XLM Price Forecast: Stellar nightmare may not be over

- XLM price leads the race to the downside, recording the first break below the May lows on the coverage list.

- Stellar to close with trading volume above the 50-day average for the first time since May 25.

- Over the last seven days, the digital asset has fallen over 40% and 75% from the May high.

XLM price declined over 20% yesterday, providing a wicked reminder of the risks inherent in cryptocurrency investing, notably when towering support is quickly eliminated like the May 23 low. However, Stellar bulls have stepped into the market today, lifting the cryptocurrency off the early lows and potentially forming a doji candlestick pattern on the daily chart. It may be a bullish development, but XLM price still has a lot to prove before the nightmare is officially over.

XLM price vocabulary may not include ‘The Bottom’...yet

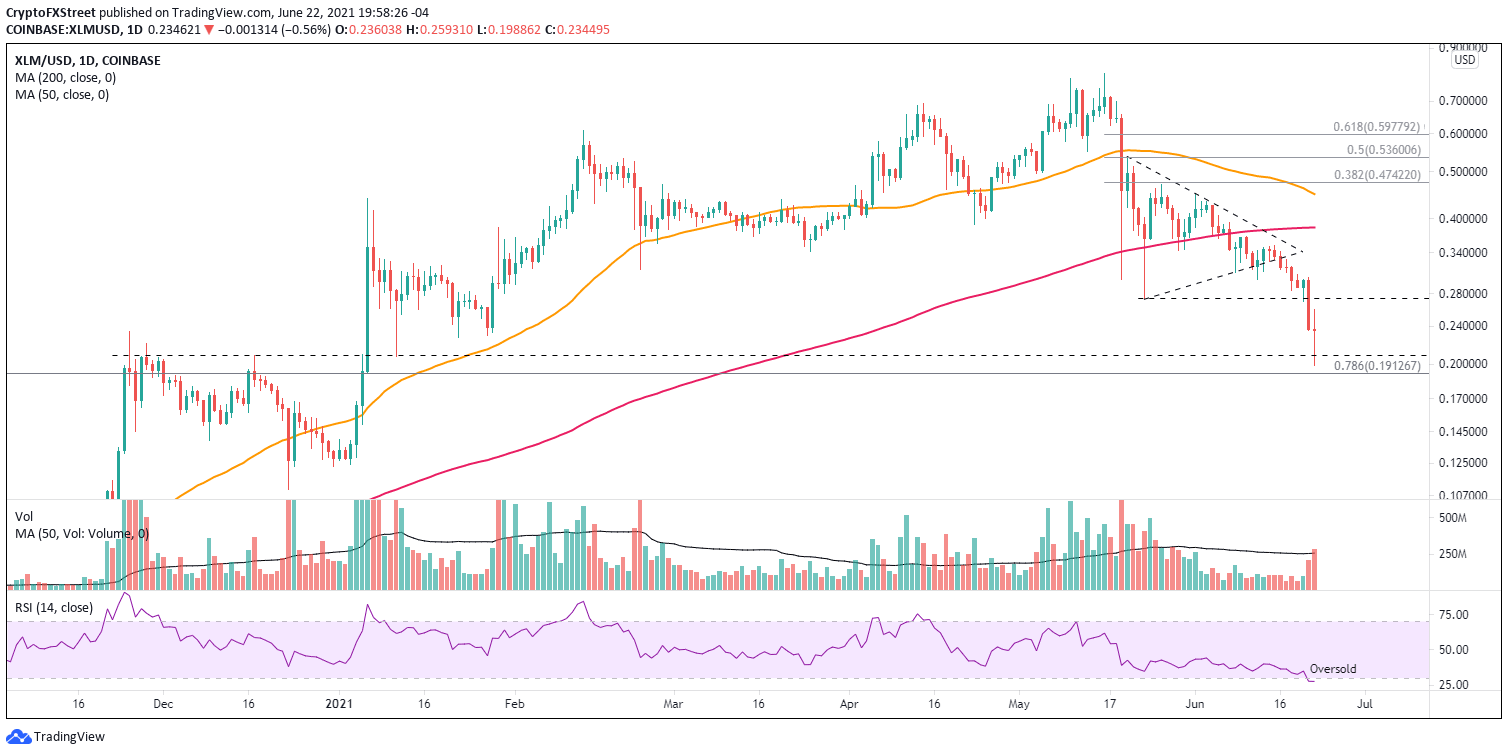

XLM price over the last month had formed a symmetrical triangle with a measured move of approximately 50%. The resolution to the downside on June 16 keyed investors to be ready for a decline to $0.166 if the measured move was to be fulfilled.

By today’s low XLM price had declined 40% from the June 16 breakdown, pressing Stellar down near the 78.6% Fibonacci retracement of the March 2020-May 2021 advance at $0.191. In the process, the digital asset quickly overcame support at the May 23 low of $0.274 and logged the first oversold reading on the daily Relative Strength Index (RSI) since the September 2020 low.

The washout did not come as a surprise. In an FXStreet post on June 15, it was forecasted that Stellar would be one of the first altcoins to sweep the May lows.

Considering the recent price collapse, investors should remain tentative in their pursuit of a high probability entry point in Stellar. Yes, the potential doji pattern could signal a XLM price reversal, but it could also just be a pause in a more significant decline that may eventually reach the measured move target of $0.166. Nevertheless, today's spike in volume underlying the doji indicates that it has been an intense battle between sellers and buyers.

A trade above today’s high would be the first compelling opportunity for investors to entertain a pilot buy. A daily close above the May 23 low of $0.274 would be the additional confirmation needed to deepen their involvement with Stellar from the long side. Beyond $0.274, XLM price is not burdened by any resistance until the symmetrical triangle apex at $0.341, generating a 30% return from today’s high.

XLM/USD daily chart

XLM price may have printed the correction low today, but there still has been no confirmation in a market of uncertainty and shifting support levels. Until Stellar realizes the points of confirmation mentioned above, the token may be listless, refining a new level of support around $0.210 and the 78.6% retracement level to engineer a substantive rally.

Stellar is now the 19th largest cryptocurrency with a market capitalization of $5.45 billion, sandwiched between Wrapped Bitcoin and Dai after XLM price was unable to avoid a bearish fate. It was a nightmarish turn of events for stubborn investors.

Of course, bottoms in the cryptocurrency markets are sometimes only a tweet away, so being alert to the precise Stellar support and resistance levels will be the optimal approach to capitalize on emerging price structure clarity.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.