VeChain Price Prediction: VET coils up for 30% rally

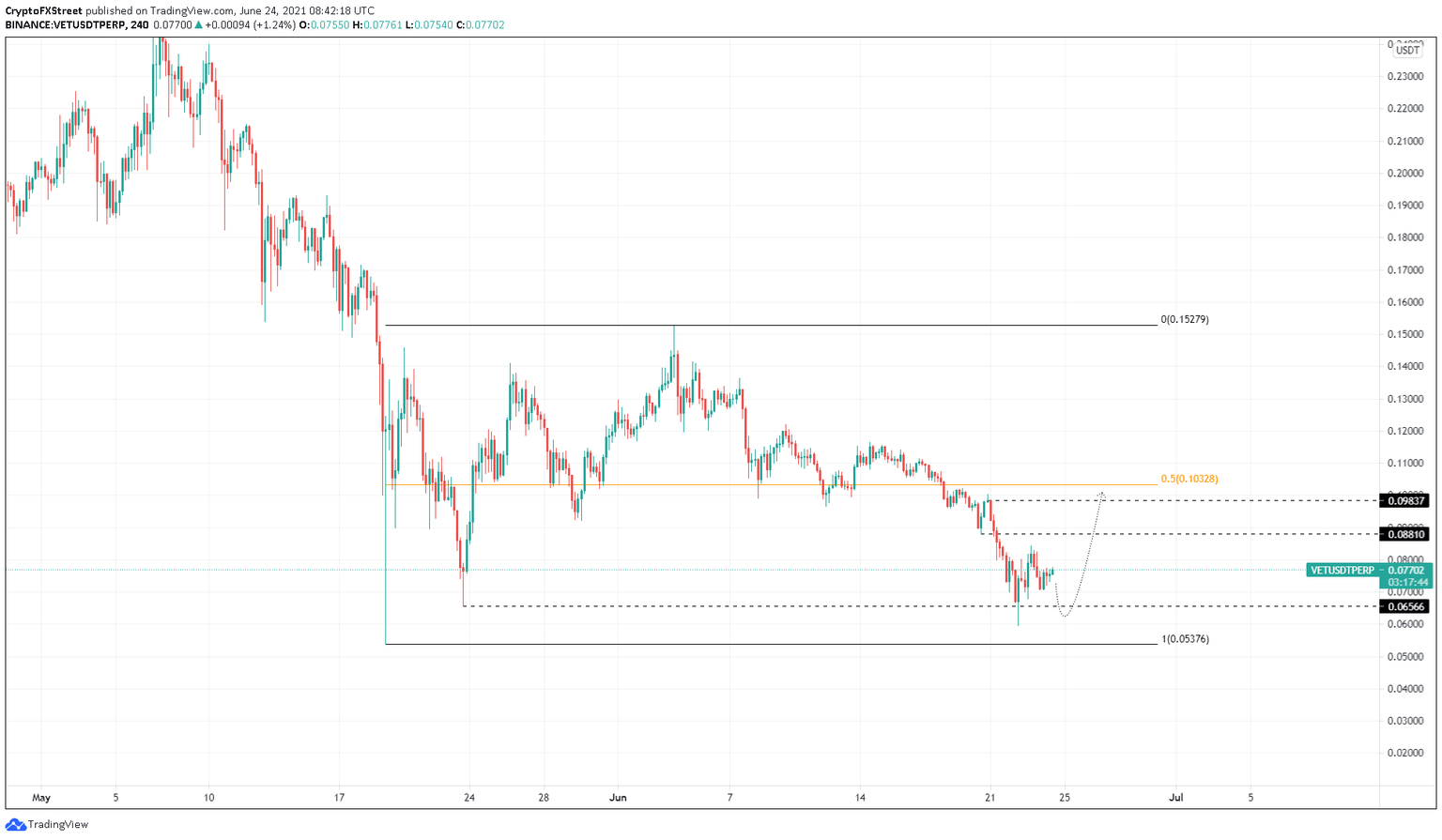

- VeChain price consolidates between the support barrier at $0.0657 and the swing high at $0.0843 set up on June 23.

- VET could rally 30% to tag the resistance level at $0.0984 if buyers push it past $0.0843.

- A breakdown of the support level at $0.0657 will invalidate the bullish thesis.

VeChain price performance has been splendid after the May 19 crash. After forming a tight range, VET stayed above the equilibrium point, hinting at bullish pressure. However, as the entire market shifted to bearish sentiment on June 20, VeChain price crashed.

Now, the altcoin is trying to make a comeback as it consolidates in a tight range.

VeChain price anticipates breakout

VeChain price went from $0.1 to $0.0596 as it crashed roughly 40% between June 20 and June 22. After forming a temporary bottom at $0.0596, VET rallied 40% and was on the verge of full recovery, but investors began booking profits, resulting in a minor pullback.

Although unsure if this retracement is completed, investors can expect a bounce from the support barrier at $0.657. If the buying pressure continues to build up, leading to a breach of the consolidation, the bulls might target $0.088 and $0.0984, which is roughly 30% away from the current position, $0.077.

In a highly bullish case, the 50% Fibonacci retracement level at $0.103 could be tagged.

VET/USDT 4-hour chart

While things seem to be going in the right direction for VeChain price, market participants need to note that a breakdown of the support level at $0.0657 not only indicates weak buying pressure but also invalidates the bullish thesis.

If this were to happen, VET would likely retrace 18% to tag the range low at $0.0538.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.