VeChain price stuck in tight range, VET will go sideways for the rest of the summer

- VeChain price has not been able to go higher after the recovery from $0.04 towards $0.16.

- VET corrected further down and is looking for support from buyers.

- The area around $0.1 is forming a heavy cap on the possible further upside for Vechain.

VeChain price looks to be in a difficult spot with upside potential very limited, but even for sellers, it doesn’t look appealing to go short VET.

VeChain price bears with a limited edge

VET looks bearish but is actually in a weekly triangle pattern, which might hint at a break to the upside.

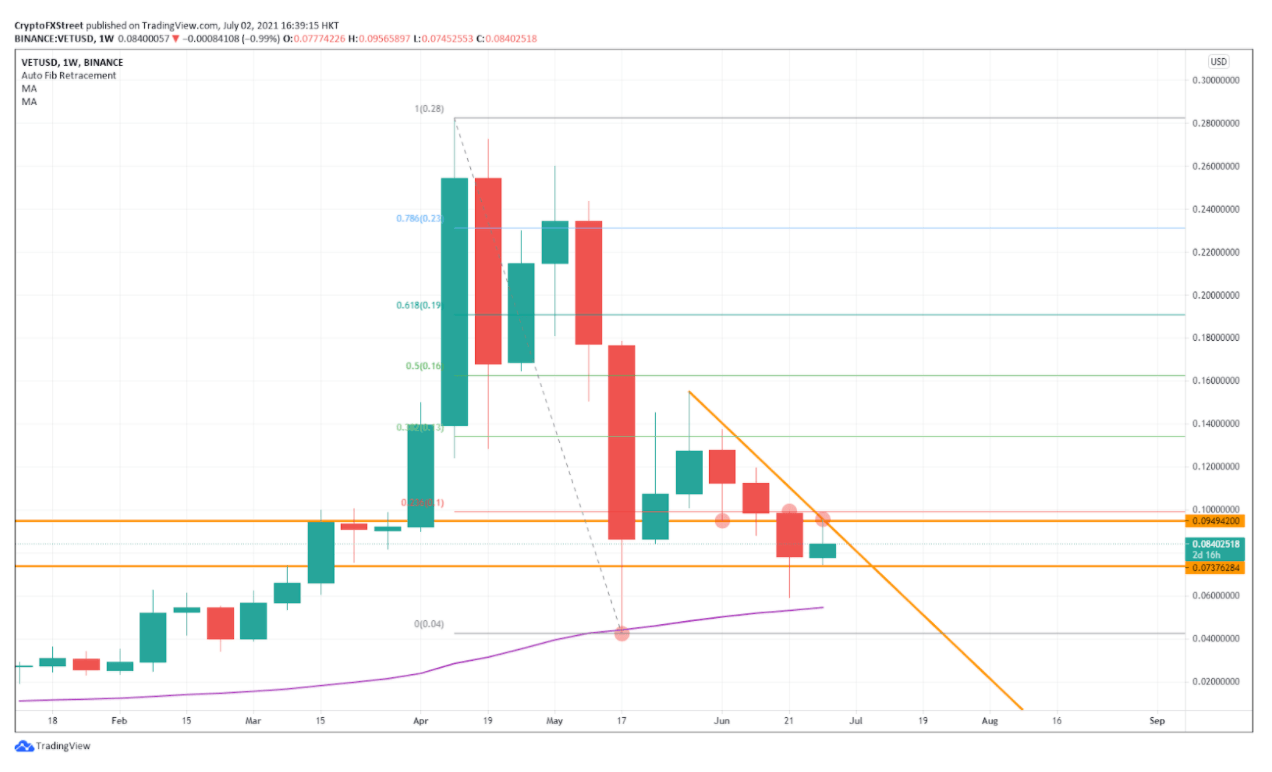

With the correction we saw six weeks ago, VeChain price rebounded from the 200 weekly simple moving average (SMA) at $0.04. A lot of buyers flocked together at that point and made a recovery that lasted for two weeks, pushing it towards $0.1550

Since then, VeChain price has formed a bearish descending trendline and almost went for the retest of the 200 weekly SMA. Buyers stepped in just before and pushed VET back up towards $0.1, but the further upside looks to be limited. Not only do we have the psychological $0.1 marker that falls in line with the descending orange trendline, located at $0.095, a level that was respected three weeks ago before clearly breaking to the downside.

Further down, VeChain price is producing higher lows, so it will be essential to see if $0.073 can hold, as it was a significant level in March, before the jump and retrace happened in VET.

VET/USD weekly chart

All in all, VeChain price is trading in a tight range between $0.073 to the downside and $0.095 to the upside. Should VET break to the downside, expect support coming in at the 200 weekly SMA. A bullish breakout would target $0.134, which is the 38% Fibonacci level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.