VeChain Price Prediction: VET to enter new rally to $0.084

- VeChain price withstood the turmoil in the markets very well.

- All technical indicators were respected, keeping VET supported.

- It can ride the risk-on tailwinds towards $0.084.

VeChain price made it out of the storm in a decent technical position. Markets got caught in a two-day spiral of risk-off and cryptocurrencies saw a negative return. Now it is time to look upward again, with markets back to risk-on today.

VeChain price can rely on two solid supports to pop by 13%

VeChain was no different from other cryptocurrencies and risk assets after publishing the Fed Minutes past Wednesday. Markets went for two consecutive days of red prints. But VET held very solid its price action and looks to come out of the correction relatively unharmed.

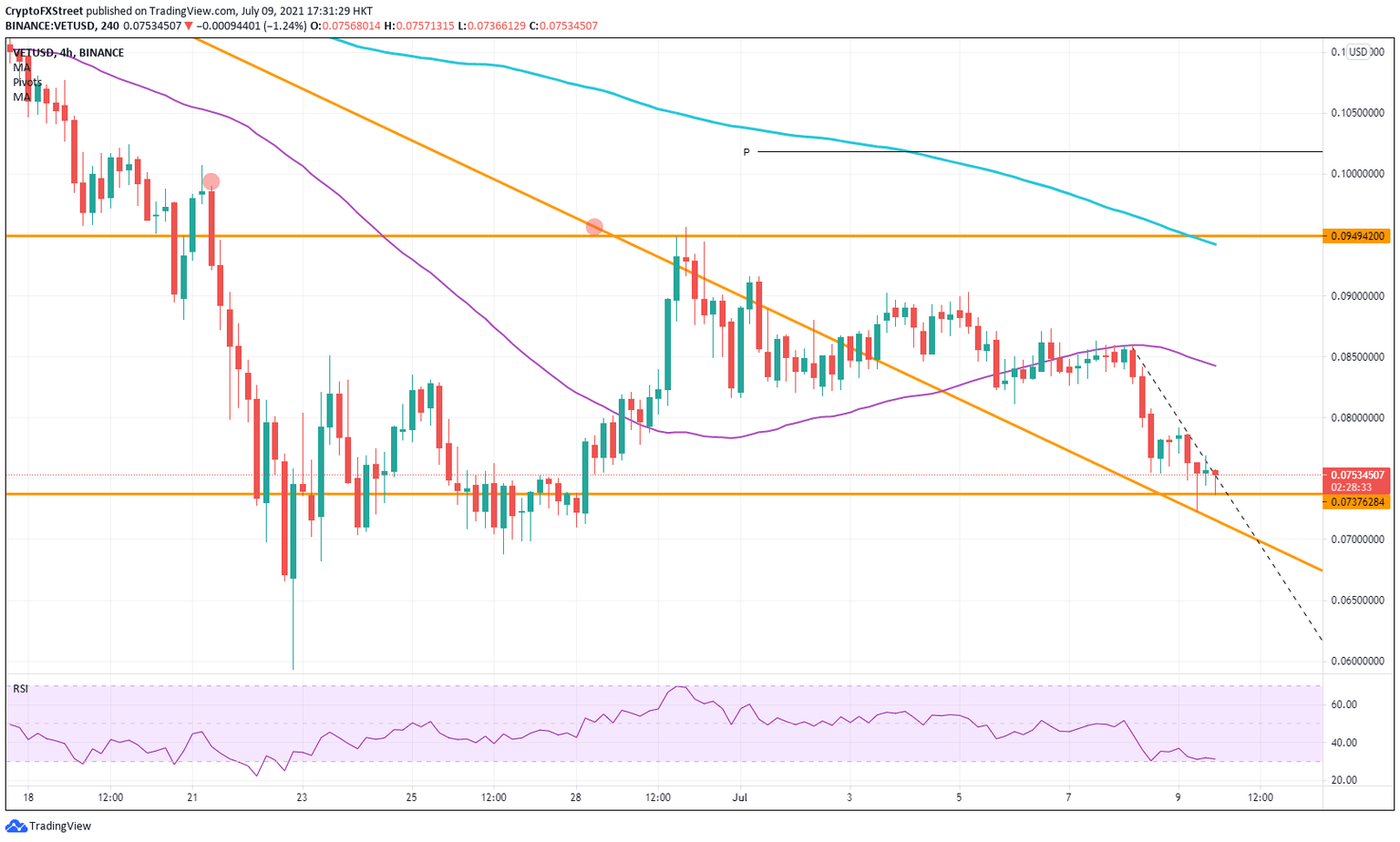

The dip yesterday made buyers go in on VeChain at $0.0725, where a technical bounce off the orange descending trendline that goes back to the beginning of June took place. Buyers paired the losses, and the next four-hour candle even closed above $0.0737, which acted as an intermediate support.

Add that the RSI dipped briefly below 35, and thus in the oversold territory, and buyers could not resist picking up some VET tokens.

Target to the upside would be the 55-four hour Simple Moving Average (SMA) that has put a cap on price action since July 7.

VeChain price proves that technicals and fundamentals are essential to look at, and the fact that they can withstand a sell-off, as we’ve seen the last two days, proves that buying and interest are still there. So, VET looks bright and ready for some upside.

Should markets roll over again further today or this weekend, look for $0.07 as psychological level and $0.065 as first support. VeChain price action to the downside will be limited with RSI by then in oversold territory. So, sellers will look to cover their positions earlier than that.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.