XLM Price Prediction: Stellar resumes uptrend after bouncing off key technical pattern

- Stellar has printed a double-bottom pattern, leading to gains above $0.36.

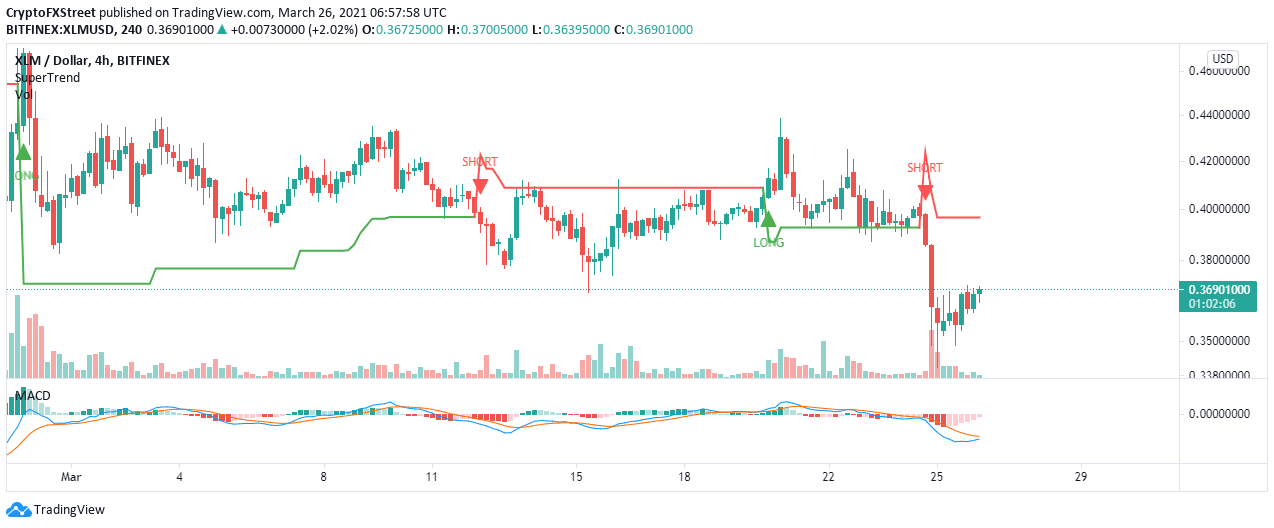

- The MACD is likely to flip bullish in the short-term as XLM momentum becomes stronger.

- The 4-hour SuperTrend indicator recently sent a signal to short Stellar, casting a bearish cloud.

Stellar plunged to levels around $0.34 before the ongoing recovery came into play. The entire cryptocurrency market has been on a downtrend this week. However, minor gains can be witnessed across the board on Friday, with cryptoassets such as XLM rebounding from crucial support levels.

Stellar makes a comeback from weekly lows

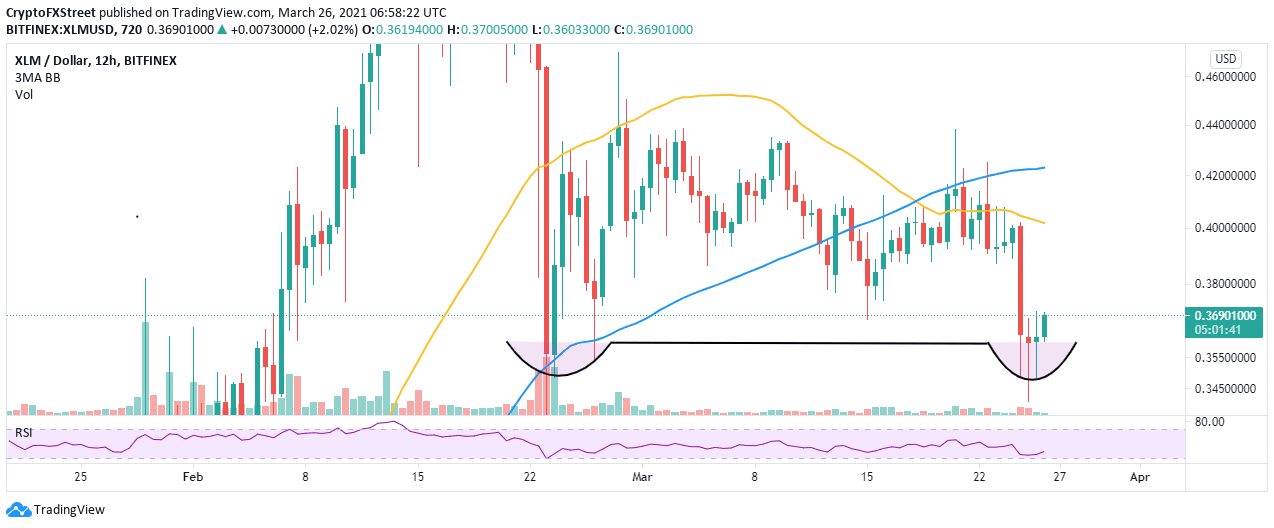

The cross-border token has been on an upward roll following the formation of a double-bottom pattern. This is a highly bullish technical pattern that forms after an asset hits a particular anchor zone a couple of times, separated by a peak.

The double-bottom pattern is confirmed in technical analysis when the asset bounces off the support area. Its recovery is characterized by increased trading volume. It is crucial to wait for the confirmation of this pattern to avoid false breakouts.

Stellar is likely to continue with the uptrend as long as the support at the double-bottom holds. Note that gains above the 50 Simple Moving Average (SMA) on the 12-hour chart could trigger massive buy orders as XLM heads back to $0.6.

XLM/USD 12-hour chart

The Moving Average Convergence Divergence (MACD) indicator hints that recovery could stay intact in the near term. However, the uptrend will be validated by the MACD line (blue) crossing above the signal line on the 4-hour chart.

XLM/USD 4-hour chart

Looking at the other side of the picture

The SuperTrend indicator has recently flashed a sell signal on the 4-hour chart. This call to sell occurred when the indicator flipped above the price and turned red. Traders use the SuperTrend indicator to foresee the general direction of the asset. If the situation remains the same, Stellar may start retreating to the support at $0.34 and $0.3, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren