Why buying Solana price at these levels will provide the best ROI?

- Solana price seems to be hovering inside a consolidation with no signs of a breakout.

- Investors can expect a dip to $31.66 or $24.52 levels in the near future as liquidity below these levels remains untapped.

- A daily candlestick close below $24.52 without recovery will invalidate the bullish thesis for SOL.

Solana price faces a choice that could either propel it to highs seen in early May or push it into boring sideways consolidation. Investors need to pay close attention to the liquidity pools mentioned below.

Solana price at crossroads

Solana price has been producing higher lows since its bottom at $25.71 on June 15. Since this local bottom, SOL has produced four higher highs as it rallied 84% at one point. Currently, SOL trades at $39.

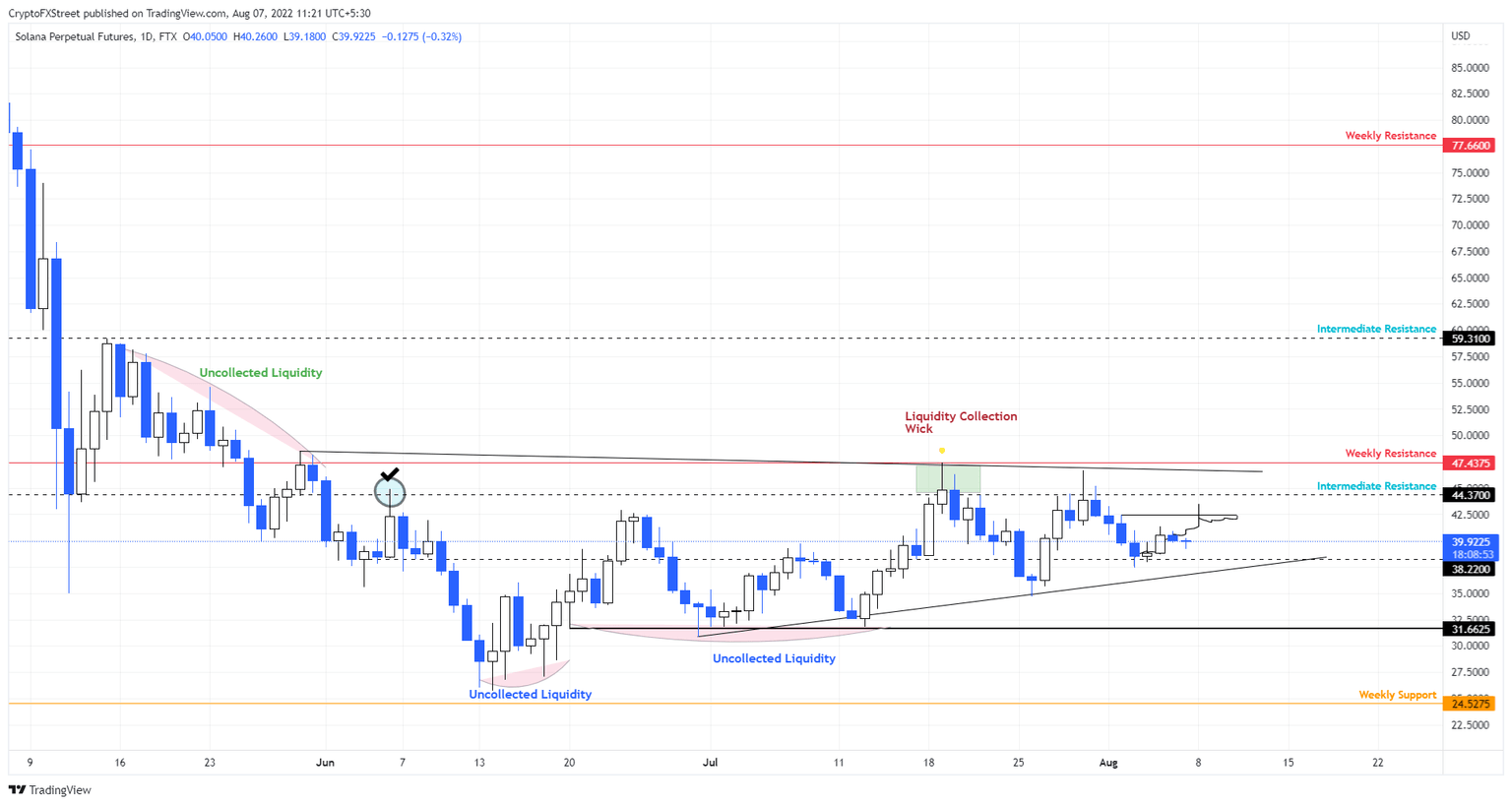

There are liquidity pools of uncollected stop-loss present below $31.66, and the swing lows formed around $26 during the bottom formation in June 2022. From a market makers’ perspective, these levels are likely to be swept and, when it happens, will trigger a run-up.

Likewise, similar liquidity pools are present above $47.43 and higher.

Therefore, if investors are looking to buy the dips on Solana price, the best levels would be $31 to $25. Assuming the sell-stops are swept first, the potential returns would range anywhere from 40% to 90% with SOL reaching $45 to $60 levels.

SOL/USDT 1-day chart

While the upside narrative looks appealing, investors need to understand that the directional bias the cryptocurrency market is in shambles. If Solana price moves to collect the liquidity present above at $47, then a lack of upside objective could leave SOL consolidating for a long time.

However, if Solana price produces a lower low below the $24.52 support level, it will flip this barrier into a hurdle and invalidate the bullish thesis for SOL.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.