Ethereum Price Prediction: ETH holds steadfast above $1,200 ahead of upswing to $1,400

- Ether is stable above $1,200 as buyers get ready for the utmost upswing to $1,400.

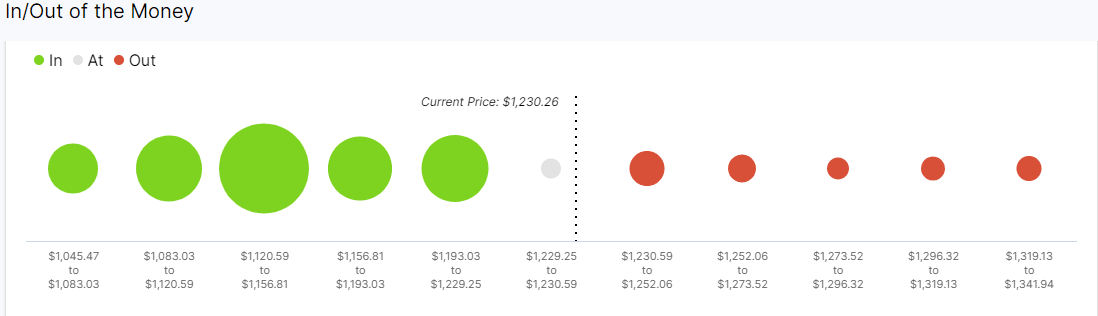

- The IOMAP model reveals that Ethereum has little overhead pressure that could prevent a potential uptrend.

Ethereum has not moved much since Friday. However, support at $1,200 has remained intact. At the time of writing, the largest altcoin is trading at $1,220. The least resistance path seems upwards, but a consolidation period is expected before Ethereum resumes the uptrend to $1,300 in the coming week.

Ethereum nurtures an uptrend within a parallel ascending channel

Despite the stalling after breaking above the resistance at $1,200, ETH has generally been trending upwards within a parallel ascending channel. Recovery is set to continue if Ethereum closes the day above $1,200. Besides, the price action to $1,400 will be validated following a break of the middle boundary resistance.

ETH/USD 4-hour chart

On the other hand, it is worth keeping in mind that the moving average convergence divergence, or MACD, adds credence to the optimistic outlook.

This technical indicator, which follows the path of a trend and calculates its momentum, appears to be turning bullish. As the 12-day exponential moving average crossed above the 26-day exponential moving average, the odds for a bullish impulse are likely to rise in the coming sessions.

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals no supply barrier that will prevent the second-largest altcoin by market cap from achieving its upside potential.

Based on this on-chain metric, there is only one central area of interest between $1,230 and $1,252 filled by a high number of investors who had previously purchased Ether around this price level. Here, roughly 118,000 addresses are holding nearly 386,200 ETH.

This area may have the ability to absorb some of the buying pressure seen recently. Holders who have been underwater may try to break even on their positions, slowing down the uptrend. But if Ether can slice through this hurdle, it would likely climb to $1,400.

Ethereum IOMAP chart

On the flip side, the IOMAP cohorts show that Ether sits on top of stable support. Nearly 164,000 addresses bought roughly 8.3 million ETH between $1,121 and $1,156. This crucial area of interest suggests that bears will struggle to push prices down. Right now, the odds favor the bulls.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520-%25202021-01-17T165343.184-637464884324759766.png&w=1536&q=95)