Yearn.Finance Price Forecast: YFI’s next buying opportunity may come at $18,000

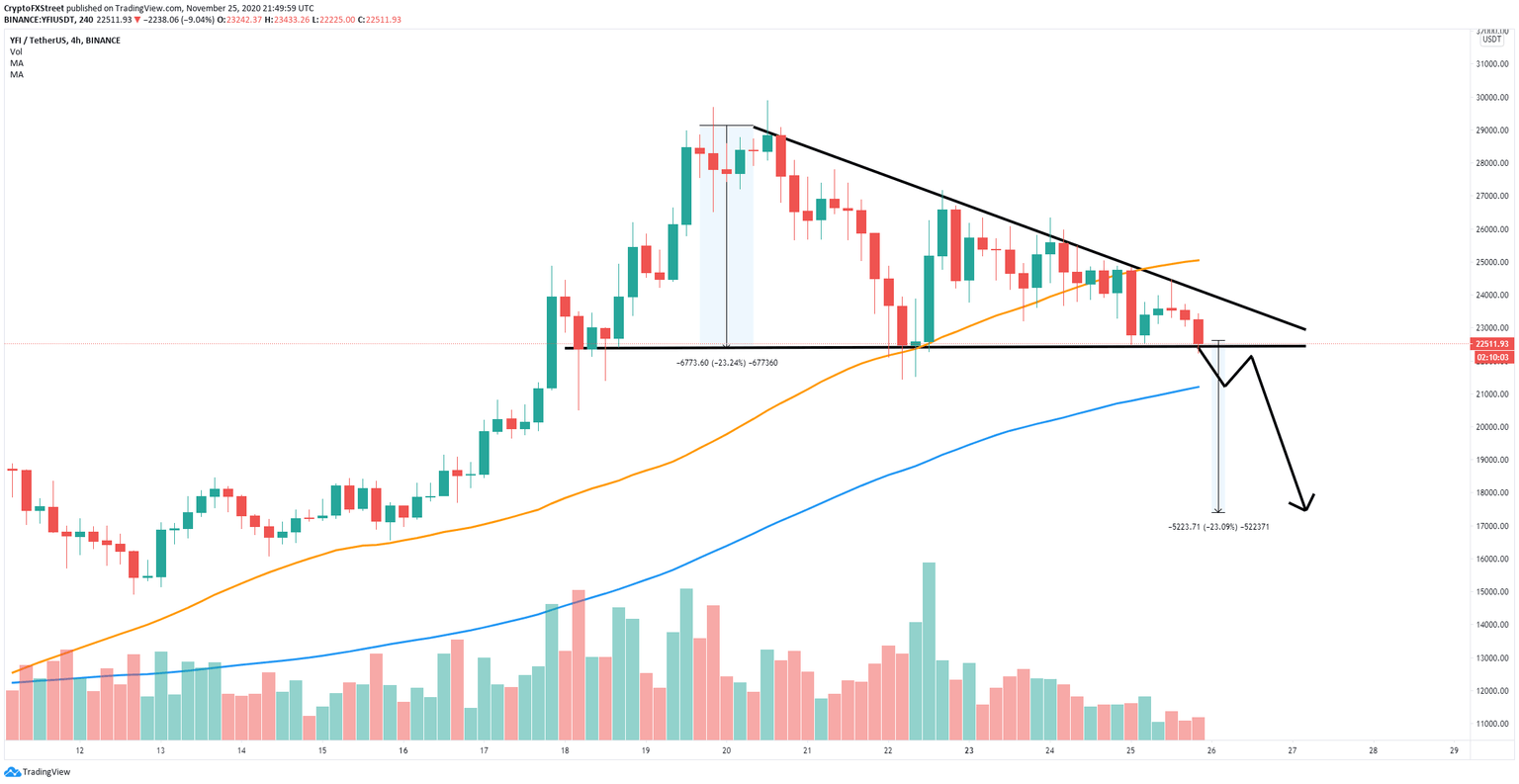

- Yearn.Finance price is trading inside a descending triangle on the 4-hour chart.

- Several on-chain metrics have turned bearish in the past week, indicating that YFI is poised for a pullback.

YFI had an astounding 290% bull rally that started on November 5 and peaked on November 20 at $29,890. The digital asset seems to be under consolidation, and many indicators are turning bearish in the past week.

YFI needs to hold critical level to avoid a 23% pullback

On the 4-hour chart, Yearn.Finance price is trading at $22,459, just above the lower boundary of the descending triangle pattern formed. A breakdown from this point would most likely drive YFI price towards $17,500.

YFI/USD 4-hour chart

The bulls have lost the 50-SMA support level on November 25. If the support level at $22,459 fails to hold, the nearest price target would be the 100-SMA at $21,230, from which the price could potentially rebound towards the lower boundary of the channel as a re-test.

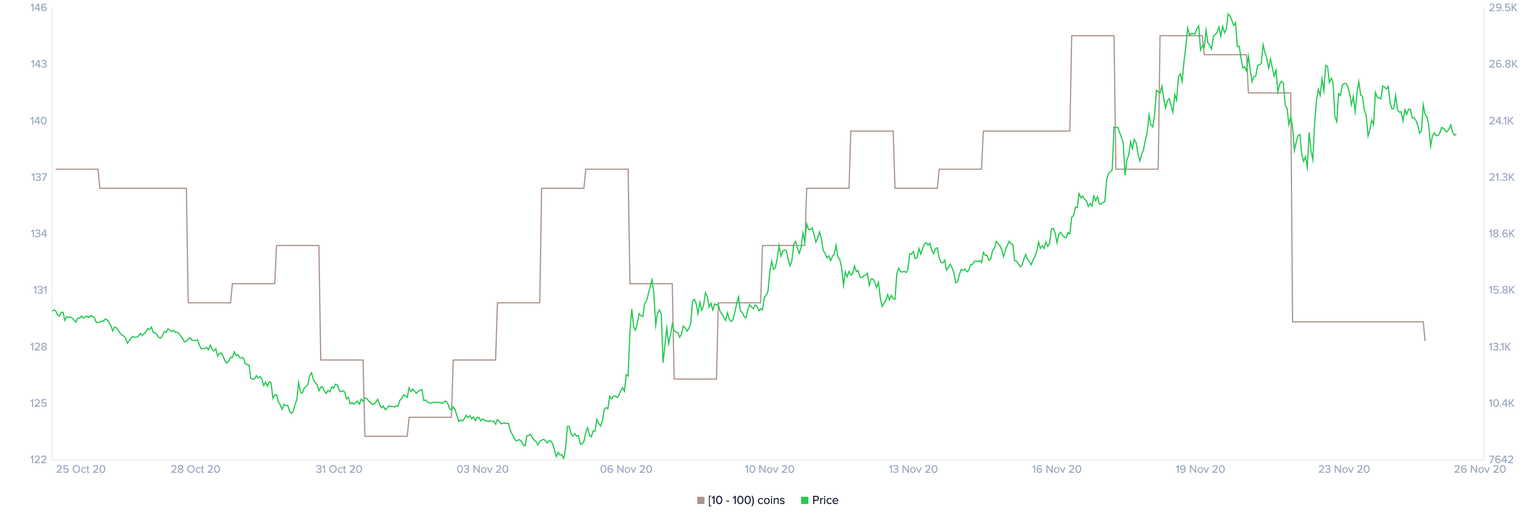

YFI Holders Distribution chart

It also seems that YFI whales are dumping their coins. The holders distribution chart shows that the number of investors holding between 10 and 100 YFI coins ($240,00 and $2,400,000) has significantly dropped since November 16 from a high of 145 to a current low of 130.

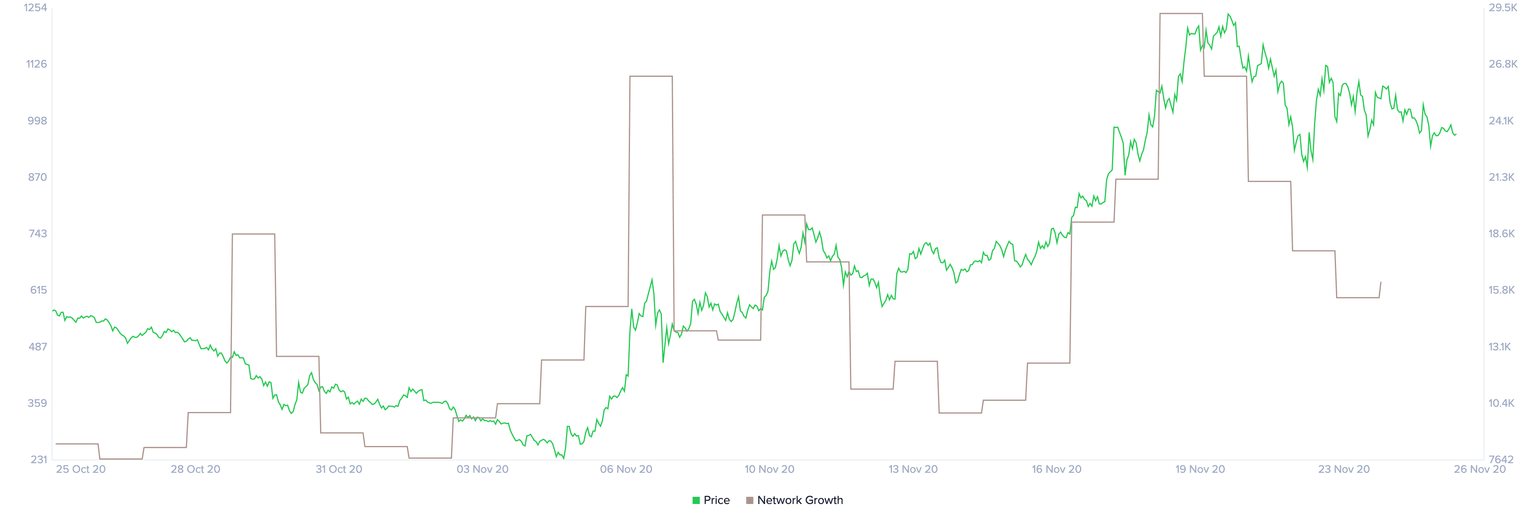

YFI Network Growth chart

Additionally, the network growth of YFI, which had a massive spike that started on November 16, is now declining significantly, which indicates the digital asset is weak and prone to price correction periods.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.