When is it time to buy Bitcoin as crypto winter holds an opportunity?

- Bitcoin price trades heavy at $28,695.13, with the risk of saying goodbye to $30,000.00

- BTC price could slip further to the downside as bearish elements outweigh bulls.

- Expect some more pain to come with one significant area marked up to enter before a rally jumpstarts.

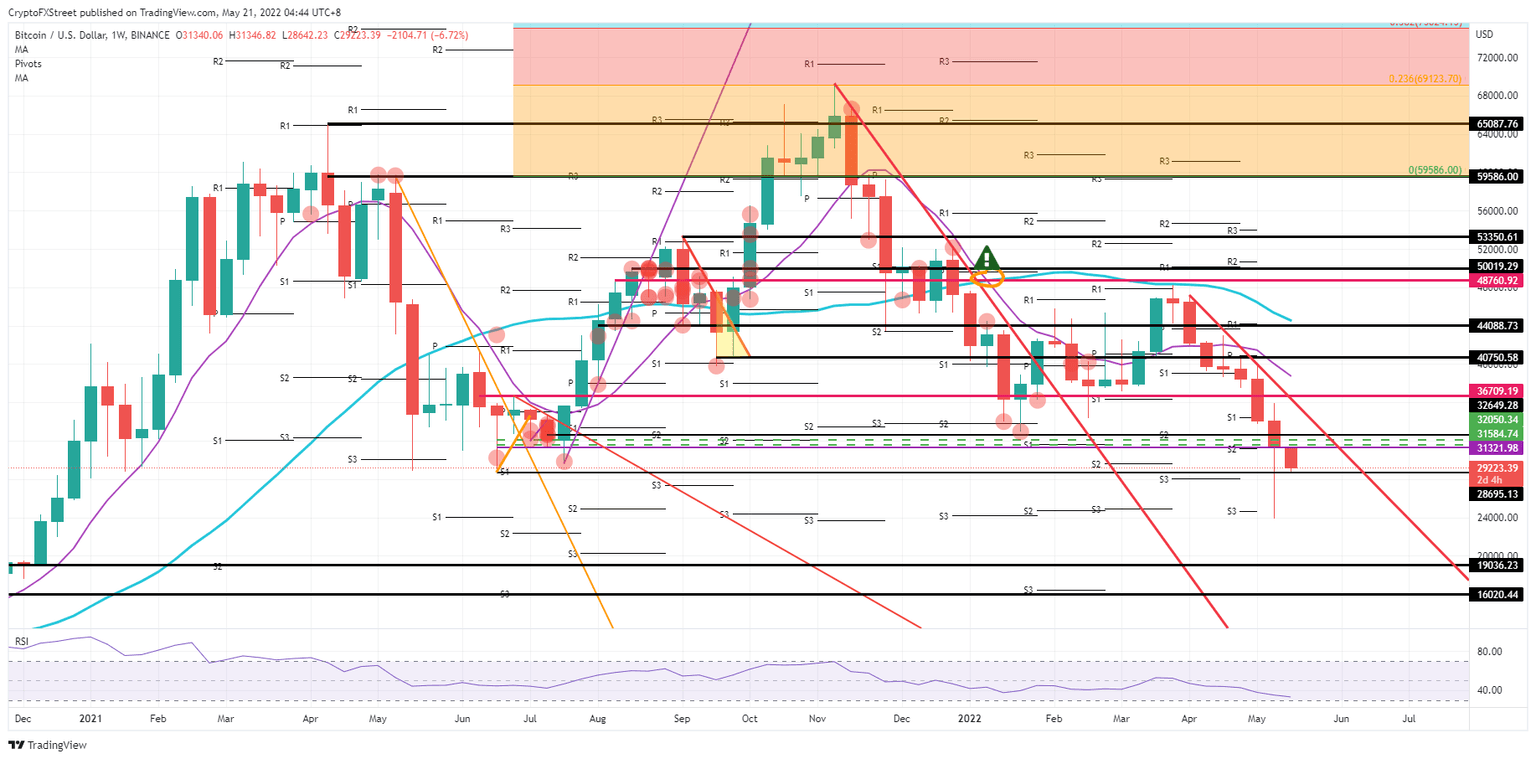

Bitcoin (BTC) price is on the cusp of slipping further to the downside as a firm rejection unfolded at the opening of the trading week at $31,321.98. With the distribution zone just above and the break below, Bitcoin price is set to shed more value as bears are in the driving seat. But a turnaround is always in the cards, and certainly at lower levels, BTC price could be a steal with an identified zone between $19,036 and $ $16,020 as a new distribution area to enter for bulls.

BTC price can rip another 40% to 50% before a turnaround is initiated

Bitcoin price is under several pressures as price tumbles week after week. Not only are significant macroeconomic and geopolitical issues hanging over the price action, as it does with global markets. There is as well the image issue as the push for ESG, and more green assets is exponentially growing, it is becoming harder for institutions, hedge funds, and pension funds to maintain a part in Bitcoin as the mining of it is not eco-friendly at all. The vast carbon footprint that flows out of the energy consumption of that mining creates a systemic issue for Bitcoin price in the long run as to when it will ever become sustainable to mine and be used as the principal cryptocurrency.

BTC price thus has plenty of elements going against it, which only means that more downside is to come. At one point, the price will have reached its fair value point, where bulls will want to engage. Looking at the charts, a zone can be identified from late 2020, between $16,020 and $19,036. That is an ideal distribution level for bulls to take it over from the bears. By then, Bitcoin investors might have found a greener solution to mine to brush off the negative image that is denting investor sentiment in the cryptocurrency.

BTC/USD weekly chart

An earlier turnaround is, of course, always possible as investors have their pick on several geopolitical themes where one headline could easily trigger a steep rally that breaks the back of these downward pressures. A turnaround would mean a weekly close back above $30,000, preferably above $32,650, which would pave the way for a rebound to $36,709. From there on, $40,000 comes back into play with $40,750.58 as the silver lining on the upside, translating into a 40% turnaround.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.