

ZIL/USD 1-hour chart

The past two hourly candlesticks show that investors are indecisive. A breakdown and close below $0.074 would push Zilliqa price down to $0.055, which is a 26% drop calculated using the height of the descending triangle pattern.

However, it’s also entirely possible for the bulls to push Zilliqa price up to the resistance level at $0.08, which is the upper boundary of the pattern. A breakout above this point would drive ZIL towards a high of $0.1.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.