Why Bitcoin bulls remain optimistic about higher prices

- Bitcoin price gets rejected against a critical barrier.

- Yet BTC price can still jump higher if it can overcome resistance.

- Expect to see a 10% jump onto the next hurdle, targeting a total 25% profitable rally.

Bitcoin (BTC) price has undergone a rejection against a significant short-term barrier but if it can break above a 25% rally could get underway. 10% is up for grabs if bulls can swing from one resistance to another. An endpoint for the run-up is likely to be the 55-day Simple Moving Average (SMA), with bulls potentially booking 25% of solid gains in the process.

Bitcoin price could go for a 25% rally

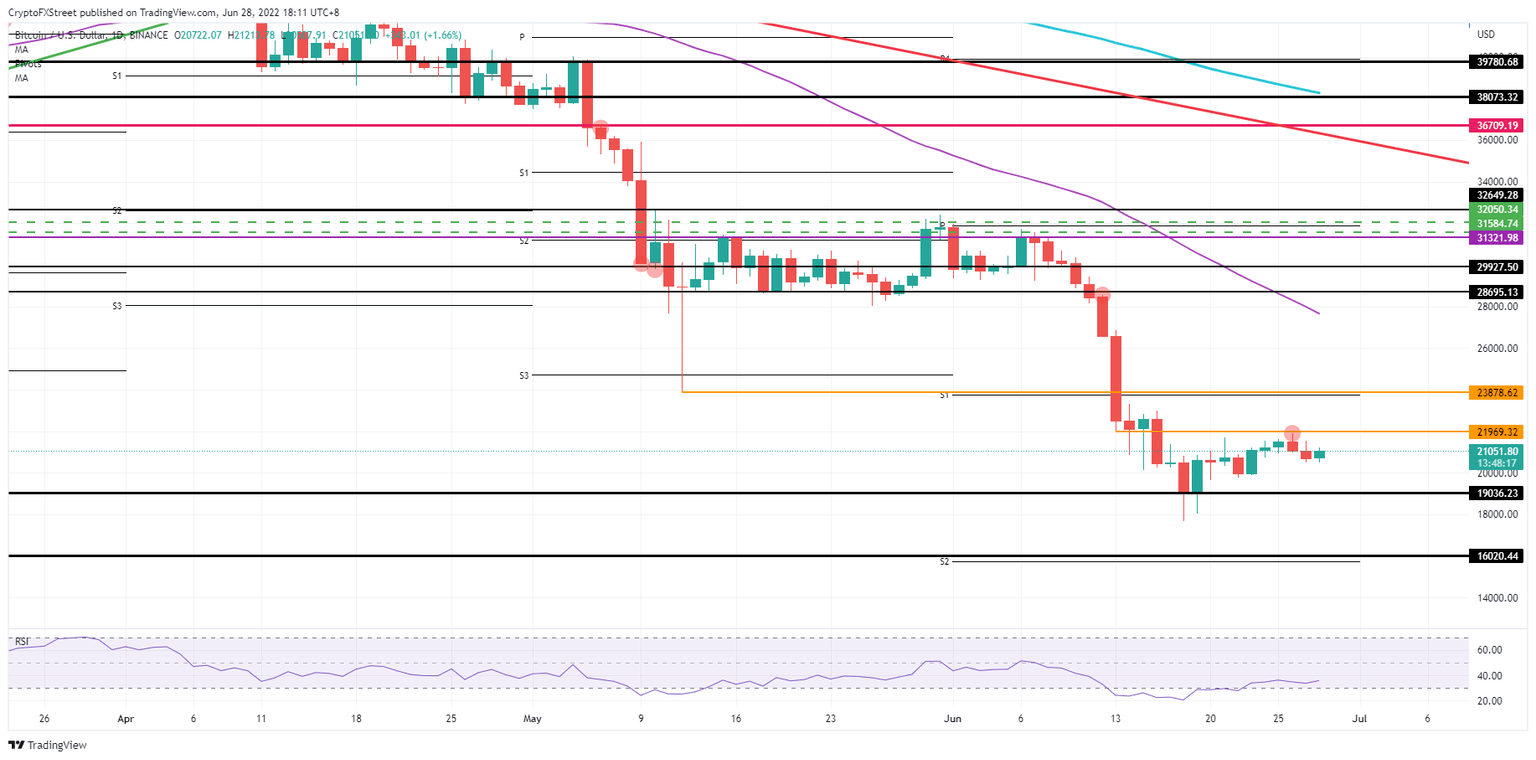

Bitcoin price sees bulls hurt a bit by a firm rejection from the $21,969 level, the low of June 13, and a key short-term level on the chart. Although price action took a little step back since then, the Relative Strength Index shows bullish signs as it trades back above the oversold area and looks like it is tilting higher. With more bullish pressure mounting, supported by tailwinds from global markets that have entered a sort of a soft patch, Bitcoin could get set to return above $27,000.

BTC price will first want to break through the aforementioned $21,969 before it can swing higher to the next level at $23,878, which is equally important,the low of May 12, and a falling knife. Once both these areas are cleared, BTC bulls have a stretched area without any resistance to rally up to roughly $27,660, where the 55-day SMA can be found.

BTC/USD daily chart

The risk to the downside still comes from the overall tail risk from inflation and monetary tightening. As the Fed has mentioned, it is willing to push the US economy into a controlled recession, which means that plenty of households will face tough times as their income drops and expenses rise. With almost no disposable income, the money flow to cryptocurrencies will dry up, and Bitcoin price could drop to $16,020.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.