Yearn.Finance brushes shoulders with $40,000 overshadowing Bitcoin’s $36,000

- Yearn.Finance has a clear path to $42,000, according to the IOMAP model.

- YFI/USD is claiming Bitcoin’s spotlight by becoming the world’s most expensive cryptocurrency again.

Yearn.Finance has consistently recovered from the recent dip to $25,000. The price drop was not unique to the decentralized finance (DeFi) token but affected the entire cryptocurrency space. Bitcoin tumbled to $30,000, while Ethereum retested $900. On the other hand, Ripple’s mission to hit levels at $0.4 was cut short, with losses hitting $0.25.

Meanwhile, Bitcoin is trading slightly above $36,000 amid growing uncertainty. The flagship cryptocurrency could spike to $40,000, but bulls seem exhausted; hence, the odds favor a breakdown back to $30,000.

Yearn.Finance bullish breakout unstoppable

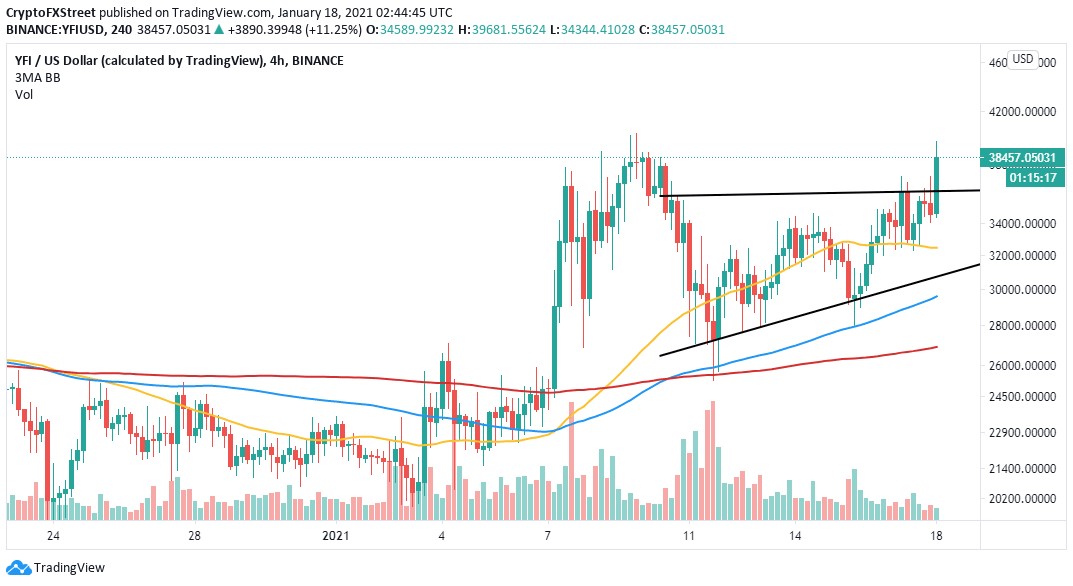

YFI is exchanging hands at $38,530 after retracing from higher price levels around $40,000. The spike in price followed the formation of an ascending triangle pattern.

The DeFi token endured a massive breakdown after topping $41,000 in the first week of January. While its price has made a series of higher lows since then, the $36,000 resistance level continued to reject Yearn.Finance from advancing further.

Such market behavior seemingly formed an ascending triangle on YFI’s 4-hour chart. A horizontal line can be drawn along with the swing highs, while a rising trendline developed along with the swing lows.

A recent spike in the buying pressure behind the token allowed it to break above the overhead resistance. Now, it could shoot up nearly 24% based on the ascending triangle formation. This target is determined by measuring the distance between the two highest points of the triangle and adding it to the breakout point.

YFI/USD 4-hour chart

IntoTheBlock’s IOMAP model reveals the absence of a robust supply barrier that will prevent Yearn. Finance from achieving its upside potential. Based on this on-chain metric, only one major area is of interest to the bulls and runs between $37,254 and $38,423. Here, roughly 760 addresses are holding a total of 154.4 YFI.

This area may act as a formidable barrier and absorb some of the buying pressure seen recently. Holders who have been underwater could break even on their positions, slowing down the uptrend. But if Yearn.Finance can slice through this hurdle, and it would likely climb to $42,000.

On the flip side, the IOMAP cohorts show that YFI sits on top of stable support. Roughly 926 addresses bought approximately 3,900 YFI between $31,850 and $32,956. This crucial area of interest suggests that bears will struggle to push prices down. Right now, the odds favor the bulls.

Yearn.Finance IOMAP chart

It is worth mentioning that the breakout to $42,000 may be invalidated if YFI closes the day under $40,000. Overhead pressure could force the DeFi token retest support at the triangle’s x-axis. The lower price levels expected to provide anchorage include $34,500, the 50 Simple Moving Average, and $28,500.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637465369516010808.png&w=1536&q=95)