XLM Price Prediction: Stellar might drop 15% as lackluster performance continues

- XLM price shows no signs of revival as it trades near the range low at $0.196.

- A breakdown of the support level at $0.272 might trigger a 15% sell-off to 0.228.

- If Stellar shatters the range high at $0.303, it will invalidate the bearish thesis.

XLM price has been in a massive downtrend since mid-May and shows that the buyers are nowhere to be found. As a result, Stellar has been trading near the lower range and attempts to revert to the mean has been foiled.

XLM price might experience another sell-off

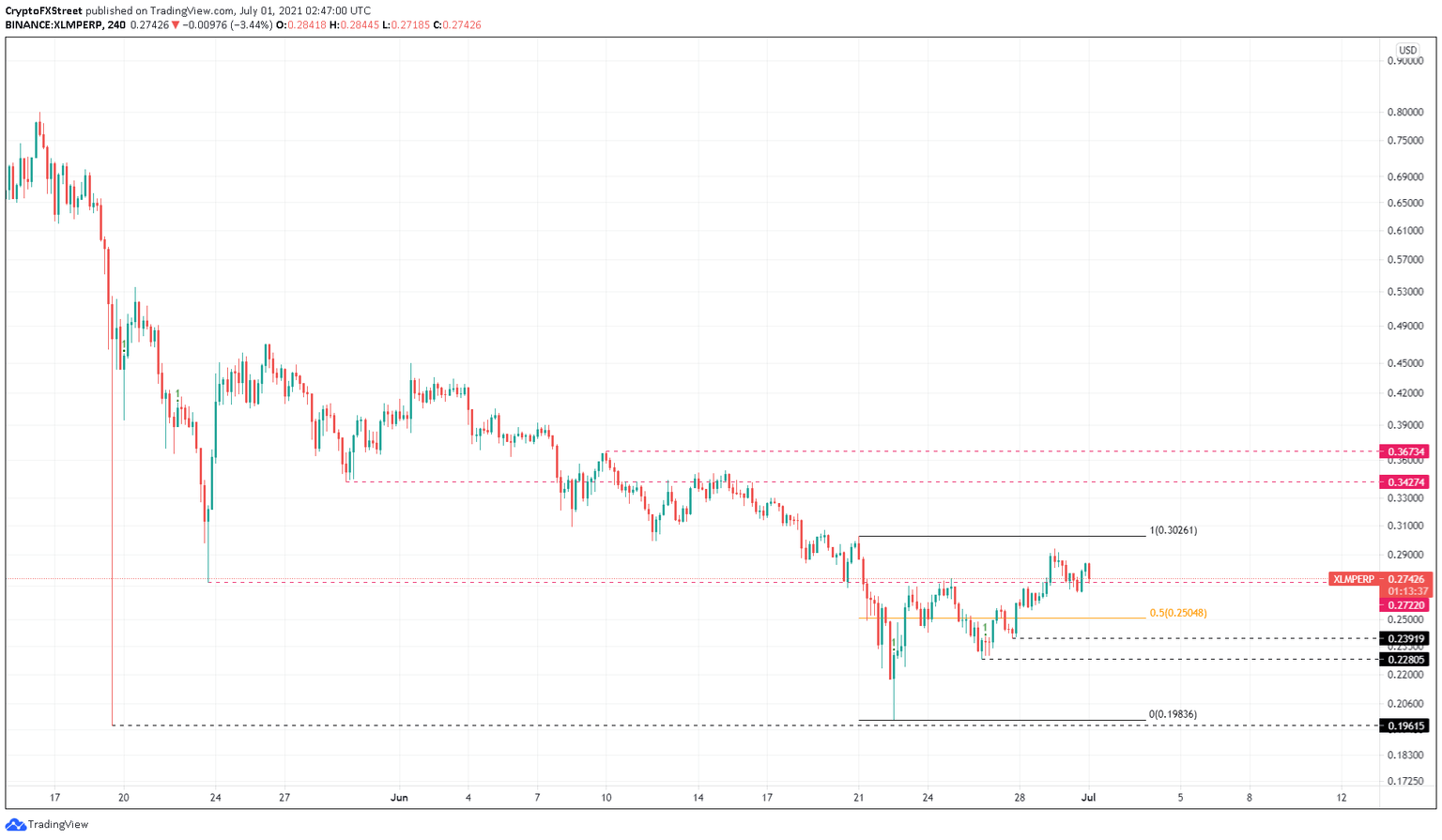

XLM price slid below the May 23 swing low at $0.272 on June 21 to form a bottom at $0.198. Lack of buying pressure has led to a slow recovery of the remittance token. Although Stellar has sliced through the crucial barrier at $0.272, it is currently being retested.

The fragile nature of the crypto market makes it harder for the remittance token to rally higher. Any potential short-term selling pressure will be enough to push XLM price to breach the said support.

In such a case, the crash might drag Stellar to the 50% Fibonacci retracement level at $0.250. Following the said support floor breakdown, XLM price could head to $0.239 or $0.228.

If the bulls rescue Stellar here, there is a chance for reversal. However, the range low at $0.198 or the May 19 swing low at $0.196 might be tested in a highly bearish case.

XLM/USDT 4-hour chart

On the flip side, a bounce from $0.272 will signal investor interest. A potential spike in buying pressure here could propel XLM price to take a jab at the range high at $0.303.

If the bulls push through this barrier, the bearish thesis will be invalidated. In such a case, Stellar will likely head to $0.343, a 25% rally from the current position at $0.274.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.