XRP Price Prediction: Ripple set to go out the year with an 18% decline

- Ripple price keeps slipping below vital supports.

- XRP is on its way in search of support, as the RSI is still not oversold.

- Risk comes with this last trading week to see a nosedive move of 18%.

Ripple (XRP) price sees traders returning from the price action as XRP paints a blood-red picture after the last US data points. With the PCE Deflator unmoved, the Fed is nowhere near done hiking and markets are set for a big reshuffle and rebalancing as they undershot the Fed’s warnings. With that repricing for 2023, the risk now comes that more declines are in the cards, with another 18% losses at hand for this last trading week.

Ripple price sees traders having a hangover

Ripple price is still letting the dust settle over the last data points of past Friday when the Fed’s preferred inflation measure, the PCE Deflator, came out. The week before that, US inflation numbers came down, but now the PCE Deflator pointed to an unchanged moment in inflation. This means that the Fed will want to do more rate hikes to abate inflation, which means markets need to reprice, as several market analysts thought the Fed would be near its pivotal level.

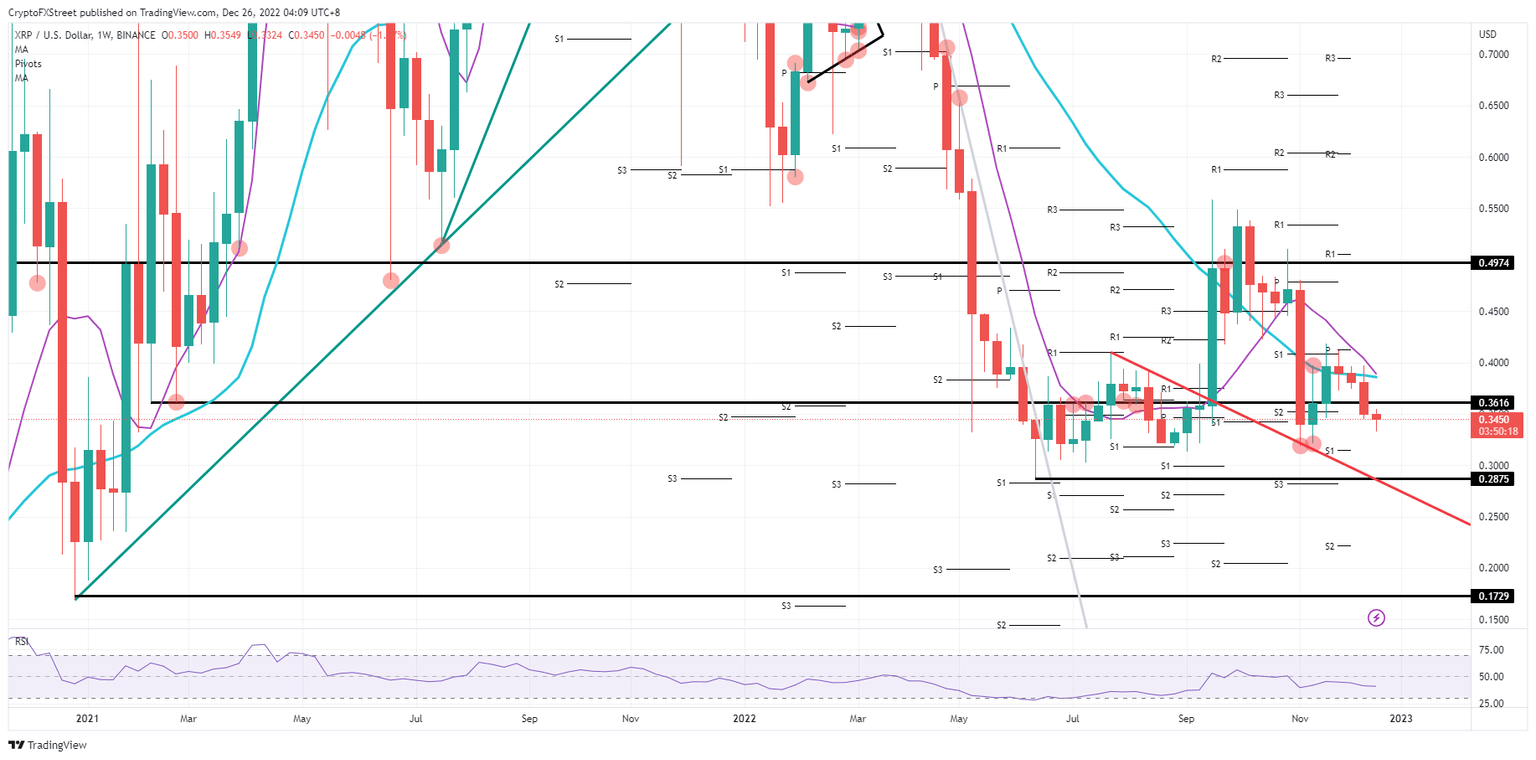

XRP thus broke below key pivotal levels such as $0.3616 and last week made a new low for December. More downside looks granted as there is no real support in sight now, together with the Relative Strength Index (RSI) nowhere near oversold. A nosedive move could be seen towards $0.2875, which would mean an 18% decline and traders giving up the $0.3000 psychological level.

XRP/USD weekly chart

With the last week of the year, no data points or Fed speakers are lined up to comment on the markets. This opens a window of opportunity for bulls to push price action higher. Indeed, with the thin liquidity conditions, Ripple price could jump 13% with the 55-day Simple Moving Average (SMA) and the 200-day SMA as a double cap to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.