XRP Price Forecast: This setup could propel Ripple to $1

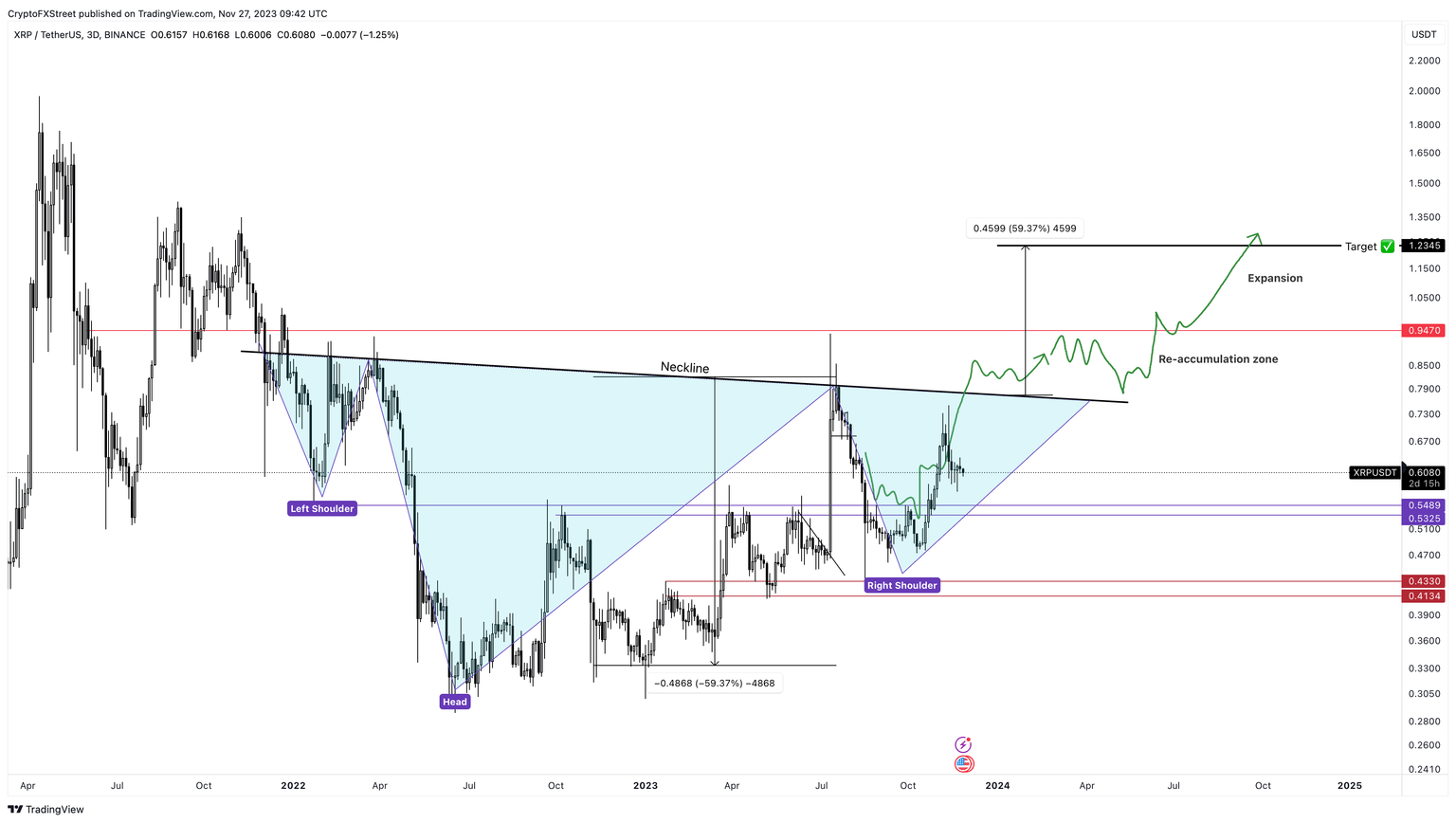

- XRP price action has produced a potential inverse head-and-shoulders setup.

- This technical formation forecasts a 60% upswing to $1.234.

- Invalidation of the bullish thesis will occur if Ripple breaks below the last key swing low of $0.475.

Ripple (XRP) price is in a multi-month consolidative pattern that could provide patient holders with handsome gains. The head-and-shoulders setup (a bullish variety) is almost close to being complete. If the XRP price continues to scale higher and produce a breakout, it could trigger a swift rally to the upside.

Also read: Ripple plans to be the torchbearer of the potential $300 trillion cross-border payment industry

XRP price promises massive gains

XRP price action from March 2022 to November 2023 has produced an inverse head-and-shoulders setup. This technical formation contains three distinctive swing lows, with the central one deeper than the other two. This swing low is termed the head, and the swing lows on either side of the head are usually of comparable depths and are named shoulders. Hence, the namesake.

Connecting the peaks of these three swing lows with a trend line shows a resistance level known as the neckline. A breakout from this setup, which includes a decisive close above the neckline, forecasts a near-60% rally to $1.234. The target is obtained by measuring the distance between the head’s right peak and the lowest point and adding this measure to the breakout point.

In Ripple’s case, the breakout could occur around $0.774.

Beyond the neckline, XRP price will face a critical hurdle at $0.947, clearing which would open the path for Ripple bulls to retest the $1.234 target. Ripple currently trades at $0.606, which makes the retest of $1.234 a 103% move.

XRP/USDT 3-day chart

While the forecasted targets might seem overwhelming, the recent buying pressure and bullish momentum have pushed major altcoins to double in the past few weeks. This outlook for XRP price has a higher chance of occurring if Bitcoin price does not collapse.

On the other hand, if XRP price produces a lower low below the key swing low of $0.475, it will invalidate the bullish thesis. In such a case, Ripple could slide 13% and revisit the $0.413 support floor.

Read more: XRP price might be looking at a decline even as speculation of Ripple and SEC settling intensify

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.