XRP Price Prediction: Ripple price makes traders choke in the leftovers as XRP tanks over 2%

- Ripple price slides on the back of remaining recession concerns for 2023.

- XRP sees technical traders back off after a firm rejection from resistance.

- At the time of writing, losses were over 2% and could mount to 17%.

Ripple (XRP) price slides as traders flee into safe havens with US bonds as the preferred place-to-be. The flight to safety became clear on Tuesday after the release of some tier-two data in the form of the US Housing Index showed a substantial decline in every state in the US, and San Francisco flirting with a decline on a yearly basis. Additional proof of the demand for US bonds came with the 2-year tenor auction of US Treasury bonds that saw a Stop Through of 1.7 bps, which points to the biggest demand since 2017.

Ripple traders are converting into bond traders

Ripple price again showed signs of a recovery as the cryptocurrency jumped over 5% on Monday, as a Christmas rally seemed to be underway after all. Unfortunately, that profit is almost gone as snow before the sun, as traders cannot unchain themselves from the recession fears for 2023. Even in the quietest week of the year, the recession risk still hangs over the price action as smaller data elements indicate that a recession is unavoidable.

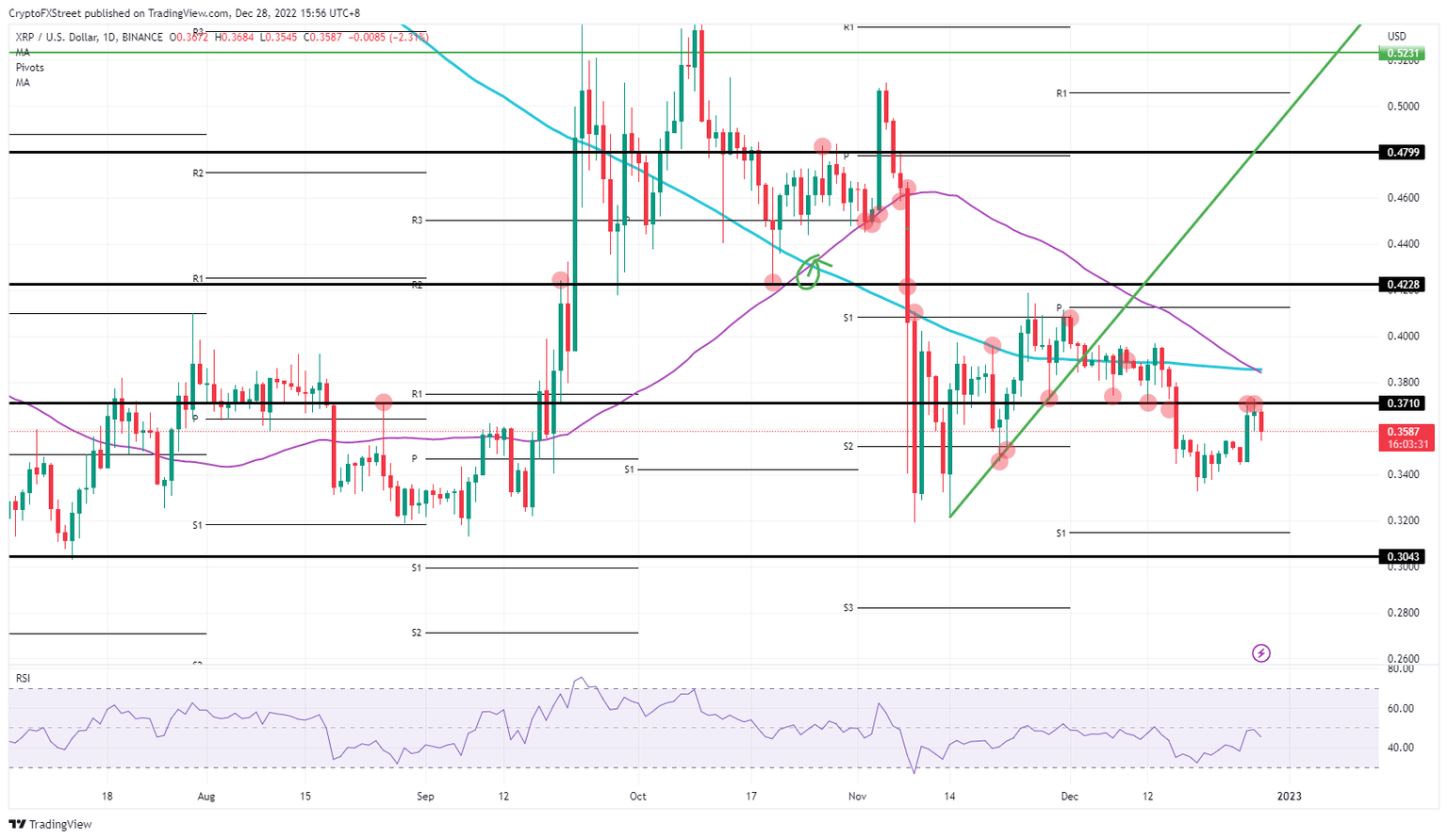

XRP thus sees traders shy away from risk assets, such as equities and cryptocurrencies, in favour of safe havens, such as the Swiss Franc and US bonds. Expect to see more losses being eked out should equities dip further. The ideal candidate for the first test for support comes in at $0.3333, and more to the downside, $0.3043 comes into play, with mounting losses for the week between Christmas and New Year reaching towards -17%.

XRP/USD daily chart

Any upside moves need to be firmly aligned and confirmed by a clear break on the chart. Of course, there is only one level to watch then: $0.3710, as that level has been substantial in support throughout November and is now acting as resistance. Once Ripple price can break above there, $0.3850 pops up quite quickly, with the 55-day Simple Moving Average (SMA) and the 200-day SMA intersecting with one another nearby.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.