XRP Price Prediction: Ripple targets $0.25 but could take months to play out

- XRP price fell by 38% in November and printed a classical bearish pattern on the monthly timeframe.

- Ripple settled the monthly auction 50% above the bear rallies' decline.

- A monthly close above $0.44 would create new countertrend possibilities.

XRP price has commenced December with the same bearish plot to bring XRP back into 2020 price territory. November's monthly settlement paints an interesting picture of what lies ahead for the digital remittance token.

XRP price bearish to a fault

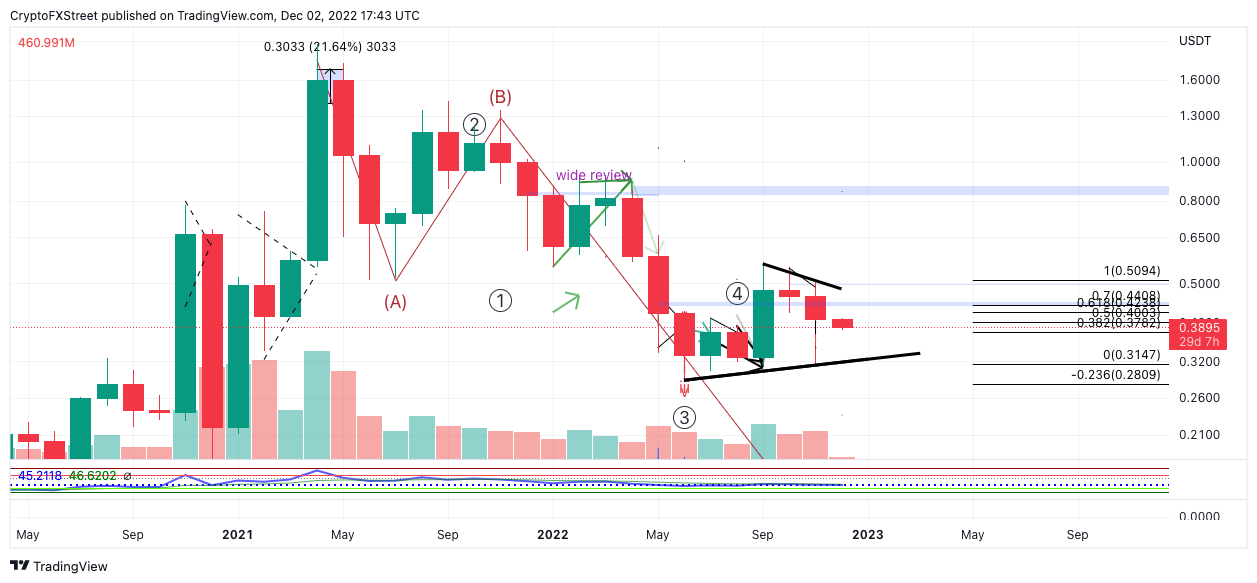

XRP price fell by 38% in November, printing a monthly low of $0.3160. Throughout the month, the bulls produced several retaliation events and recovered 30% of market losses. A Fibonacci retracement tool surrounding November's trading range shows the monthly settle at $0.407, closing above the 50% Fib level.

While November's closing price is an optimistic gesture, it was still simultaneously 12% lower than the October settle at $0.464. Additionally, a shooting star pattern is displayed due to the settlement, which could spell bad times for the Ripple price. T

Classical price action techniques warrants that the last candle within a shooting star pattern can be used to project the next target. Taking the size of November's candle and projecting it from the monthly settle forecasts a 38% decline targeting $0.25.

Still, the bullish strength displayed during the late stages of November should not be overlooked XRP price does have the potential to rally 13% into October’s broken support zone near $0.44.

XRP/USDT 1-month chart

Keeping these factors in mind, The decline targeting $0.25 could take months. A monthly settle above the broken support zone at $0.44 broken could create new possibilities for an uptrend bounce, specifically targeting the November swing high at $0.51. XRP price would rise by 30% if said price action occurred.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.