With cryptos bleeding, should you buy SafeMoon price?

- SafeMoon price has seen three consecutive days of down candlesticks as the crypto markets tank.

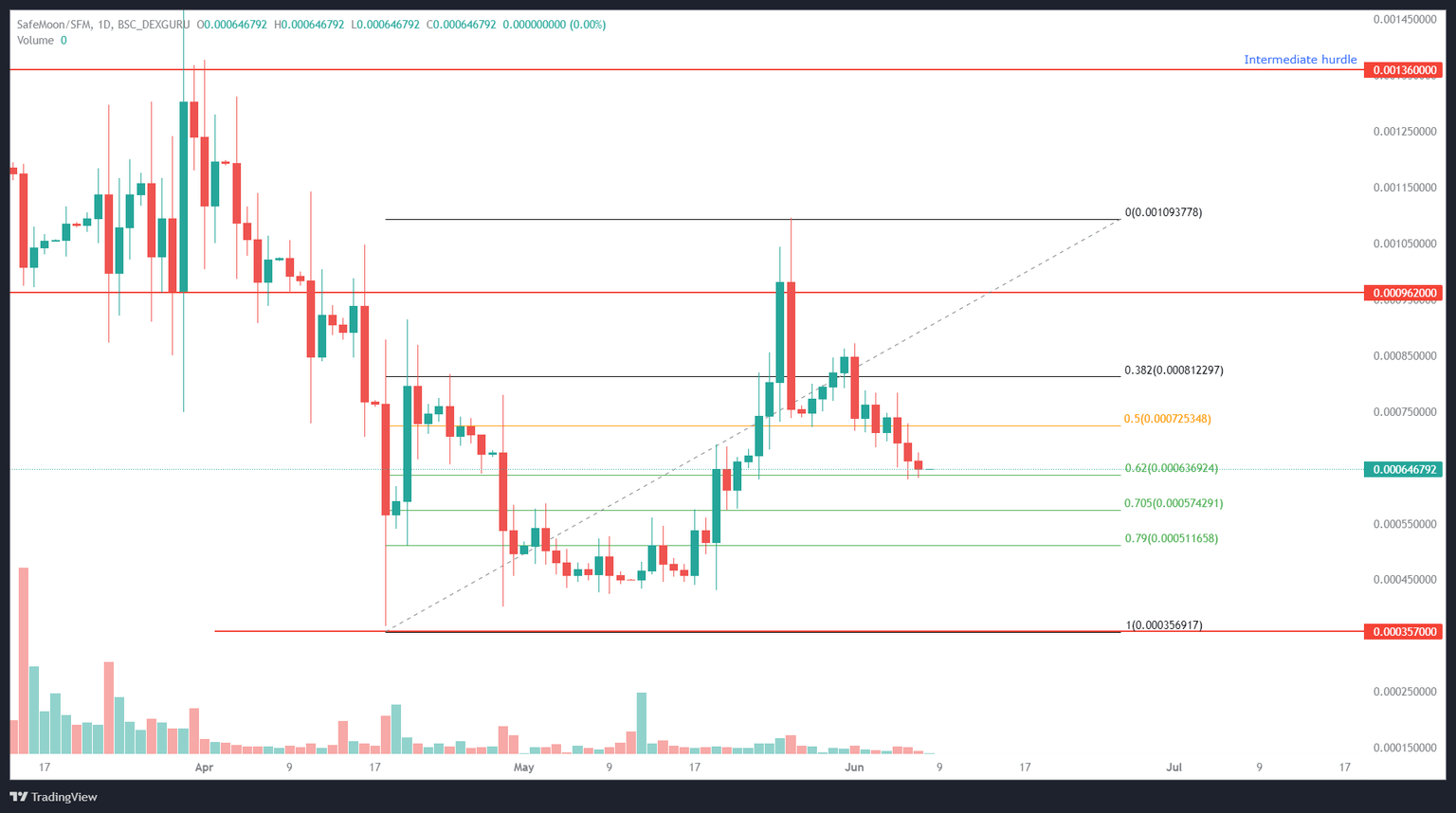

- This downtrend, however, has brought it closer to the buy zone, extending from $0.000511 to $0.000636.

- Investors need to be careful with their timing and not be caught off guard if Bitcoin price takes another dip.

SafeMoon price is approaching a potential reversal area and hoping for a quick turnaround. This buy area could trigger another rally that could result in a similar uptrend as that seen between April 18 and May 26.

SafeMoon price prepares for a touchdown

Safemoon price has been in a downtrend since the May 26 swing high at $0.001090 was formed after a 197% rally. So far, the altcoin has dropped 42% and is currently grappling just above the buy zone, extending from $0.000511 to $0.000636.

The previous articles about the altcoin have mentioned that there is a chance SafeMoon price will bounce off this area and rally 100% or more. Considering the recent sell-off in Bitcoin price, retail investors might be panicking, but the outlook remains the same.

The $0.000511 to $0.000636 buy zone is still valid and will put SAFEMOON price in a deep discount mode relative to the range, extending from $0.000356 to $0.001090. Hence, the chances of an uptrend or a trend reversal in this deep-discount mode are higher.

As for targets, investors can safely expect SAFEMOON to trigger the next run-up and retest the range high at $0.001090. This move would constitute a 90% ascent from $0.000574. However, in a highly bullish case, SafeMoon price would set a higher high at the $0.001360 hurdle. This run-up, however, would amount to a 140% gain from the $0.000574 barrier.

SAFEMOON/USDT 1-day chart

While things are looking up for SafeMoon price, a potential spike in selling pressure that pushes Safemoon price to create a daily candlestick close below the range low at $0.000356 will invalidate the bullish thesis.

Since this move creates a lower low, SafeMoon price could set a new all-time low.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.