VeChain Price Prediction: VET is on the verge of a massive rebound

- VeChain technical indexes present multiple signals ahead of an impending spike.

- A sharp rise in the demand of VET may kick start a rally to the 100-day SMA.

VeChain price has consistently dropped from its yearly high of $0.023 reached in July. The hunt for a bottom appears to be approaching an end, especially now that multiple technical indexes hint at a recovery. VeChain is ranked 30th in the market and boasts of a market cap of $614 million. Its 24-hour trading volume stands at $178 million.

VeChain rebound seems imminent

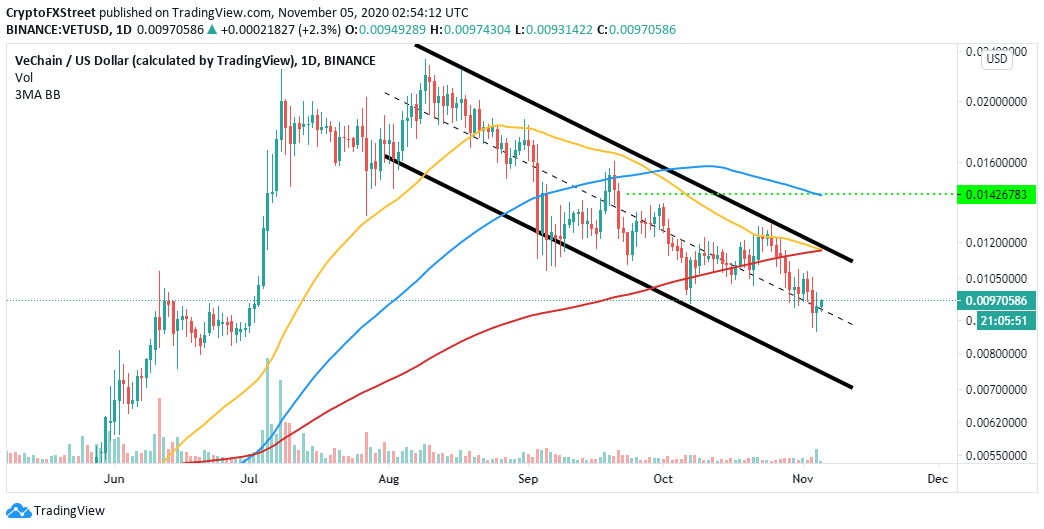

The TD Sequential indicator recently presented a buy signal on the daily chart, which gives credence to the bullish outlook. The bullish picture formed as a red nine candlestick, suggesting that an upswing in demand for this token may culminate in prices rising for approximately one to four daily candlesticks. It is worth noting that VET might begin uptrend afresh if the expected buying pressure becomes strong enough.

VET/USD 1-day chart

Simultaneously, the bullish argument seems to hold as VeChain fights for a rebound at the lower boundary of a descending parallel channel that developed within the same timeframe. A break above the channel's upper limit may elevate VET to highs of $0.014, as highlighted by the 100 Simple Moving Average (SMA).

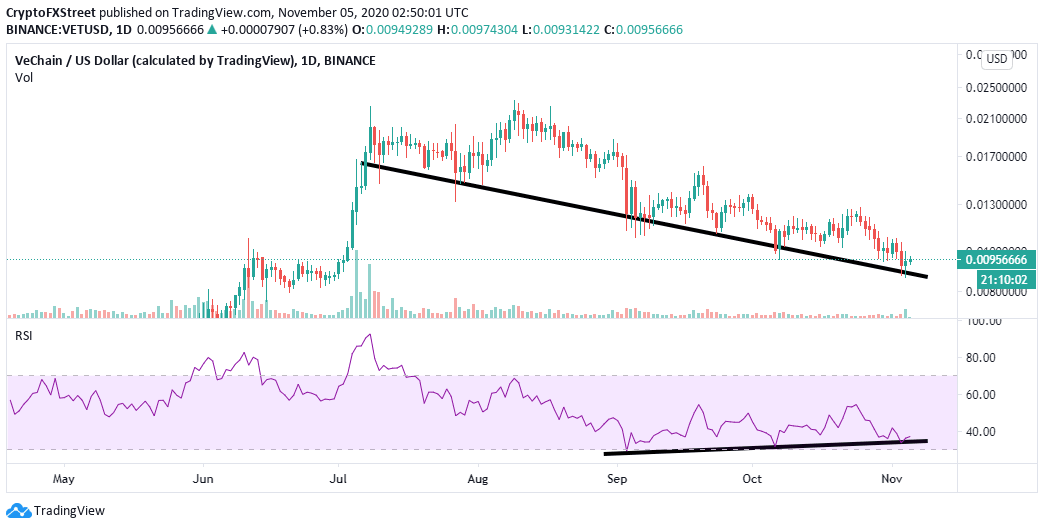

VET/USD 1-day chart

On the other hand, the Relative Strength Index (RSI) emphasizes the bullish outlook. A bullish divergence has been forming between the price and the RSI within the same daily timeframe. It is worth noting that bullish divergences develop when the price creates a lower low pattern while the RSI forms a higher low pattern. Although this technical outlook does not provide a precise buy signal, it shows that the asset's downtrend is nearing exhaustion.

VET/USD 1-day chart

It is worth mentioning that VET/USD must hold above the descending channel's middle boundary to validate the bullish validate narrative. Failure to do so would call for more sell orders, which are likely to pull downwards towards the next key support target at $0.008.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren