XRP Price Prediction: Ripple epitomizes relative strength, portends higher prices

- XRP price confidence weakens slightly as breakout from bullish base falters.

- XRP/BTC pair has gained over 300% in the last eight weeks.

- Ongoing SEC case and the documentation production battles cast a wide shadow.

XRP price has gained 100% since the April 22 low while building a solid foundation for further gains in the coming weeks. Consolidation may extend for a couple of days. Still, the technicals point to the continued relative strength and solid absolute returns.

Judge warns SEC to stop stalling

In a new inning of the documentation production battle between the Securities and Exchange Commission (SEC) and Ripple, judge Sarah Netburn has restated that the SEC must produce all documents related to Bitcoin, Ether and XRP.

The regulatory agency has repeatedly stated that it does not possess any material related to the major cryptocurrencies. Still, if it is revealed that the SEC did discuss XRP with the two largest cryptocurrencies, it would further establish Ripple’s argument. More specifically, the most important materials are related to the SEC’s clarification of Bitcoin and Ethereum as not being securities. The agency regards XRP as a security.

The enforcement action of the SEC against Ripple has to be the most important lawsuit in the cryptocurrency space. However, unlike lawsuits involving other crypto-related enterprises or assets, Ripple has the firepower to battle the case to the Supreme Court if necessary.

XRP price strikes bullish posture in the legal anxiety

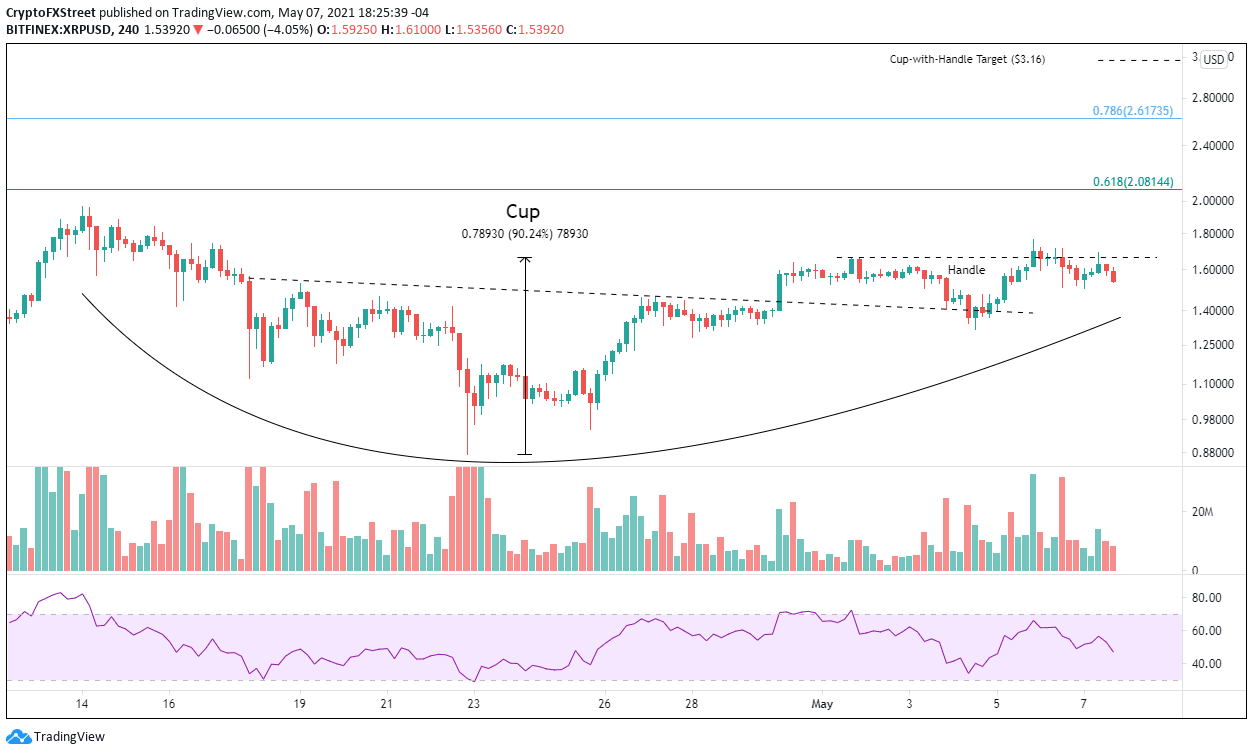

Ripple has provided three opportunities to engage bullish speculators, the hammer candlestick pattern on April 23, the inverse head-and-shoulders breakout on April 30 and yesterday’s emergence from a bullish cup-with-handle base. In all, XRP price has assembled a substantial foundation to build a long-duration advance.

Yesterday, XRP price broke out from a bullish cup-with-handle base, allowing new speculators to capitalize on a timely entry price. Unfortunately, the breakout mildly pulled back into the base, forcing speculators to practice patience as XRP price clarifies intentions.

The reversal back into the base triggered a longstanding trading rule: the pullback-plus-four. It specifically states that speculators need to give the digital asset four days to trade above the breakout high. A failure to do so augments the probability that XRP price will decline or evolve into a more complex pattern.

At the moment of writing, the bullish thesis remains active, with the first notable resistance arriving at the convergence of the April high at $1.96, the psychologically important $2.00 and the 61.8% Fibonacci retracement of the 2018-2020 bear market at $2.08.

The measured move target of the cup-with-handle base is $3.16, generating a gain of 90% from the handle high of $1.66. A rally of this significance would position XRP price to target at least the 2018 all-time high at $3.30.

XRP/USD 4-hour chart

Speculators should turn defensive if XRP price fails to rally above the breakout high of $1.76 within four days, starting with today. A decline below the handle low of $1.31 immediately places Ripple in a vulnerable technical position, signifying a complex bottoming process or even a plunge to the April low at $0.874.

XRP price has withstood the legal gyrations to be one of the top-performing cryptocurrencies since the April low, displaying noteworthy speculator demand. Similarly, the explosion higher for the XRP/BTC pair affirms that the returns have been strong on an absolute basis and a relative basis.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.