Ripple woes continue as Polkadot claims fourth spot by market capitalization

- Ripple falls again, taking the fifth spot on the market as Polkadot rise to new all-time highs.

- Polkadot uptrend could remain intact mainly if the ascending channel’s middle boundary stays put.

Ripple has consistently lost traction in the market from the time the United States Securities and Exchange Commission (SEC) filed a lawsuit against it. XRP incurred massive losses from highs above $0.6 to lows of $1.7. Recovery has been slow, allowing smaller altcoins such as Polkadot to rise to the extent of overtaking XRP.

Polkadot soars to the fourth spot as XRP slides

DOT is currently the fourth-largest cryptocurrency in the market, following a 19% spike. The token boasts $14.8 in market capitalization after surpassing XRP. On the other hand, XRP’s market value stands at $13 billion.

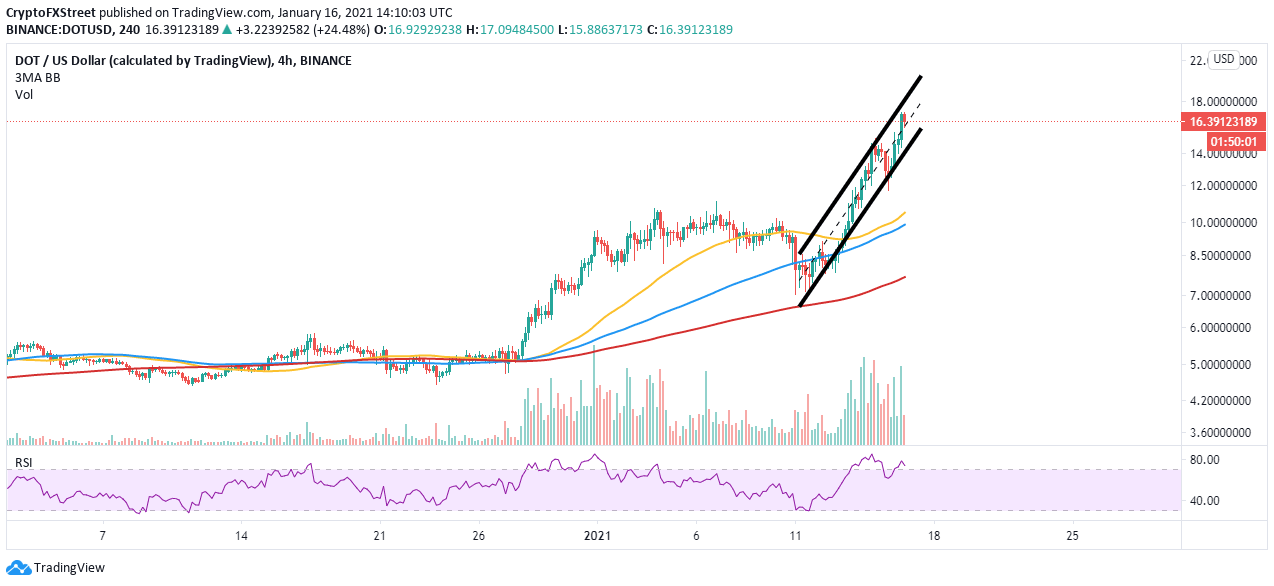

From a technical perspective, Polkadot is poised to retreat from the recently achieved all-time high. The ascending parallel channel’s middle boundary is likely to be tested in the near-term. If broken, DOT could embark on a journey of searching for formidable support, perhaps sub $14.

DOT/USD 4-hour chart

On the other hand, it is essential to realize that bulls are still relatively in control, especially with the 50 Simple Moving Average staying and edge above the 100 SMA. The gap made by the 100 SMA from the 200 SMA adds weight to the bullish outlook.

Ripple’s holds firmly in consolidation

The now fifth-largest cryptocurrency is trading at $0.287 after losing the support at $0.29. Also limiting movement is the 50 SMA. However, the support provided by the 100 SMA helps keep XRP afloat, thereby suggesting that consolidation may last longer.

XRP/USD 4-hour chart

It is worth noting that the Relative Strength Index hints at overhead pressure building. Another daily close under $0.29 could see selling activity rise as buyers get exhausted. Extensive losses may come into the picture if XRP slides under the 50 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(45)-637464037640530894.png&w=1536&q=95)