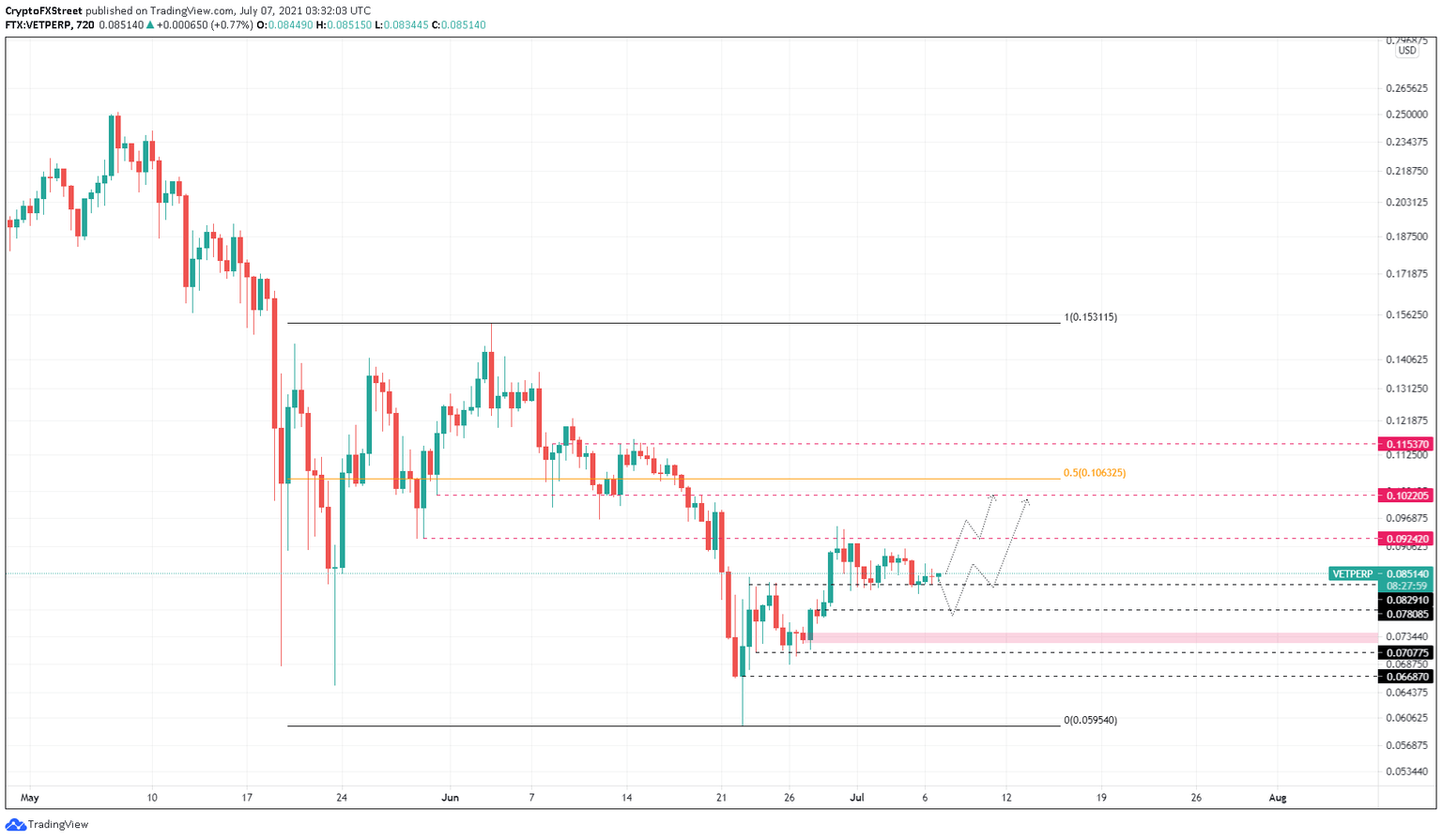

VeChain Price Prediction: VET lurks in search of foothold that could propel it to $0.106

- VeChain price is currently trading above the support level at $0.0829.

- VET might retest $0.0781 or the demand zone extending from $0.0722 to $0.0740.

- A breakdown of the $0.0708 foothold will likely invalidate the upswing narrative.

VeChain price is currently traversing above a critical support level, which could break down easily. If this were to happen, VET could slide to the subsequent barriers or a demand zone, serving as a launching pad that triggers a massive upswing.

VeChain price in search for stable grounds

VeChain price is currently hovering above the support floor at $0.0829 and is likely to break down at first sight of increased selling pressure. Therefore, investors can expect a retracement to $0.0829 or the demand zone stretching from $0.0722 to $0.0740.

Assuming VET bounces off $0.0829, investors can expect an 18% upswing toward the resistance level at $0.0924. Breaching this area could open the possibility of VeChain price tagging the $0.102 barrier, which is an 18% upswing.

In a highly bullish case, the bulls might try to push VET to tag or sweep the 50% Fibonacci retracement level at $0.106, representing a 36% rally from the $0.0782 support floor.

With Bitcoin showing a bullish bias, the altcoins will likely follow its lead. If BTC were to tag $40,000 or the range high at $42,451, VeChain price could easily glide through $0.106 and tag the ceiling at $0.115.

VET/USDT 4-hour chart

While things look good for VeChain price for now, a breakdown of the $0.0829 level will lead to a dip into the demand zone that extends from $0.0722 to $0.0740. This move would not negatively affect the optimistic outlook.

However, a decisive 4-hour candlestick close below $0.0708 will invalidate the bullish thesis, pushing VET down to $0.0669.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.