XLM Price Forecast: Stellar accelerates decline, set to test $0.27

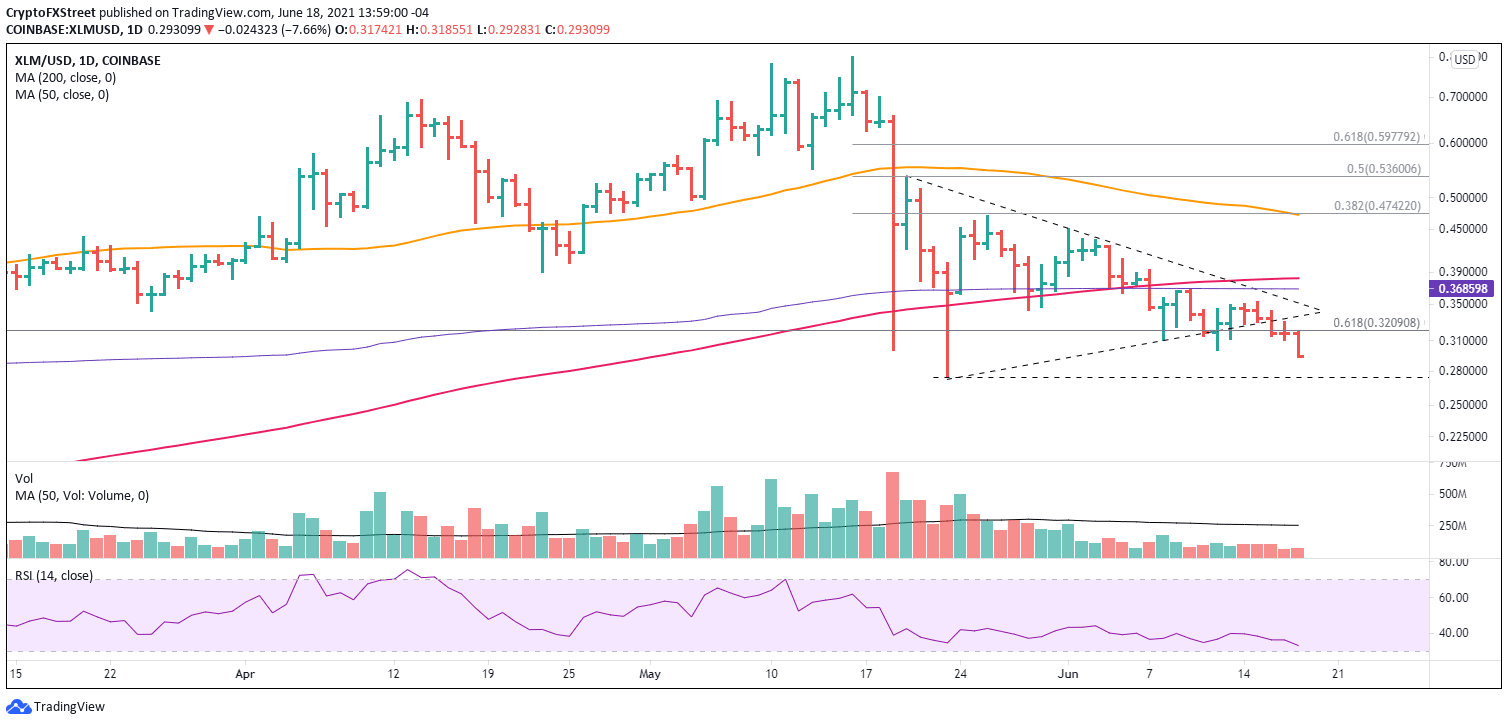

- XLM price shatters symmetrical triangle’s lower trend line, drops 14% over the last three days.

- Stellar 61.8% Fibonacci retracement level fails to halt breakdown, unleashing the digital asset to test the May 23 low.

- Daily Relative Strength Index inches closer to an oversold reading, something that did not occur in May.

XLM price had been propped by the symmetrical triangle’s lower trend line and the 61.8% retracement level of the March 2020-2021 rally. However, the corrective bounce was limited, unaffected by the Bitcoin 30% rally. The result was a quick breakdown from the triangle and a double-digit decline, with Stellar now on the cusp of testing the May 23 low.

XLM price has Stellar bulls looking for shelter

XLM price correction in May was a wicked reminder of the risks inherent in cryptocurrency investing, as Stellar collapsed 65% into the May 23 low of $0.274. Not only did it remove pockets of anxiety and weak holders, but the decline erased a notable portion of the advance from the beginning of 2021.

The price action following the correction took the form of a symmetrical triangle as Stellar oscillated in an increasingly tighter range with noticeably lower than average volume. The resounding breakdown from the triangle on June 16 removed any doubt about XLM price intentions and put bullish forecasts under pressure.

The measured move of the symmetrical triangle is 50%. The resolution to the downside could motivate XLM price to plummet to $0.166, which is well below the 78.6% retracement of the March 2020-2021 advance at $0.191. It would be a significant blow to Stellar; a network originally envisioned to boost financial inclusion by reaching the world’s unbanked.

Today’s trade below the June 12 low of $0.300 is the necessary confirmation of a new downtrend. It almost guarantees a sweep below the May 23 low of $0.274 and raises the odds that Stellar will resume the larger correction, but probably not to the measured move target of $0.166.

XLM/USD daily chart

For sure, XLM price did not avoid a bearish fate. Still, considering that the triangle resolution occurred close to the apex, the longevity and magnitude of the present leg lower may not be extended nor vastly exceed the May 23 low of $0.274. Nevertheless, it may be enough to generate an oversold reading on the daily RSI that would accelerate the construction of a sustainable XRP price low.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.